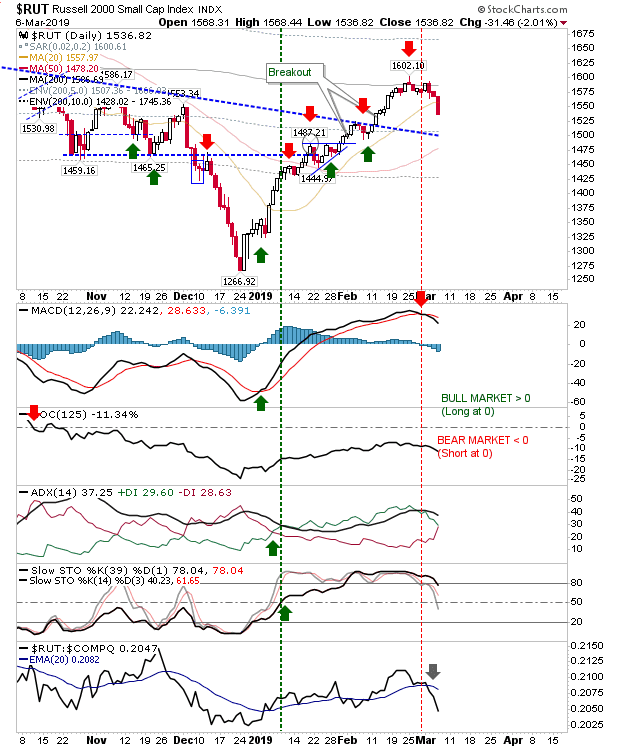

The Russell 2000 lost over 2% yesterday, as it undercut the 20-day MA in a move which could pull the other indices down with it. The ROC is well below the mid-line and the -DI is on the verge of a bearish cross with its +DI following the earlier lead of the MACD.

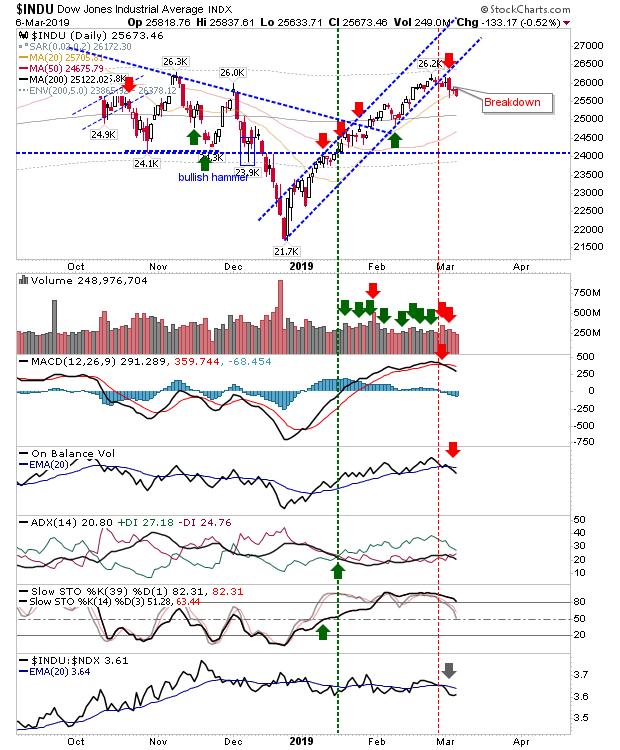

The Dow Jones Index confirmed its channel break but is still holding 20-day MA support. In addition, selling volume declined on the price loss. However, there are confirmed 'sell' triggers in MACD, On-Balance-Volume and relative loss trigger to the NASDAQ 100.

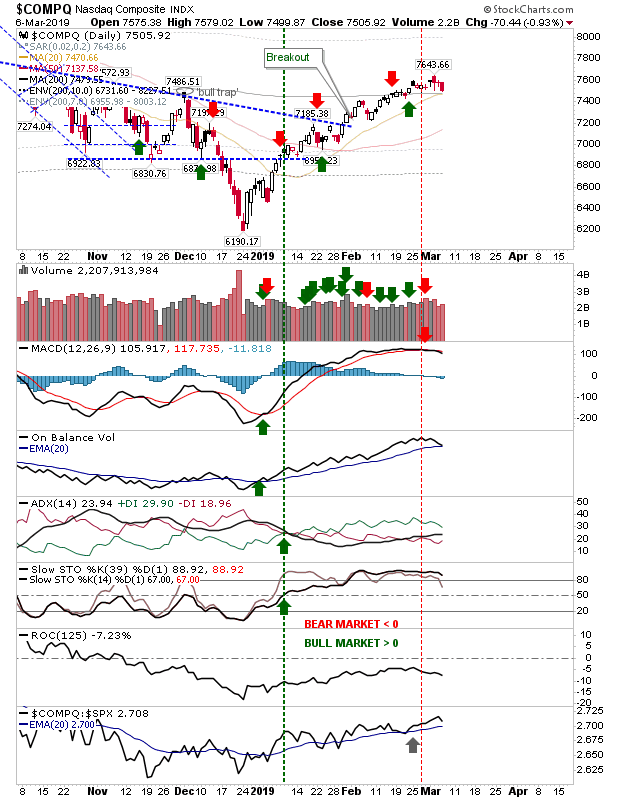

Yesterday's decline in the NASDAQ wasn't enough to break the 20-day MA and 200-day MA but there is limited room for maneuver for further losses. There is a MACD trigger 'sell' and pending On-Balance-Volume 'sell' trigger but bulls still have a workable edge.

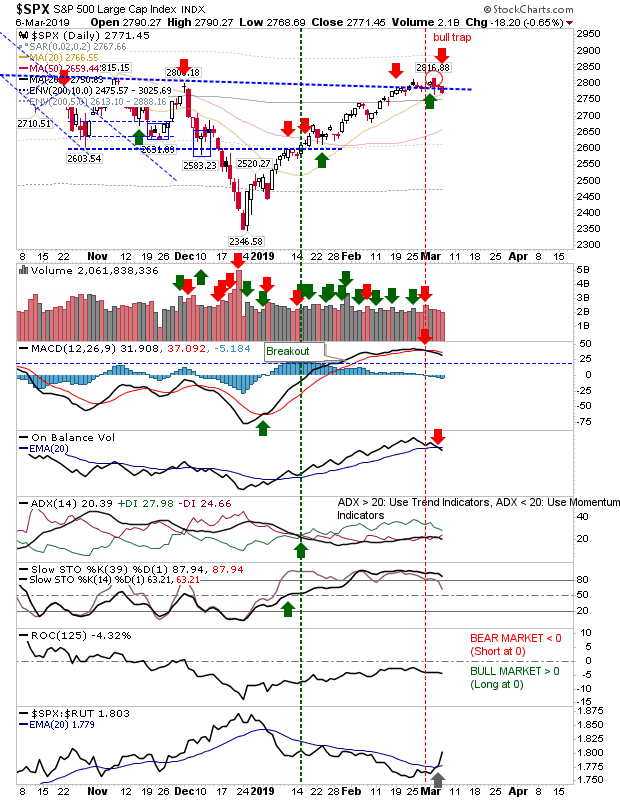

The S&P finished with a 'bull trap' and a new 'sell' trigger in On-Balance-Volume. A big test of the 200-day MA is coming up.

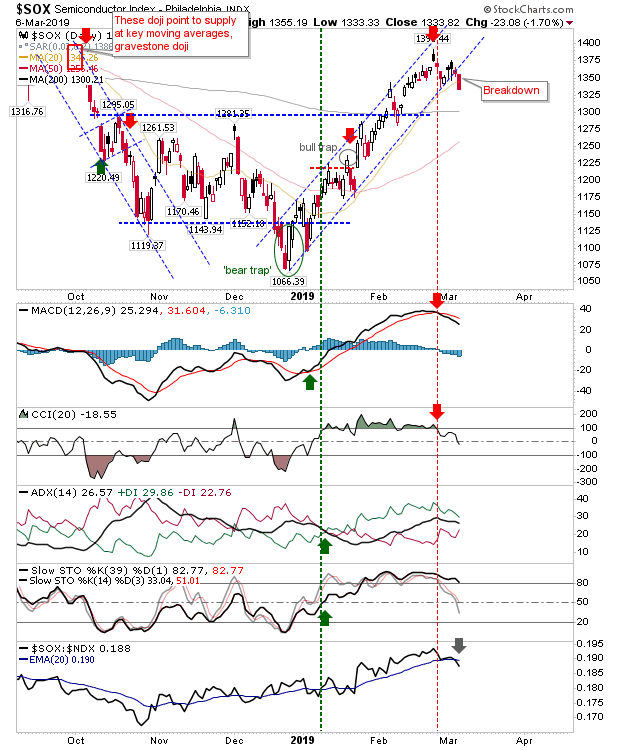

The Semiconductor Index finished yesterday with a clean channel breakdown. This switches pressure on to the NASDAQ and NASDAQ 100, especially the upcoming tests of their respective 200-day MAs.

For today, pressure will be on those indices still holding their 200-day MAs to stay above them. Should these fail, then the question will be how far will indices fall—Fibonacci will be our guide.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI