Markets traded in a risk-off fashion yesterday and today in Asia, with the drivers still being the uncertainty surrounding the war in Ukraine, the slowdown in China, and increasing expectations over aggressive monetary policy tightening.

Overnight, data showed that Australia’s headline and Trimmed CPI rates rose by more than expected in Q1, with the Aussie rebounding but staying in a broader downtrend against currencies, the central banks of which are seen as moving more aggressively.

Tonight, investors may turn their attention to the BoJ, as they are eager to see what officials have to say about their yield curve control policy, as yields have been stubbornly testing the upper end of the Bank’s range lately.

Investors Keep Reducing their Risk Exposure Thanks To Economic Fears And Tightening Expectations

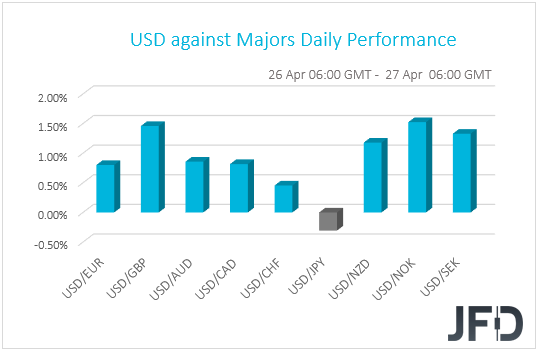

The US dollar traded higher against all but one of the other G10 currencies on Tuesday and during the Asian session Wednesday. It gained the most versus NOK, GBP, and SEK, in that order, while it lost ground only versus JPY.

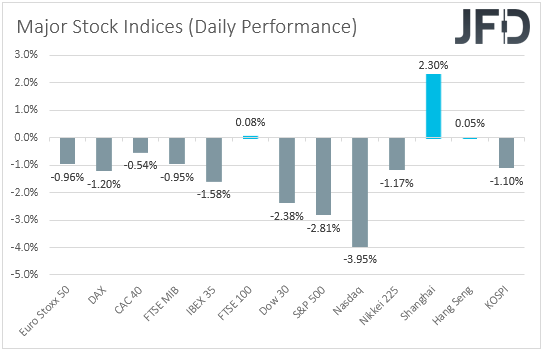

The strengthening of the US dollar and the safe-haven yen suggests that markets may have traded in a risk-off fashion yesterday and today in Asia. Indeed, turning our gaze to the equity world, we see that all but one of the major European indices under our radar closed in negative territory.

The only one which managed to stay fractionally positive was UK’s FTSE 100. Risk aversion intensified during the US session, and all three of Wall Street’s leading indices tumbled more than 2%, with the NASDAQ posting its steepest one-day fall since September 2020.

In Asia today, China’s Shanghai Composite gained, Hong Kong’s Hang Seng traded virtually unchanged, but Japan’s Nikkei and South Korea’s KOSPI lost more than 1% each.

With not much to say, we believe that the drivers behind the reduction in risk appetite remain the same as in the last few weeks. Those are the uncertainty surrounding the war in Ukraine and its effects on the global economy, the slowdown in China due to the very restrictive policies for dealing with the new outbreak of COVID 19, and increasing expectations over an aggressive monetary policy tightening by some major central banks, especially the Fed.

Speaking about monetary policy yesterday, ECB policymaker Martins Kazaks said that his Bank should raise interest rates soon. It has room for up to three hikes this year, joining the officials calling for an earlier exit from stimulus. The ECB has signaled that a rate hike could be delivered “some time” after its APP scheme, which is telegraphed to be over in the third quarter.

However, such rhetoric is too vague and calls for an end to APP early in July so the Bank can lift rates within the same month may have encouraged market participants to bring forth their rate-hike bets, and that’s why we saw European indices drifting lower.

But why didn’t the euro gain? It did against most of the other G10s. It underperformed only against the safe-haven JPY and CHF, as well as the US dollar. The reason why EUR/USD kept drifting south is that even with the ECB beginning its hiking cycle in July, the Fed is still expected to proceed much more aggressively.

Therefore, there is still ample divergence in monetary policy between those two central banks. According to the CME FedWatch tool, the Fed is widely anticipated to hike by 50 bps when it meets next week, while there is a 72% probability for a 75bps hike in June. There is even a 68% chance for 50 more basis points to be added in July.

DAX – Technical Outlook

The German DAX index traded lower yesterday after it hit resistance at 14165 and managed to break below the 13875 barrier, marked by the low of Apr. 12, thereby confirming a forthcoming lower low. This, combined with the fact that the index remains below the downside line drawn from the high of January 5th, makes us believe that some more declines may be on the cards for the near future.

The dip below 13875 may have opened the path towards the low of Mar. 11, at around 13285, where the bears may decide to take a break, thereby allowing a slight rebound. However, as long as such a rebound stays limited below the aforementioned line, we would still see a negative near-term picture, and thus, we would see the case for another leg south and, why not, a break below 13285. If so, the bears may extend their march towards the low of Mar. 7, at 12425.

We will start examining whether the bulls have gained complete control only if we see a strong rebound above the key area of 14900, which acted as a floor between May 4th, 2021, and Feb. 14 this year. It was also tested as resistance on Mar. 29.

So, its upside break may initially lead to a test at 15230, the break of which could extend the advance towards the high of Feb. 16, at 15540. Slightly higher lies the high of Feb. 2, at 15740, which, if also gets broken, could pave the way towards the high of Jan. 12, at 16085.

AU CPIs Accelerate, but the Aussie Stays in a DowntrendStaying in the FX world, the Aussie was found lower against its US counterpart this morning, but it was much lower before the Australian CPIs were out.

The headline rate rose to 5.1% yoy in Q1, from 3.5% in the last quarter of 2021, exceeding expectations of a rise to 4.6%. The Trimmed mean rate also rose by more than expected, and while the Weighted mean rate missed its forecast by a fraction, it was still half a percentage point higher than it was in Q4.

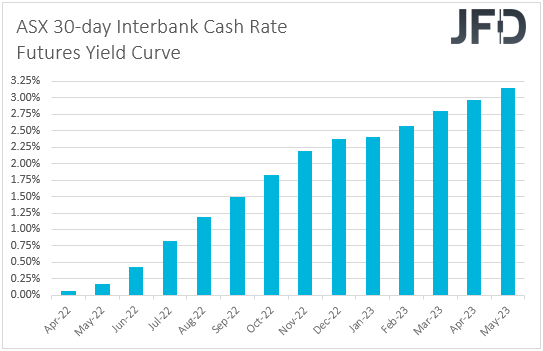

These numbers may have encouraged some participants to add to their bets regarding future rate hikes by the RBA, and that’s why we saw the Aussie rebounding. According to the ASX 30-day interbank cash rate futures yield curve, they expect interest rates to exceed 2.25% by the end of the year.

Remember that the current level of the benchmark cash rate in Australia is 0.10%. Having said all that, though, the RBA has yet to confirm whether those expectations are realistic, and that’s why we expect any CPI-related upside extensions to be short-lived.

We believe that against currencies like the US dollar, the British pound, and the Canadian dollar, we will see a corrective bounce before the next leg south. We reason that the Fed, the BoE, and the BoC have already signaled that they will continue with aggressive tightening in the following months.

AUD/USD – Technical Outlook

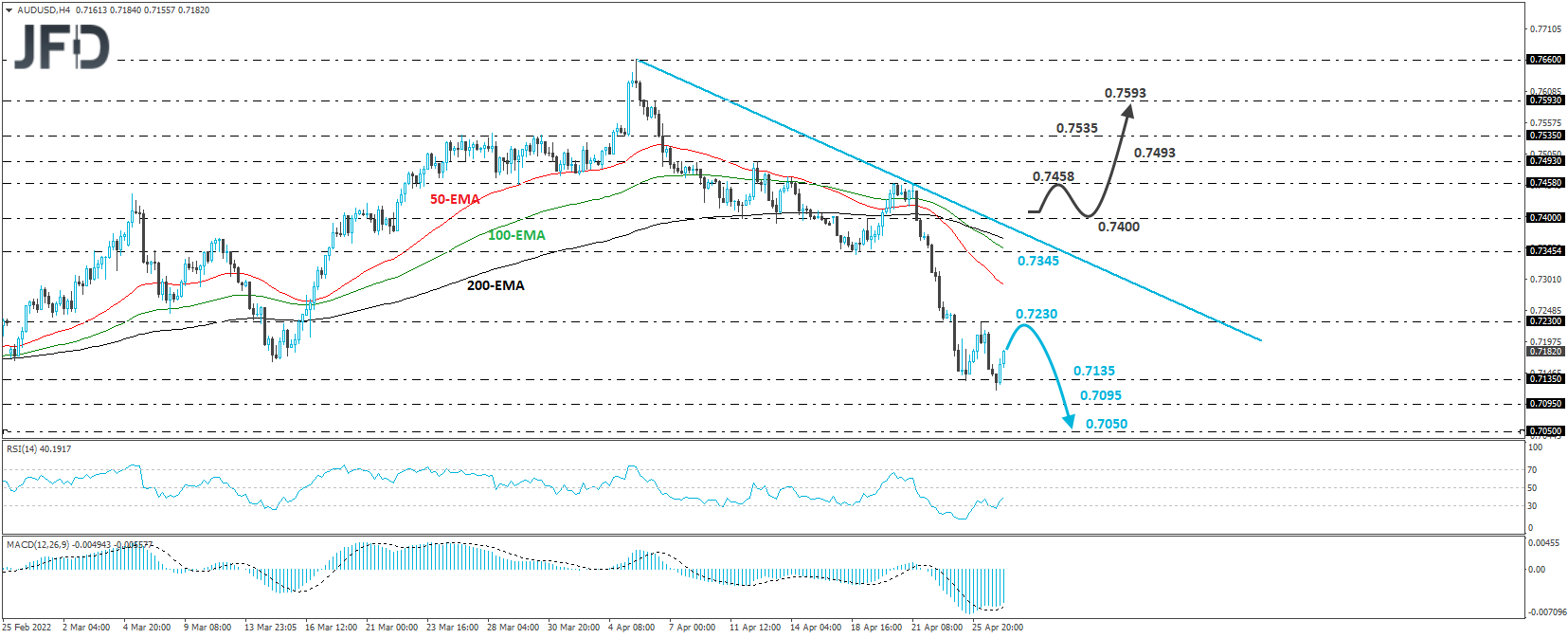

AUD/USD traded lower yesterday, but today, during the Asian session, it hit support below 0.7135 and rebounded somewhat. Overall though, the pair remains well below the downside line drawn from the high of Apr. 5, and even if the rebound continues for a while more, we will still see a negative short-term picture.

The current recovery may continue until the rate challenges once again the 0.7230 level, marked by yesterday’s high. If the bears are strong enough to recharge from there, we may see them pushing for another test at 0.7135, the break of which could extend the fall towards the 0.7095 barrier, marked by the low of Feb. 24, or even the 0.7050 zone, marked by the low of Feb. 4.

On the upside, we will start examining a bullish reversal upon a break above 0.7400. This may confirm the break above the aforementioned downside line and initially target the 0.7458 barrier, which provided resistance on Apr. 20 and 21.

Slightly higher lies the high of Apr. 12, at 0.7493, which could take the rate up to the 0.7535 zone, which provided strong resistance between Mar. 25 and 30. Another break, above 0.7535, could extend the advance towards the high of Apr. 6, at 0.7593.

Will BoJ Policymakers Discuss Changes to YCC?

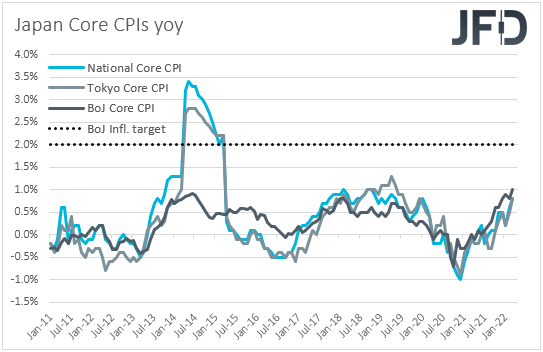

Tonight, market participants may turn their attention to the BoJ decision. Usually, meetings of this bank pass unnoticed as they provide little action or important information to excite the markets. However, things may be different this time around. As the benchmark Japanese government bond yield keeps rising to the upper limit of the central bank’s range, many are eager to hear what policymakers say.

The Bank has in recent weeks defended its policy under which it pledged to keep 10-Year yields around 0%, within a ±0.25% range, at a time when the Fed is pushing aggressively for sizable rate hikes.

And thus, with yields staying stubbornly near the upper end of the policy range, many market participants believe that the BoJ has to take some action. Some believe officials should widen the allowable range, while others call for targeting yields with shorter maturity. There are also a few saying that the Bank should give up its yield curve control policy entirely.

Officials are not expected to proceed with any action at this meeting, but the accompanying statement will be monitored closely. Anything pointing to any of the aforementioned changes, or something similar, could support the Japanese yen, as it may allow 10-year yields to drift higher.

However, with other major central banks expected to hike aggressively and the Bank of Japan maintaining an ultra-loose policy, we doubt that this will signal the beginning of an uptrend in the Japanese currency.

We stick to our guns that the monetary policy divergence between the BoJ and other major central banks will likely keep the yen downtrend intact. We will consider any decision-related strength as a corrective bounce.

As for the Rest of Today’s EventsAfter, the Australian CPIs and ahead of the BoJ decision, the only release worth mentioning is the US pending home sales for March, with the forecast pointing to a 1.5% Mom slide, after a 4.1% decline in February.