Financial markets continued to trade in a “Risk On” fashion yesterday as more economic data added to hopes of a faster-than-previously-thought economic recovery from the slump caused by the coronavirus spreading. Overnight, the RBA stood pat, maintaining more or less the same language as in June, with the Aussie barely reacting. We expect the main driver behind the currency to continue being the broader investor morale.

INVESTORS CONTINUE TO PUSH EQUITIES NORTH

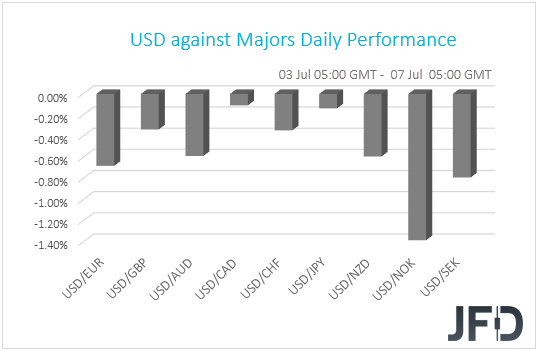

The US dollar traded lower against all the other G10 currencies on Friday, Monday and during the Asian morning Tuesday. It lost the most ground versus NOK, SEK, EUR, and AUD in that order, while it underperformed the least versus CAD, JPY, GBP, and CHF.

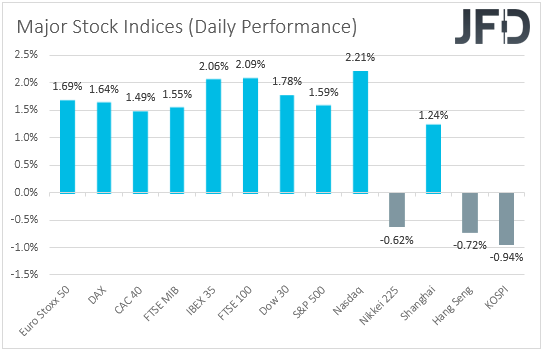

The slide in the dollar and the relative weakness of the safe-havens yen and franc suggests that risk appetite continued being supported. Indeed, shifting our attention to the equity world, we see that major EU and US indices were a sea of green yesterday, gaining 1.5% or more and following a 5.71% surge in China’s Shanghai Composite. This was the biggest one-day gain in half a decade and came after a state-owned publication that said that it is a good time to buy stocks. Appetite eased during the Asian session today. Although the Shanghai Composite gained another 1.24%, at the time of writing, Japan’s Nikkei 225 and Hong Kong’s Hang Seng are down 0.62% and 0.72% respectively.

A stronger than expected rebound in Eurozone’s retail sales for May and a surge above 50 in the US ISM non-manufacturing PMI for June may have also added to hopes of a faster-than-previously-thought economic recovery from the slump caused by the coronavirus spreading. Specifically, Eurozone’s retail sales jumped 17.8% mom after tumbling 12.1% in April, beating the 15.0% forecast, while the ISM index surged to 57.1 from 45.4, at a time when the forecast was for a rise to 50.0.

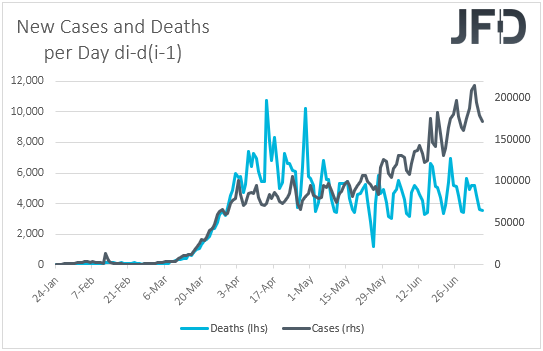

Despite the slowdown in infected cases from the coronavirus over the weekend, the daily numbers remain at elevated levels, with several US states reporting a record increase. For example, Florida surpassed the highest daily number reported by any European country. The fact that investors remained optimistic suggests that as long as most nations around the globe continue to ease their lockdown measures, they may continue to overlook the surge in US cases. Or they may be ignoring the increasing cases due to the fact that fatality rates are still low, which may be an indication of a better-prepared healthcare system and perhaps of the ability to carry out more tests.

Remember that we’ve been constantly highlighting the battle between those who believe that the global economy will recover faster than previously estimated and those who are afraid of a second wave of infections around the globe. With equities and risk linked assets resuming their recovery, it seems that the first group has now the upper hand. Until we get clear signs that this is not the case, we would expect risk appetite to continue improving. In our view, for that to change, a new round of lockdown measures around the globe will have to be introduced. That said, we see the chances of that happening as very low and the reason is that following the damages from the first round of restrictions, the global economy may not be able to weather another couple of months of freezing activity.

EURO STOXX 50 – TECHNICAL OUTLOOK

The Euro Stoxx 50 index continues to slowly grind higher towards the June high, at 3398, while balancing above a short-term tentative upside support line taken from the low of May 14th. Given the current risk-on environment in the equity markets, the upside in Euro Stoxx 50 could continue for a while more. However, to get slightly more comfortable with higher areas, from the technical side, we would prefer to wait for a break above the 3398 barrier first.

If, eventually, the price does climb and stay above the aforementioned 3398 zone, that may clear up the way to some higher areas, as such a move would confirm a forthcoming higher high, what could interest more buyers. The index might then rise to the 3468 obstacle, a break of which may set the stage for a further move north, where the next possible resistance area might be at 3597. That area is marked by the high of February 26th.

On the downside, if the previously-discussed upside line gets broken and the price slides below the 3179 hurdle, marked by the low of July 1st, that could signal a change in the short-term trend and open the door for some more selling. If so, Euro Stoxx 50 might then drift to the 3146 hurdle, or even the 3095 zone, marked by an intraday swing low of June 15th. That said, if the selling activity doesn’t stop there, a break of that support zone may open the way to the lowest point of June, at 3050.

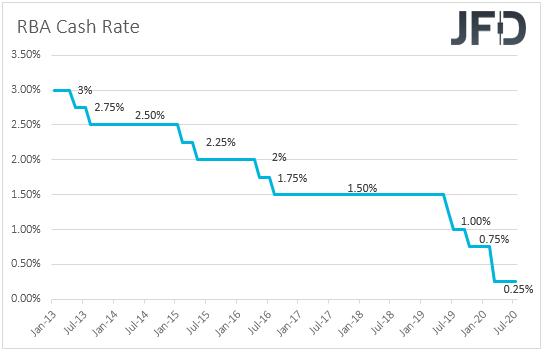

RBA KEEPS ITS POLICY AND LANGUAGE LARGELY UNCHANGED

Apart from headlines and developments surrounding the coronavirus, overnight, we also had an RBA monetary policy decision. The Bank decided to keep the targets for its cash rate and the yield on 3-year government bonds unchanged at 0.25%, adding that they remain prepared to scale-up bond purchases again if deemed necessary. Officials noted that the worst of the global economic contraction may have now passed, but still, the outlook remains uncertain and the recovery is expected to be bumpy and dependent upon containment of the coronavirus.

The Aussie barely reacted to the event, as it was more or less a reiteration of the June meeting’s language. With the Bank not appearing worried over the strengthening of the Aussie, we expect the currency to continue being driven by headlines and developments surrounding the broader market sentiment. As a risk-linked currency, it may continue to benefit as long as investors remain optimistic, especially against the safe havens, like the dollar, the yen and the franc, which tend to come under selling interest during periods of market euphoria.

AUD/CHF – TECHNICAL OUTLOOK

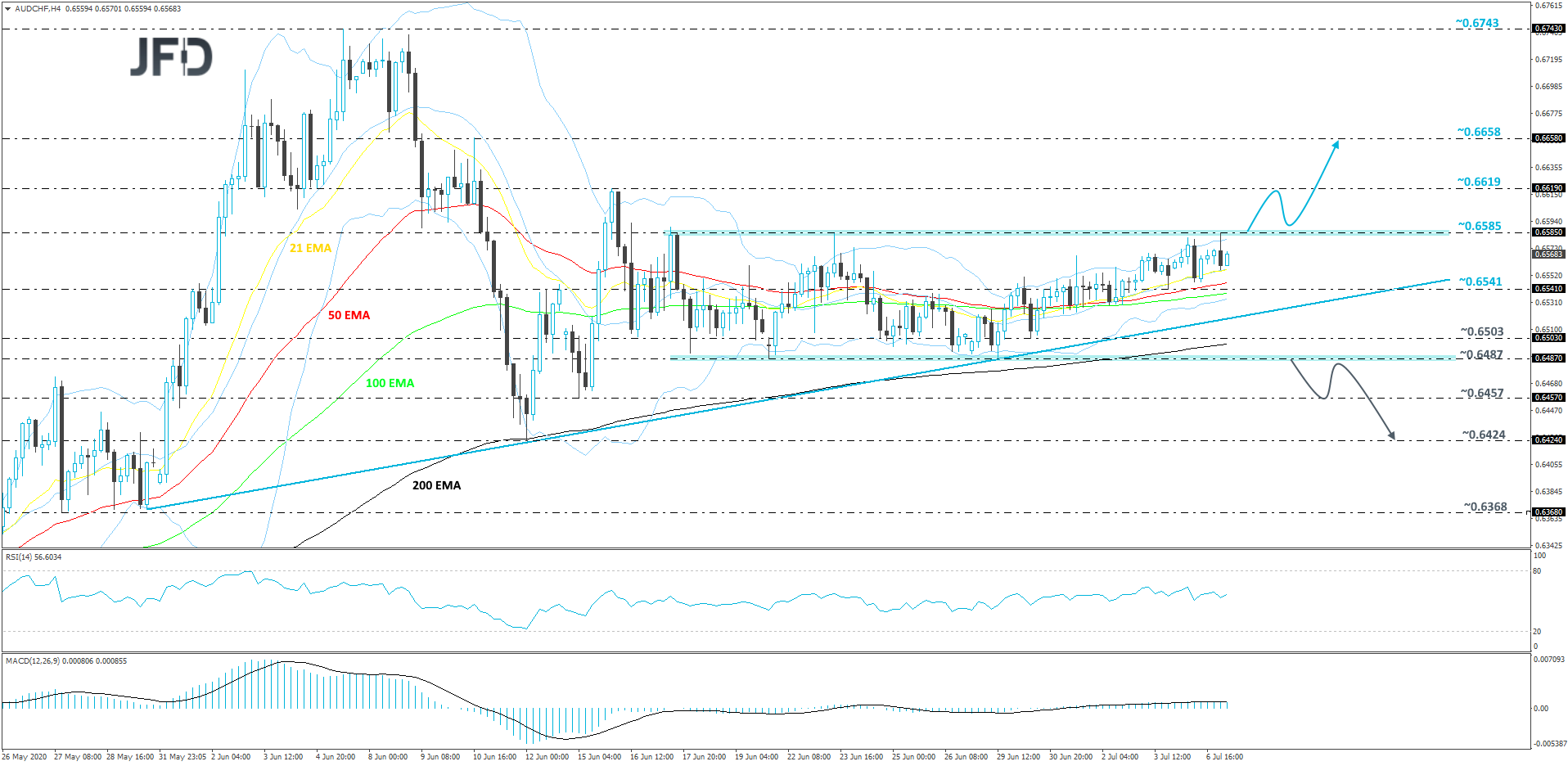

Although AUD/CHF is slowly moving higher, while trading above a short-term upside support line taken from the low of May 29th, the pair still remains below its key resistance barrier, at 0.6585, marked near the highs of June 17th and 23rd. That barrier also acts as the upper bound of the short-term range, where the rate is currently moving in. That has been in play from around mid-June and is roughly between the 0.6487 and 0.6585 levels. However, we will take a cautiously-bullish approach, at least for now, as the pair is still on a slight incline.

If AUD/CHF does pop above the previously-discussed 0.6585 barrier, that may increase the buying activity even more, as the rate would confirm a forthcoming higher high. The pair could then drift to the high of June 16th, at 0.6619, a break of which might clear the path to the 0.6658 level, marked by the high of June 10th.

Alternatively, a break of the aforementioned upside line and a slide below the 0.6487 hurdle, which is the lower bound of the above-discussed range, may spook the remaining bulls from the field and allow more bears to take control. AUD/CHF might then travel to the 0.6457 obstacle, a break of which could clear the path to the 0.6424 area, which is the low of June 12th.

AS FOR THE REST OF TODAY’S EVENTS

Germany’s industrial production for May, the US JOLTs job openings for the same month, and Canada’s Ivey PMI for June are coming out. The German industrial production is expected to have rebounded 10.0% after tumbling 17.9%, while the US JOLTs job openings are expected to have declined to 4.850mn from 5.046mn. No forecast is available for Canada’s Ivey PMI.

With regards to the energy market, we get the API (American Petroleum Institute) weekly report on crude oil inventories, but as it is always the case, no forecast is available.

As for the speakers, we have four on today’s agenda: Atlanta Fed President Raphael Bostic, Richmond Fed President Thomas Barkin, San Francisco Fed President Mary Daly, and Fed Board Governor Randal Quarles.