Thursday November 3: Five things the markets are talking about

The Fed kept the status quo on rates as expected Wednesday, now it’s on to tomorrow’s nonfarm payroll (NFP) to queue further short-term market direction.

Data yesterday showed that private U.S. employers continued to hire at a solid clip last month, further proof that the world’s largest economy’s labor market remains strong even though Octobers API private payroll increase (+147k vs. +170k exp.) was the lowest in four-months. September’s print was revised up to +202k vs. +154k.

The market is expecting an increase of +173k in October payrolls tomorrow, up from a +156k September gain. The unemployment rate is anticipated to fall to +4.8% from +5%.

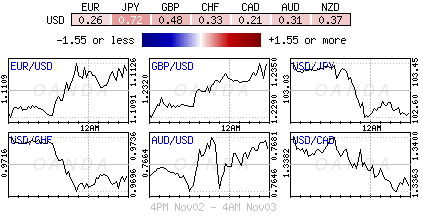

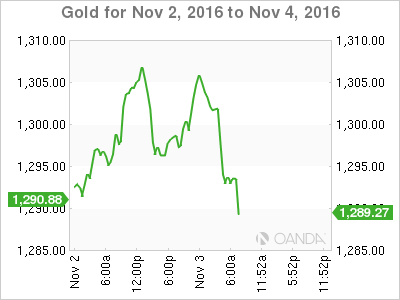

While investors wait for the granddaddy of U.S economic releases, market price action remains subjected to a tightening race for the U.S. presidency. This is prompting demand for haven assets (JPY, gold, CHF and bonds) as the dollar comes under further global scrutiny pressured by the FBI’s investigation in to Clinton.

1. Political jitters hurt stocks

Global shares have dropped to multi-week lows overnight, as polls indicate that Trump is tightening the race to the Whitehouse.

In Asia, Hong Kong’s Hang Seng Index was down -0.4% and Australia’s S&P/ASX 200 closed -0.1% lower. In Japan, its stock exchange was closed for a holiday – equities there are yet to react to JPY’s +0.7% safe haven rise against the dollar.

In China, the Shanghai Composite closed up +0.8% as the country’s run of strong economic data continued. The Caixin China services PMI rose to 52.4 in October from 52.0 in September, hot on the heels of Tuesday’s strong manufacturing PMI data.

In Europe, equity indices are trading mixed across the board as market participants continue to remain cautious ahead of the U.S Presidential elections, and as participants await the BoE’s policy statement.

Banking stocks are providing some early support for the Stoxx 600 index; while commodity and mining stocks are trading notably lower on the FTSE 100.

Futures on the S&P 500 Index have fallen -0.1% ahead of the U.S open.

Indices: Stoxx50 +0.1% at 2,986, FTSE +0.3% at 6,870, DAX flat at 10,371, CAC 40 +0.3% at 4,430, IBEX 35 -0.1% at 8,866, FTSE MIB -0.1% at 16,461, SMI -0.1% at 7,694, S&P 500 Futures -0.1%

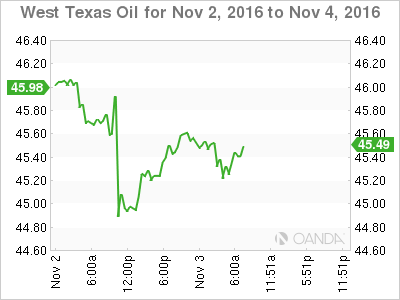

2. Crude Prices crushed

Crude oil continues to trade under pressure as the EIA reported its biggest inventory build in 34-years yesterday.

With the API shocking markets on Tuesday with a massive +9.3m barrel build; yesterday’s U.S. EIA report is only making it tougher for crude prices to find consistent price traction. Inventories increased by a whopping +14.4m barrels in the week to October 28, reaching a total of +482.6m barrels.

U.S. West Texas Intermediate is trading +$45.50 ahead of the open stateside.

Another record OPEC output last month is also damping the outlook for oil, and will complicate the group’s effort to stabilize prices at their meeting in Vienna at the end of the month (Nov. 30).

Gold prices are on the rise, climbing above +$1,300 an ounce yesterday for the first time in almost a month as the ‘mighty’ dollar falls with the race for the U.S. presidency tightening. It seems that market appetite for the yellow metal continues to mount on the possibility of a victory for Trump. Next key level of resistance is +$1,325/40.

4. Bond yields little changed

Safe haven demand continues to put pressure on global benchmarks – the belly of major sovereign curves trade atop of this week’s low yields.

Overnight, U.S. 10-Year bonds are trading at a one-week low of +1.80%. The German bund equivalent is yielding +0.136%.

However, on the move is some peripheral G10/20 debt-paper – Australia 10-Year yields have fallen -4bps to +2.30% along with similar-maturity notes in Italy, Portugal and Spain.

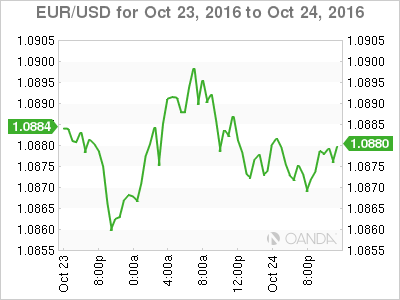

4. Dollar takes more body blows

Market risk aversion sentiment continued to simmer and that’s keeping the USD on the defensive for now, and this despite fixed income dealers continuing to price in a higher probability of a Fed rate hike in Dec (fed futures are +78%).

Risk haven demand for assets is being egged along by a U.S election proving too close for comfort and by investor sentiment being further strained by reports of expanded FBI investigation of Clinton’s server.

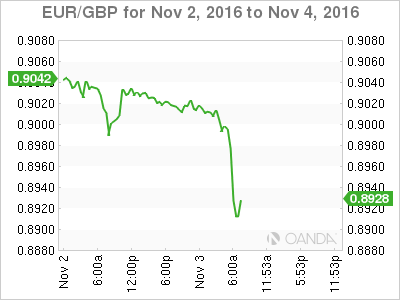

Sterling remains firmer (£1.2384) against major pairs ahead of this morning’s BoE rate decision and on a UK court ruling on Brexit process (EU Court have just ruled that PM May must ask parliament before triggering article 50).

USD/JPY continues to trade atop of its yearly lows, below the psychological ¥103 level as safe-haven flows continued to favor the yen. Europe’s single unit is holding around the €1.11 as the market heads to the U.S open.

5. It’s Super Thursday in the U.K

Super Thursday is once again upon us, which means the Bank of England (BoE) will take center stage just ahead of the open stateside.

The BoE will release its monetary policy decision, the minutes from the meeting, its quarterly inflation report and throw in a press conference, hosted by Governor Carney all starting at 08:00 EDT.

In August, the BoE cut rates to 0.25%, increased its bond purchases by +£60b, and agreed to purchase +£10b of corporate bonds while launching new Term Funding Scheme after the Brexit vote. Policy members also indicated that they look to ease monetary policy further this year. With the U.K economy surprising many and outperforming thus far, aided by a weaker pound (£1.2333), Carney’s naysaying most likely needs to be shelved at least until the end of they year.

The bank’s assessment of the current economic situation and expectations for growth and inflation should give the market a clearer picture, temporarily at least.