Equities fell sharply yesterday, driven by a selloff in tech stocks, as well as by comments from US Treasury Secretary Janet Yellen that interest rates may have to rise. Although Fed officials are sticking to their guns that it is too early to start discussing policy normalization, that view will be put into test on Friday, when we get the US employment report for April.

Yellen's Hike Remarks And Tech Sellfoff Drag Stock Indices Down

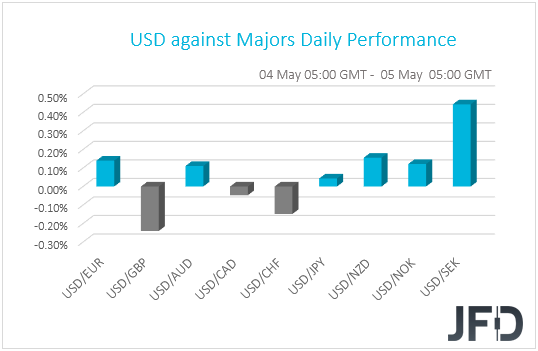

The US dollar traded slightly higher against the majority of the other G10 currencies on Tuesday and during the Asian session Wednesday. It gained against SEK, EUR, NZD, NOK, and AUD in that order, while it underperformed versus GBP, CHF, and CAD.

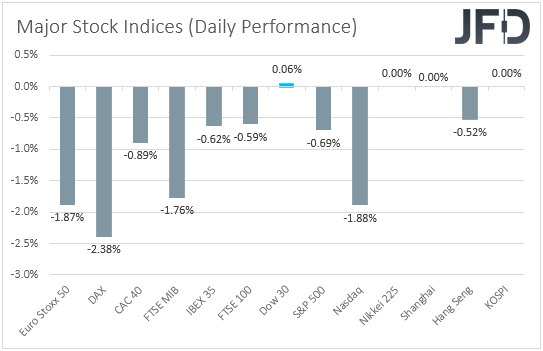

The relative strength of the US dollar and the Swiss franc suggests that markets traded in a risk-off fashion yesterday and today in Asia. Indeed, turning our gaze to the equity world, we see that major EU indices tumbled yesterday, with the negative investor morale rolling over into the US session. Today, in Asia, Japan’s Nikkei 225, China’s Shanghai Composite and South Korea’s KOSPI stayed closed due to holidays, while Hong Kong’s Hang Seng is down 0.52%.

Equities fell sharply yesterday, with the tech sector having its worst day since October, perhaps as investors became concerned over stretched valuations. What gave them another reason to abandon risky assets were comments by US Treasury Secretary Janet Yellen, who said that “It may be that interest rates will have to rise somewhat to make sure that our economy doesn't overheat.”

Later in the day, she downplayed the comment, saying that inflation would not be a problem and that any increases will be transitory. Asked directly on her interest-rate comments, she said that she was neither predicting nor recommending a hike. "If anybody appreciates the independence of the Fed, I think that person is me," Yellen said. Even after her latter remarks, equities continued to fall, which indicates the impact even a single mentioning of tightening has on the market.

Fed Chair Powell has been adamant that the labor market is still far short of where it should be to allow any discussion of tapering among Fed officials. However, that view may be tested on Friday when we get the US employment report for April. Expectations are for a strong report, which could take equities further down and the dollar higher, but if policymakers stick to their guns even after that, we are likely to see a resumption of the prevailing trends. In other words, we would expect equities to rebound and the US dollar to come under renewed selling interest.

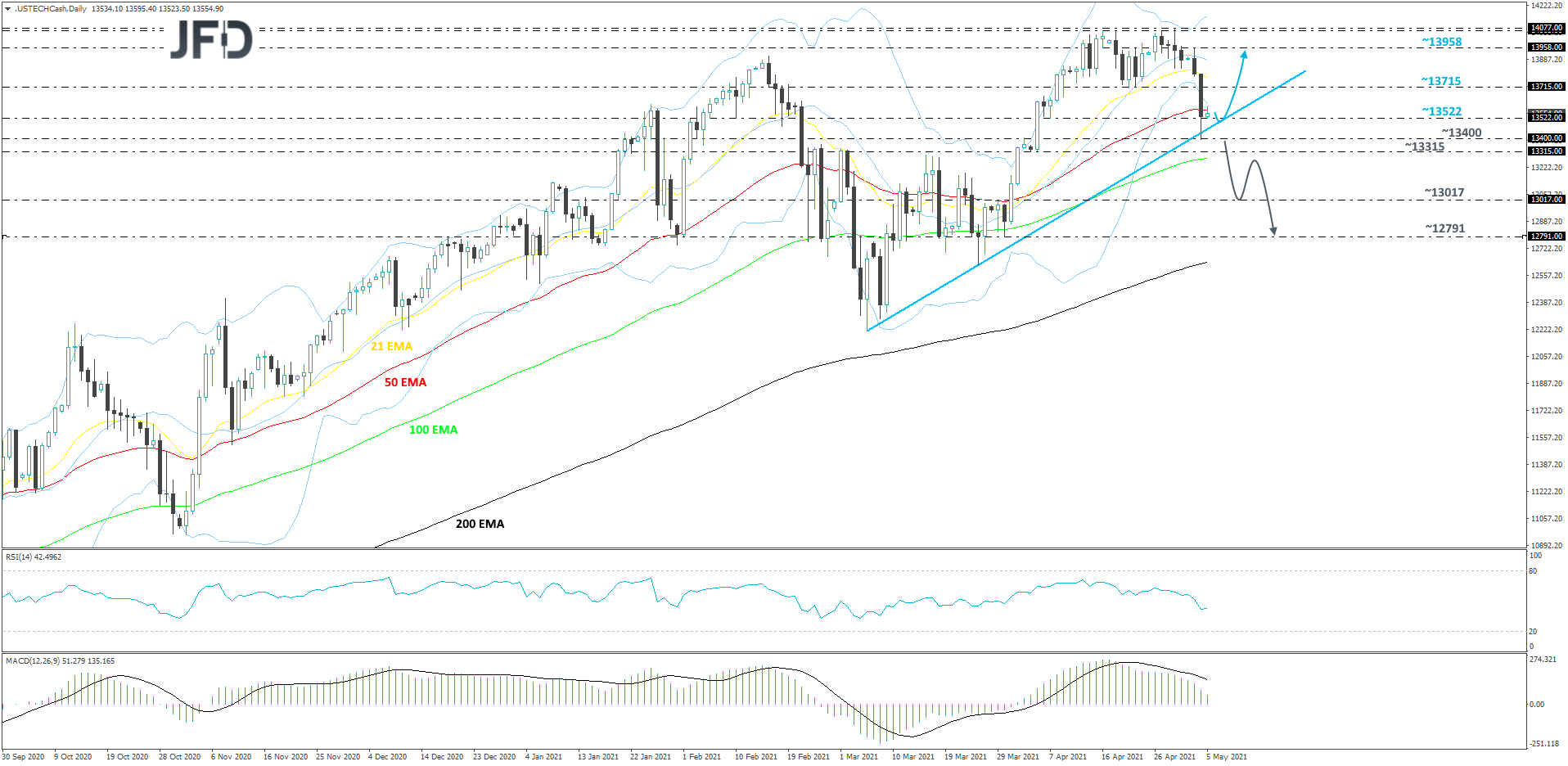

NASDAQ 100 Technical Outlook

NASDAQ 100 declined heavily yesterday, ending up testing the short-term upside support line taken from the low of Mar. 5. The cash index then rebounded and climbed slightly higher. If that upside line continues to provide support, the price may travel higher. Nevertheless, we will take a cautiously-bullish approach for now.

As mentioned above, if the index continues to float above the aforementioned upside line, the buyers may take advantage of the lower price and push north again. If so, NASDAQ 100 could test the 13715 hurdle, a break of which might clear the way towards the 13958 level, marked by the current highest point May.

On the other hand, if the index ends ups breaking the previously mentioned upside line and then falling below the 13400 zone, marked near yesterday’s low, that would confirm a forthcoming lower low. Such a move could send the index towards the 13315 hurdle, or all the way to the 13017 area, marked by the inside swing high of Mar. 29. If the selling doesn’t stop there, the next potential target might be at 12791, which is the low of Mar. 30.

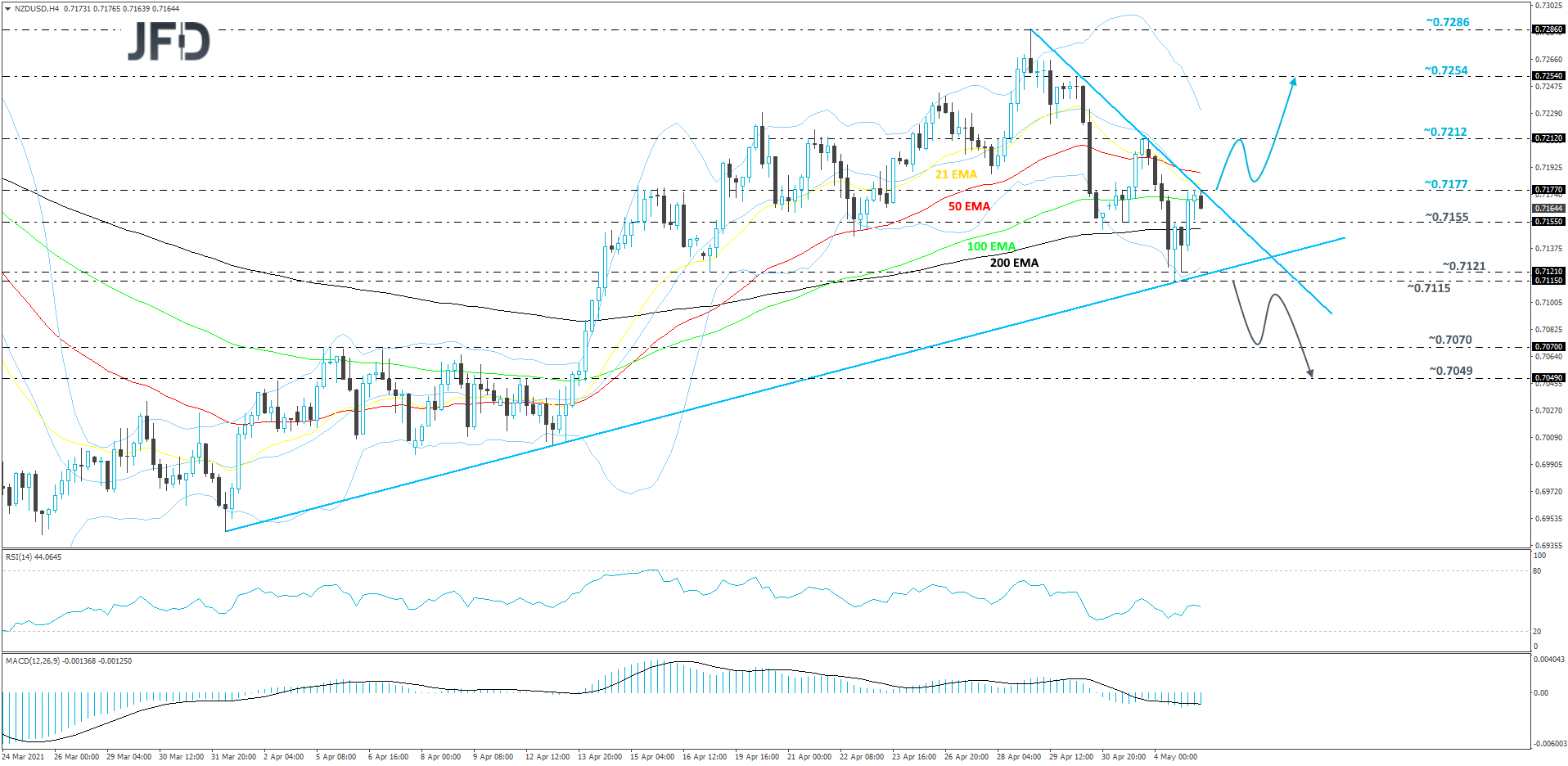

NZD/USD Technical Outlook

From around the end of April, NZD/USD continues to drift lower, while trading below a short-term downside resistance line taken from high of Apr. 29. However, we may still class this move as a temporary correction, if the short-term upside support line drawn from the low of Apr. 1, continues to hold. Nevertheless, we would need to wait for a breakout through one of the lines first, before examining the next short-term directional move.

A break through the aforementioned downside line and a push above the 0.7177 barrier, marked by the current high of today, may attract more buyers into the game. NZD/USD could then travel to the 0.7212 hurdle, which if fails to provide resistance and breaks, could open the door for a further move north, possibly targeting the 0.7254 level. That level is marked by the high of Apr. 30.

Alternatively, if the pair ends up sliding again, breaks the previously discussed upside line and drops below the 0.7115 hurdle, marked by yesterday’s low, that would confirm a forthcoming lower low and set the stage for further declines. NZD/USD may drift to the 0.7070 zone, marked near the highs of Apri.5, 6 and 7, where a temporary hold-up might occur. However, if the bears continue to dominate the field, they might overcome that zone and end up aiming for the 0.7049 level, marked by the high of Apr. 12.

As For Today's Events

During the Asian morning today, we got New Zealand’s employment report for Q1, which came in better than expected and helped Kiwi recover some of yesterday’s losses.

During the European session, the final services and composite PMIs for April from the Eurozone and the US are due to be released, but as it is always the case, they are expected to confirm their preliminary estimates.

The ISM non-manufacturing index and the ADP employment report for the month are coming out as well. The ISM index is expected to have risen to 64.3 from 63.7, while the ADP report is forecast to show that the private sector has gained 815k jobs after adding 517k in March.

We will also get to hear from three Fed officials: Chicago Fed President Charles Evans, Cleveland Fed President Loretta Mester, and Boston Fed President Eric Rosengren. Following Yellen’s remarks over higher rates, it would be interesting to see what they have to say about the Fed’s future policy plans.