Investing.com’s stocks of the week

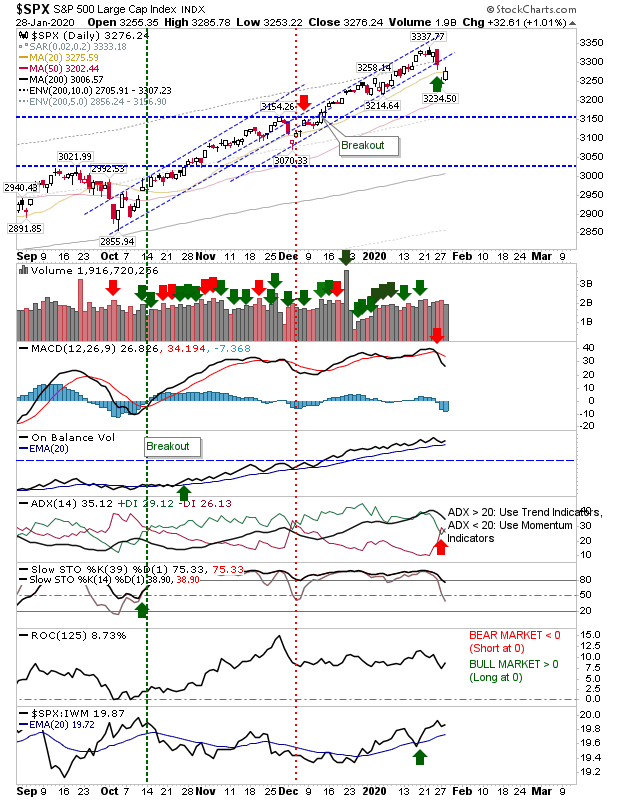

It's been two days since the last post and Monday's open began with a big gap down which started the day for the S&P below channel support (and the prospective buying opportunity), but has now left the NASDAQ in a possible buying opportunity.

For the S&P, the gap down may have been enough for value buyers but the break effectively kills the rally and likely starts a new sideways consolidation. The MACD trigger 'sell' expanded with a new 'sell' trigger in the ADX.

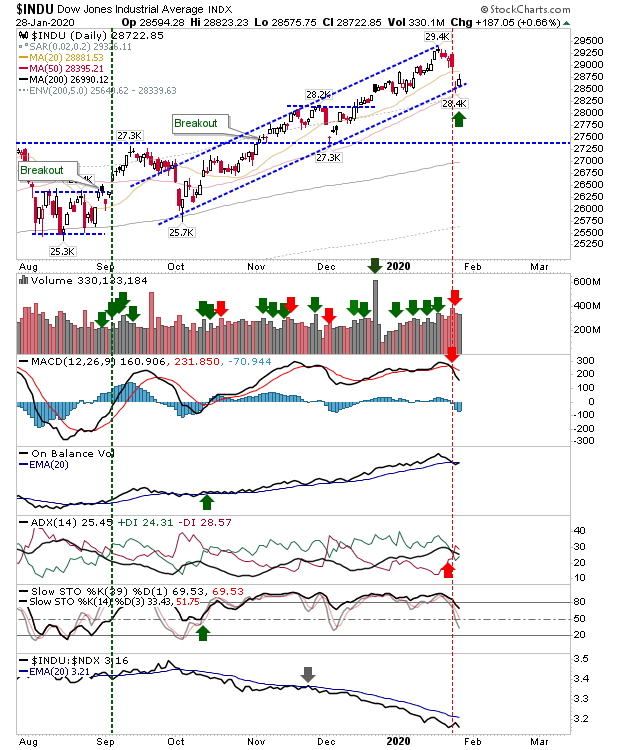

However, what hurt the S&P has instead helped the Dow Jones Index. Like the S&P, there was an ADX 'sell' trigger and a MACD 'sell'. The index has been sharply underperforming the NASDAQ 100 since October but a bounce from support could offer the foundation for a kick-on rally with a shift in relative performance in Large Caps' favor.

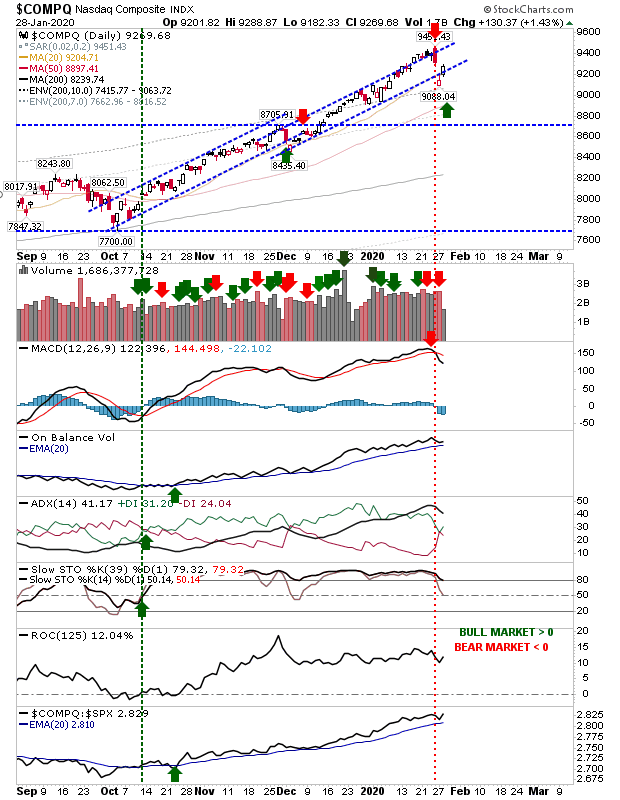

On the back of losses, the NASDAQ is also trading at channel support. Unlike the Dow Jones, it has the benefit of a relative performance advantage (vs the S&P), but does have the MACD trigger 'sell'.

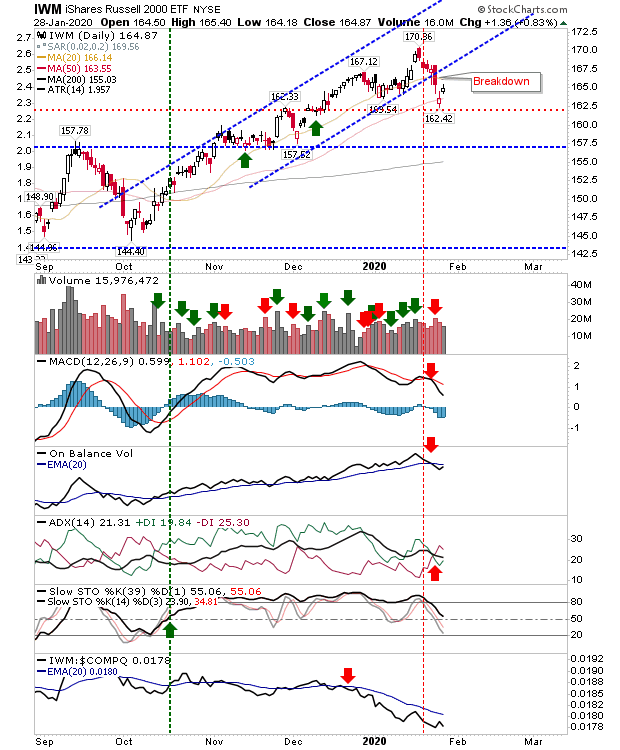

The Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM))was the first index to lose channel support. The breakdown was confirmed by a 'sell' trigger in the MACD, On-Balance-Volume and ADX; only stochastics left to switch to a net bearish picture. Relative performance remains weak.

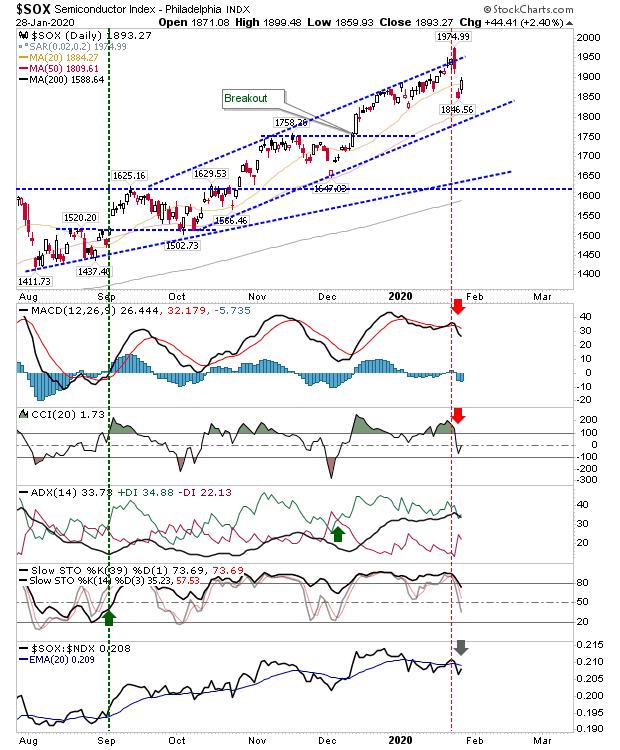

The Semiconductor Index recovered over 2% but given it's caught between channel support and resistance, so it's net neutral—although with a bullish bias because of the rising trend.

For today, look for channel support rallies from the Dow and NASDAQ—the latter in particular. Longer term, a sideways consolidation of gains generated from the August acceleration (part of the broader rally from the end of 2018) looks closer to happening now after a similar pattern started to emerge during the summer of 2019. From a trade perspective, selling covered calls against underlying long positions looks favored.