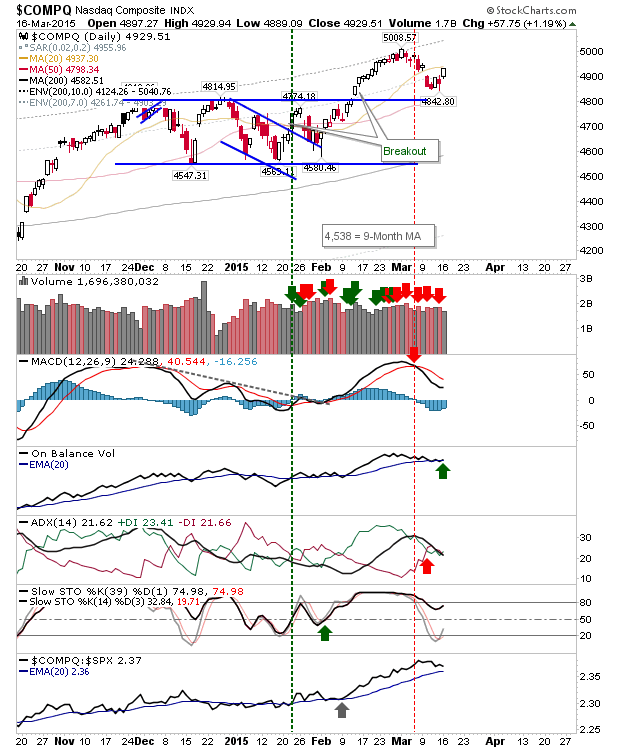

A solid gain continued the development of swing lows in the various indices yesterday. Yesterday's gains effectively confirmed the support levels for these lows. The NASDAQ had the best of the action with the swing low forming above 4800 breakout support. The index is about to close the breakdown gap from Tuesday, but first it has to contend with the 20-day MA. Shorts may view this is as an opportunity, although technicals point to mild weakness.

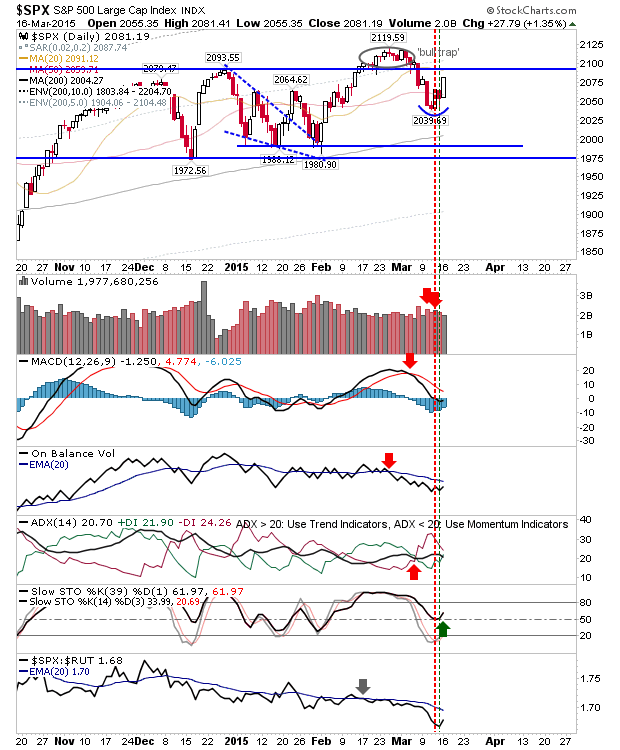

The gain in the S&P hasn't yet challenged its 'bull trap' defined by 2,090 resistance. Technicals mostly side with bears, although stochastics [39,1] are bouncing off an area associated with bullish buying opportunities.

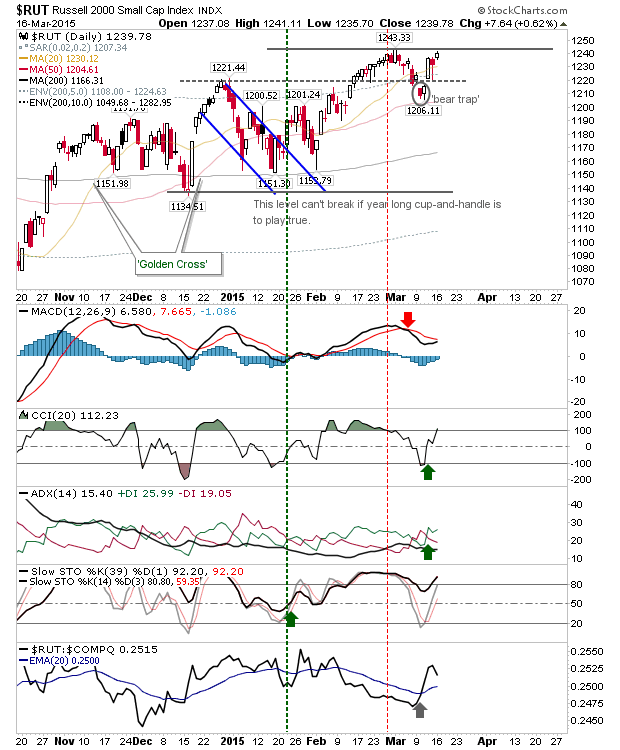

The Russell 2000 is on the verge of a breakout and is well positioned to make a run on this today. The 'bear trap' is playing well off 50-day MA and has the potential for a measured move to 1290/1300.

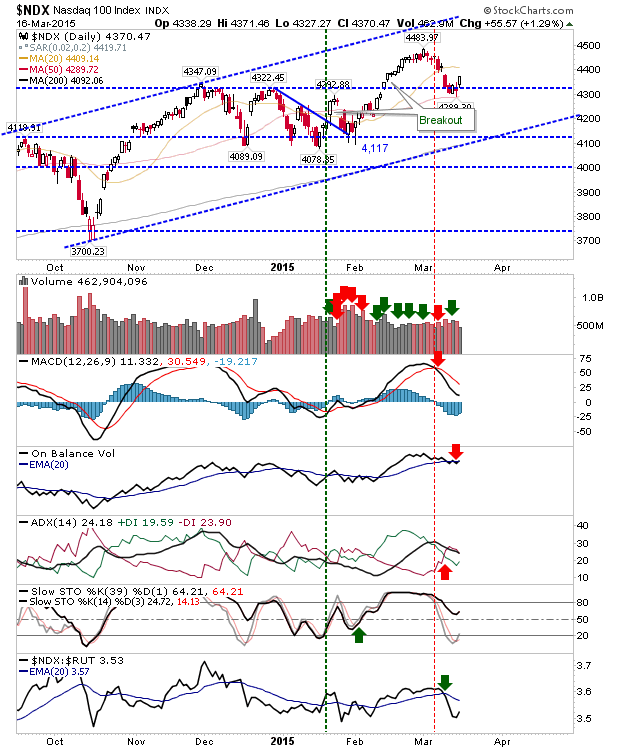

The NASDAQ 100 is working a swing low off key 4320 breakout support. This swing low has also found support at the 50-day MA.

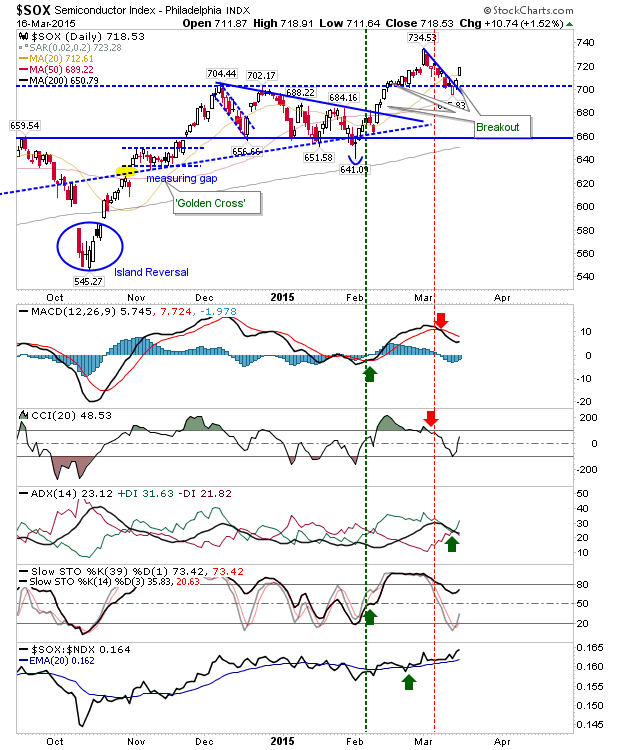

The Semiconductor Index has also regained a foothold with a new gap breakout.

For today, watch for weakening in the opening 30 minutes of the cash market. It will be important to see that any losses experienced during the day are recovered by the close. If this fails to happen, the premise for the swing low is reduced.