Yesterday's action was more subtle, with indices regaining some of Monday's lost ground, yet it was not enough to challenge prior highs.

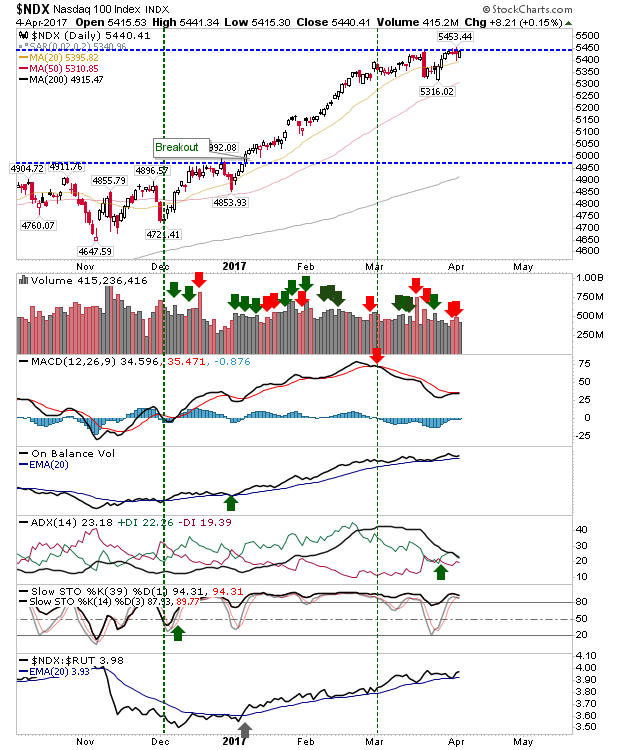

Best of the action was on the NASDAQ 100. It's well placed to break above 5,450 and free itself from resistance. The MACD is very close to a trigger 'buy' with good relative performance against improving Russell 2000.

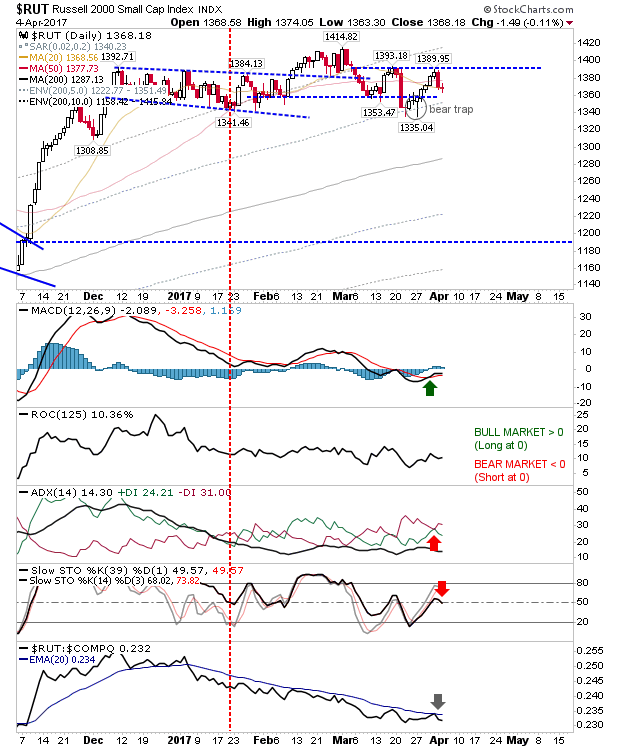

The Russell 2000 didn't post a gain yesterday; it also hung on to 20-day/50-day MA support. While it hasn't kicked on, it has managed a MACD trigger 'buy'

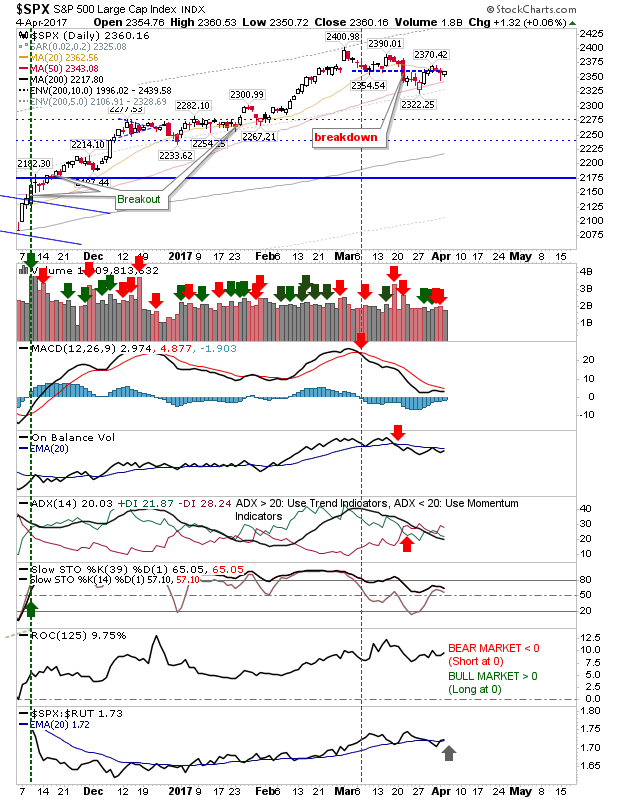

The S&P posted a small gain but also generated a fresh relative 'buy' trigger (against the Russell 2000). While momentum buyers look to the NASDAQ and NASDAQ 100, value buyers can look to the S&P. A gain here could be the start of a bullish breakout from a 'flag' consolidation. The 50-day MA can be used for a trailing stop.

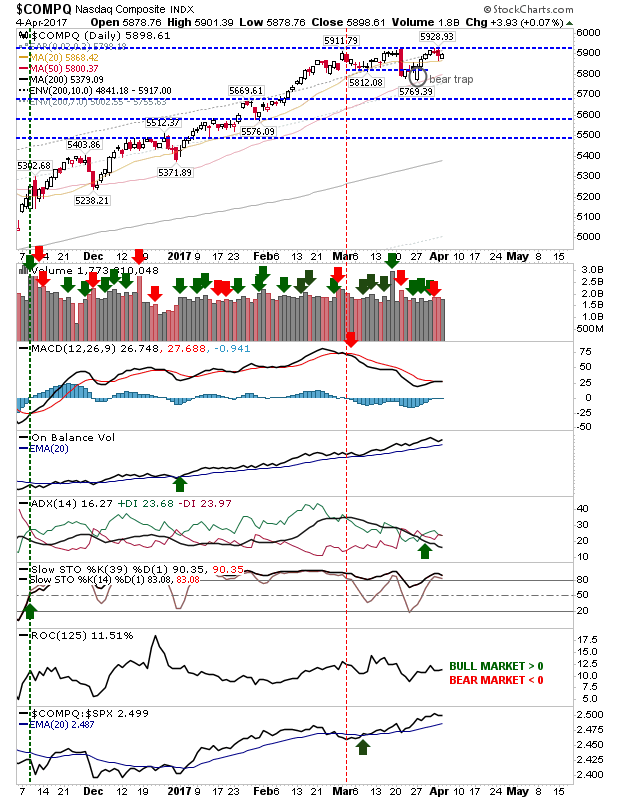

The NASDAQ defended its 20-day MA - yet didn't quite do enough for a new MACD trigger 'buy' - will it do so today? Watch it too for a MACD trigger 'buy' on what has been strong relative performance throughout 2017.

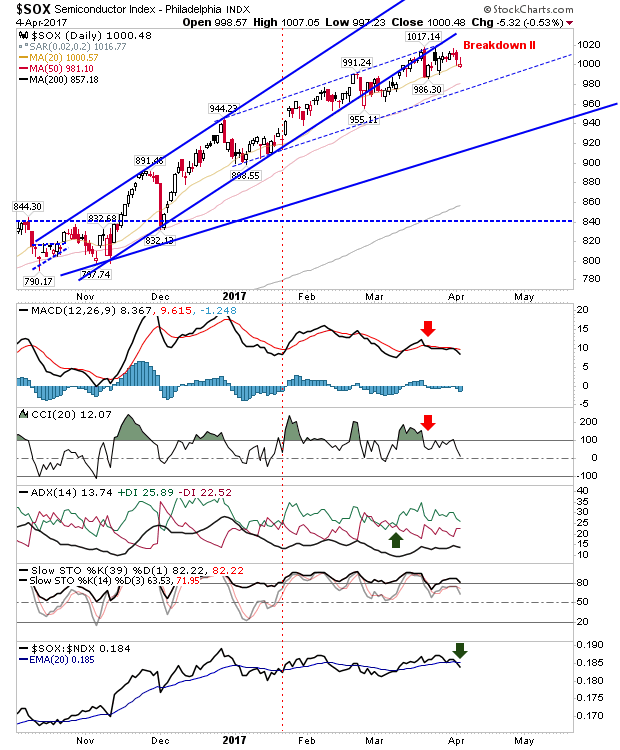

The spanner in the works remains the Semiconductor Index. It's struggling a little without truly tilting in favour of one side or the other. The 20-day MA is playing as support with the 50-day MA nearby to lend a hand if needed. Technicals are weak, and yesterday's inverse hammer looks bearish. Should this undercut the 20-day MA then breakouts for the NASDAQ and NASDAQ 100 are unlikely to hold - if such breakouts should occur.

For today, watch NASDAQ, NASDAQ 100 and Semiconductor Indexes for leads. Those late to the game may yet be able to pick up value in the S&P if there are breakouts higher.