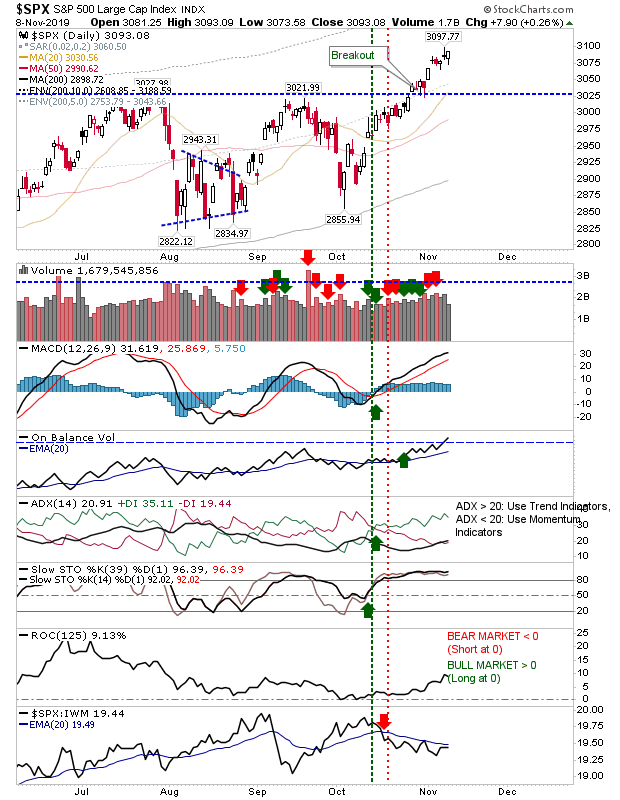

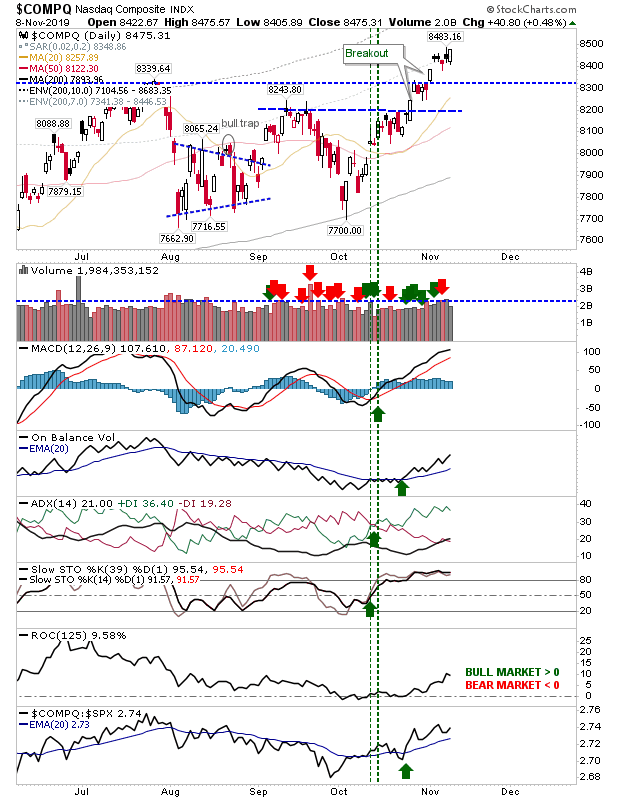

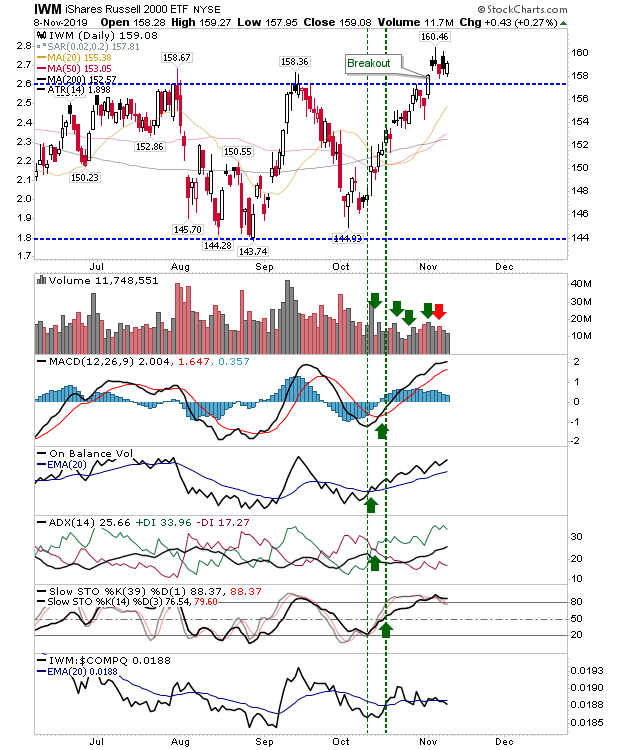

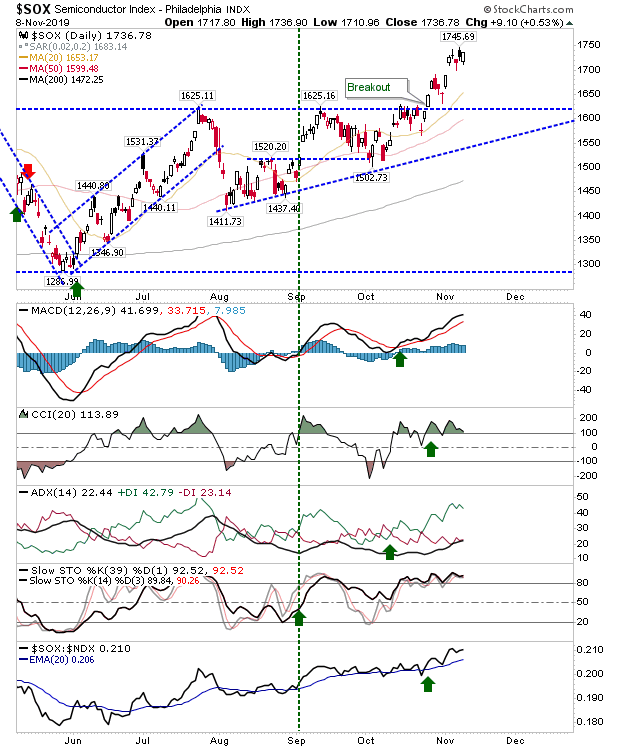

Friday was more about preserving gains and undoing some of the potential 'topping' candlesticks which had emerged on Thursday. Volume was down from the previous day, but there is now a decent buffer across markets to protect against future weakness.

The S&P has matching breakouts for price and On-Balance-Volume but the index continues to underperform relatively against Small Caps.

The NASDAQ may have put to bed the series of neutral candlesticks with Friday's engulfing pattern. However, On-Balance-Volume hasn't yet supported the price breakout (as was done in the S&P) which may see some clawback until it catches up.

Small Caps (via the iShares Russell 2000 ETF (NYSE:IWM)) are running closest to breakout support but relative performance is mixed with underperformance against the NASDAQ but outperformance against the S&P. Like the NASDAQ, On-Balance-Volume has't confirmed the price breakout but is rising

The Semiconductor Index is well above breakout support with solid relative performance against the NASDAQ 100. Gains for the Semiconductor Index should continue to feed into the NASDAQ as the latter index lags behind the former.

Monday is set up to continue Friday's gains. As indices move further from breakout support it will encourage sideline money to move into the market.