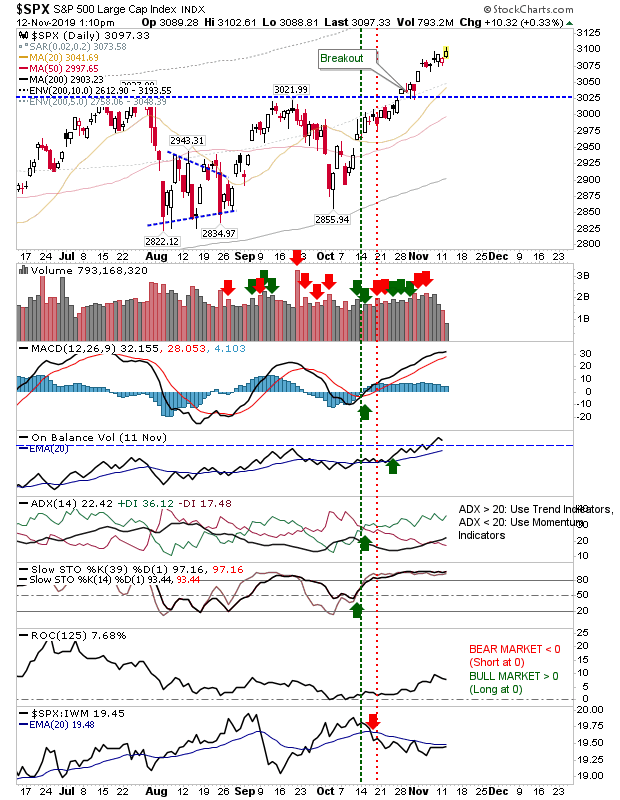

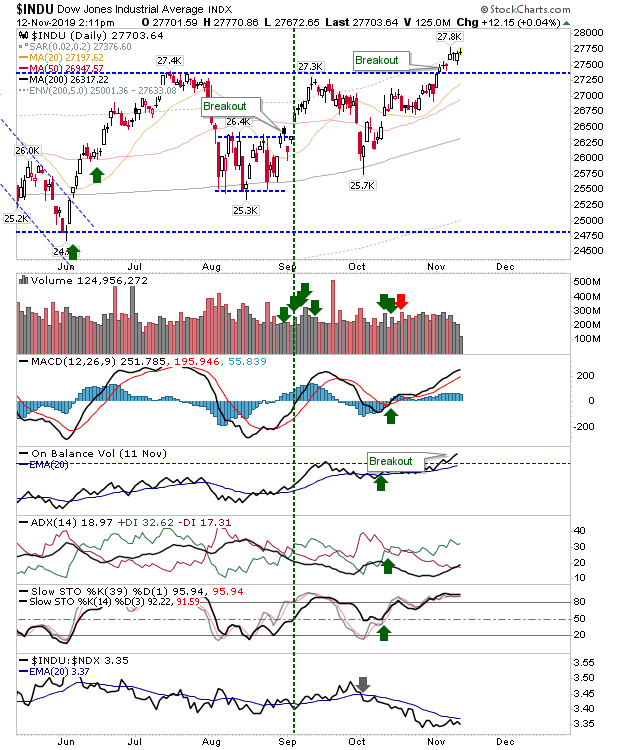

Very little to add from what has gone before; rallies continue higher with supporting technicals still positive (no bearish divergences of concern).

The S&P continues a run of small gains which keeps bulls happy without risking a runaway extension which could encourage early profit taking. The index is under-performing against the Russell 2000—which is healthy in a cyclical rally.

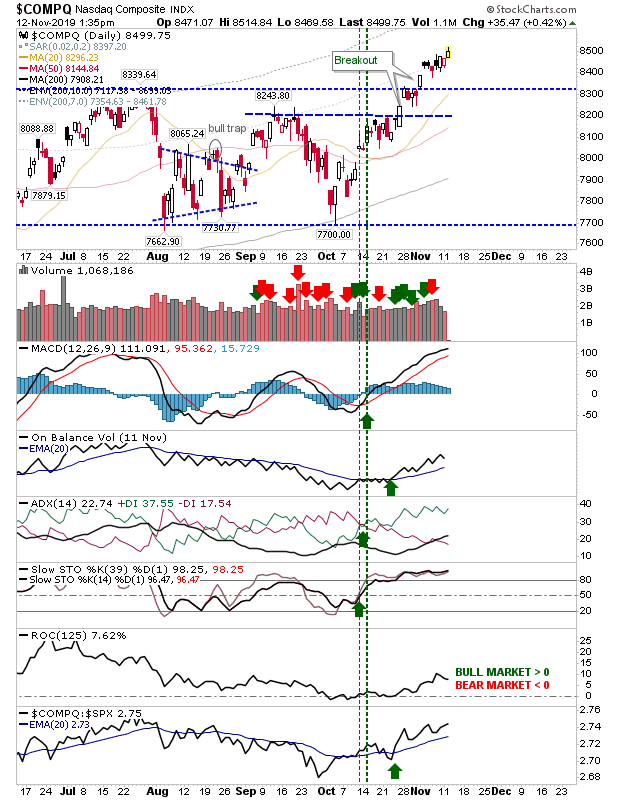

The NASDAQ has managed to pull away from its narrow consolidation of mini-bearish candlesticks. Yesterday's gain also helps with an uptick in relative performance against the S&P.

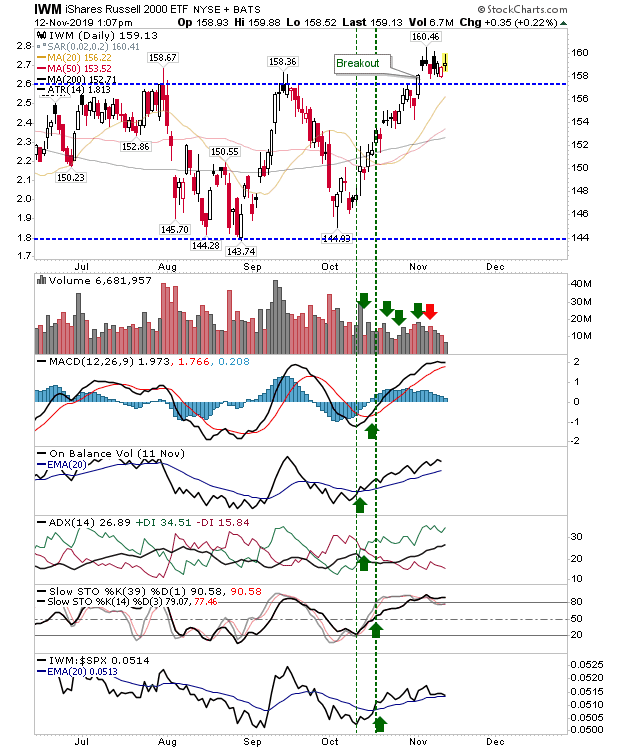

The breakout in the Russell 2000 (via iShares Russell 2000 (NYSE:IWM)) is still in its early stage but so far it hasn't threatened to develop into a 'bull trap'. As with other indices, there are no bearish divergences of concern so little reason to suggest this nascent breakout will fail.

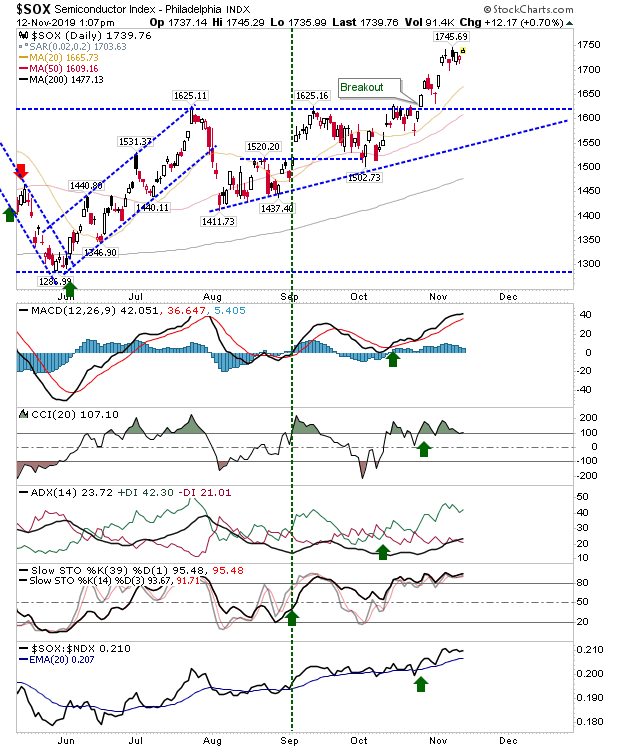

Supporting Indices are also doing well. The Semiconductor Index is well above its breakout point.

And the Dow Industrials, while still in the early stage of its breakout, does have an On-Balance-Volume breakout to help it along.

Until something changes, bulls are in control.