Market Brief

In the wake of Friday’s strong NFP report, the USD traded sideways as traders continued adjusting positions to dovish ECB expectations on March 10th. On Friday, February’s NFPs came in at 242k, beating market expectations of 195k, while the previous month reading was revised higher to 172k from 151k. However, this good news did little to revive dollar bulls as the wage figures raised questions about the inflation outlook. Average hourly earnings contracted -0.1%m/m in February, versus +0.2% median forecast. Separately, the US reported a bigger-than-expected trade deficit in February as exports fell 2.1% $176.5bn, the lowest level in fourth years, while imports slid 1.3% to $222.1bn. In Asia, EUR/USD was trading in a narrow range between 1.0975 and 1.0997. On the upside, the 1.1044 level remains the closest resistance (Fibonacci 50% on January-February rally), while on the downside the pair will find a first support at around 1.0965 (Fibo 61.8%).

We expect limited euro strength ahead of Thursday's ECB meeting as Mario Draghi could surprise the market. For now, market participants expect a cut of 10bps in the deposit rate, which would bring it down to -0.40%. However, the market is on the defensive and will avoid pricing in overly dovish expectations, especially after what happened on December 3rd last year.

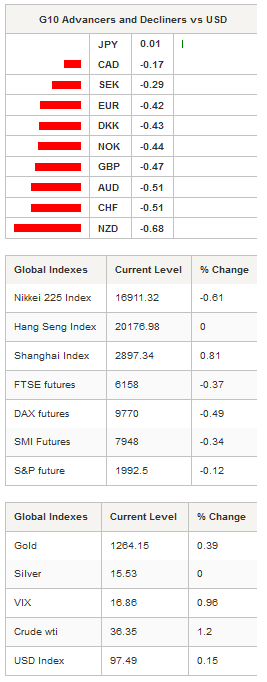

Among the G10 complex, the Japanese yen was the only currency capable of holding ground against the US dollar; thanks to its safe haven status. USD/JPY consolidated at around 113.70. On the downside, a support can be found at 112.16, while on the upside a resistance lies at 114.87.

In China, Premier Li Keqiang announced the world’s second biggest economy's goals for the year. The gross national product is expected to be between 6.5% and 7%. He also declared that the government will carefully address the problem of “zombie enterprise” “by using measures such as mergers, reorganizations, debt restructuring and bankruptcy liquidations.” The market reacted well to this announcement, pushing Chinese equities into positive territory. The Shanghai and Shenzhen Composites are up 0.81% and 2.03% respectively. In Hong Kong, the Hang Seng remained flat. In Japan, equities were edging slightly lower with the Nikkei down 0.61%, while the broader Topix index settled down 0.98%.

Crude oil continued its bull run as supply glut fears fade slowly. The West Texas Intermediate was up 1.20% to $36.35 a barrel, while its counterpart from the North Sea, the Brent, rose 0.75% to $39.01. However, crude oil’s strong gains were of little help in pushing commodity currencies higher as investors start to wonder whether the Aussie and Kiwi rally still has legs. The New Zealand dollar was down 0.68%, while the Aussie fell 0.51% in overnight trading.

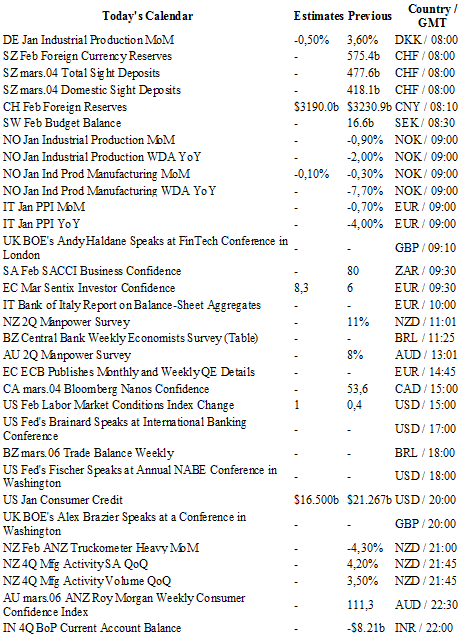

Today traders will be watching foreign currency reserves from Switzerland; industrial production from Norway; the weekly trade balance from Brazil; Fed’s Fischer speech in Washington; manufacturing activity from New Zealand.

Currency Tech

EUR/USD

R 2: 1.1193

R 1: 1.1068

CURRENT: 1.0954

S 1: 1.0810

S 2: 1.0711

GBP/USD

R 2: 1.4591

R 1: 1.4409

CURRENT: 1.4168

S 1: 1.3836

S 2: 1.3657

USD/JPY

R 2: 117.53

R 1: 114.91

CURRENT: 113.71

S 1: 110.99

S 2: 105.23

USD/CHF

R 2: 1.0257

R 1: 1.0074

CURRENT: 1.0005

S 1: 0.9847

S 2: 0.9660