S&P 500 logs worst monthly drop in two years

US stock indices dropped further on Wednesday as selloff continued following Federal Reserve Chairman Jerome Powell’s upbeat assessment of US economy. The dollar strengthening persisted as Powell’s comments boosted expectations of more aggressive Fed tightening: the live dollar index data show the ICE US Dollar Index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.3% to 90.65. The S&P 500 lost 1.1% to 27031.83, posting 3.9% monthly drop. The Dow Jones industrial fell 1.5% to 25029.20, down 4.3% on month. NASDAQ Composite index slid 0.8% to 7273.01. Futures on main US stock indices indicate higher openings today.

European stocks slide

European stocks extended losses on Wednesday tracking Wall Street. The euro and the British pound continued the slide against the dollar. The Stoxx Europe 600 lost 0.7%, closing 4% lower for February. Germany’s DAX 30 slipped 0.4% settling at 12435.85. France’s CAC 40 lost 0.4% and UK’s FTSE 100 fell 0.7% to 7231.91. Indices opened 0.3%-0.4% lower today.

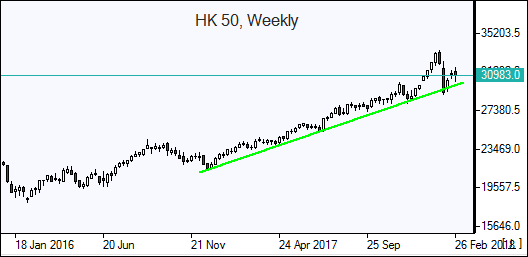

Asian markets mixed

Asian stock indices are mixed today after Wednesday’s selloff. Nikkei ended 1.6% lower at 21720 despite yen turning lower against the dollar. China’s stocks are higher after Caixin Manufacturing PMI private gauge suggested greater strength in factory activity than official data released Wednesday: the Shanghai Composite Index is 0.4% higher and Hong Kong’s Hang Seng Index is up 0.7%. Australia’s ASX All Ordinaries is down 0.7% despite declining Australian AUD/USD against the greenback after weak capital spending data.

Brent recovers after sharp drop as US supplies rise

Brent Oil Futures prices are recovering today with gains limited by the stronger dollar. Prices dropped yesterday after a bigger than expected US crude stocks build. The US Energy Information Administration reported Wednesday that domestic crude supplies rose by 3 million barrels last week while the American Petroleum Institute on Tuesday reported a rise of 0.9 million barrels. April Brent crude fell 2.2% to $61.64 a barrel on Wednesday.