Here are the latest developments in global markets:

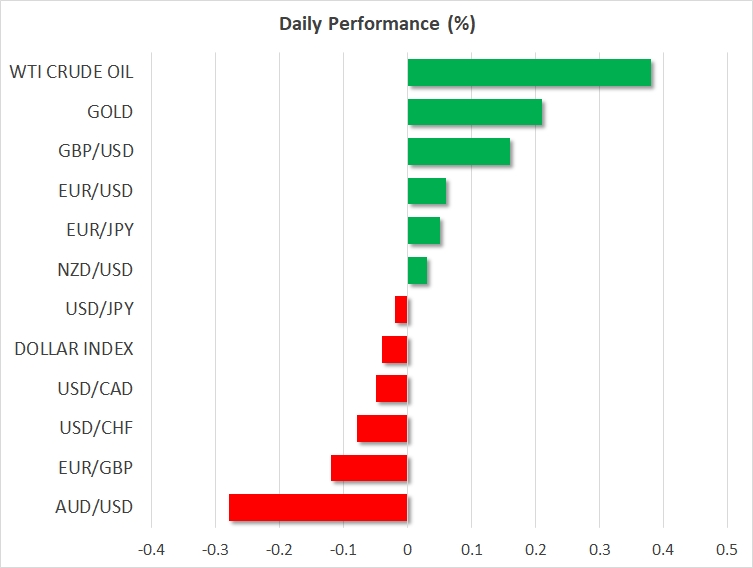

- FOREX: The US dollar index is fractionally lower on Wednesday (-0.04%), after posting some marginal losses in the previous session as well. Pound/dollar is up by 0.16%, looking set to extend the gains it posted yesterday after UK PM May announced she will be taking over the Brexit negotiations personally.

- STOCKS: Wall Street closed mixed on Tuesday. While the Dow Jones (+0.79%) and the S&P 500 advanced (+0.48%), the tech-heavy Nasdaq Composite gave back some notable gains it had posted early to close practically flat (-0.01%). Stellar earnings from Google parent Alphabet (NASDAQ:GOOGL) (+3.89%) helped to lift the broader market, with news the US will provide subsidies to farmers also lifting manufacturers like John Deere (Deere & Company, NYSE: DE) (+3.18%) and Caterpillar (NYSE:CAT) (1.24%). Asian markets were mostly higher on Wednesday. Japan’s Nikkei 225 and Topix climbed by 0.46% and 0.38% respectively, while in Hong Kong, the Hang Seng gained 1.15%. Major European and US markets were expected to open modestly lower today, according to futures, with the only notable exception being the French CAC 40.

- COMMODITIES: Oil prices climbed, amid continued signs of tension between the US and Iran, as well as optimism that increased Chinese infrastructure spending may help offset any negative impact on oil demand from the US-China trade spat. A larger-than-expected drawdown in the private API inventory data may have helped as well. Crude Oil WTI is up by 0.38% at $68.78 per barrel on Wednesday, and Brent higher by 0.82% at $74.02. In precious metals, gold oscillated in a tight range and ended the day flat on Tuesday. It is up by 0.21% at $1,226 per troy ounce today.

Major movers: Pound rebounds as PM May takes over Brexit; yen advances

UK PM Theresa May announced yesterday that she will take personal charge over the Brexit negotiations, and the Brexit Department will now focus solely on internal preparations for exiting the EU. The move was likely seen as demonstrating May’s commitment to making some progress in the talks, and was hence cheered by the pound, which closed the day higher against all its major peers – including the broadly stronger yen. With a BoE rate increase in August now all but priced in (86% probability according to UK OIS), the Brexit saga will likely remain the primary driver for sterling in the short-run.

In the US, the government announced it will help farmers affected by foreign tariffs by providing subsidies of up to $12bn. While the number is relatively small relative to the US budget, the announcement was likely seen as a harbinger of things to come, opening the way for more subsidies should trade tensions escalate further. It will also likely help to keep the Republican voting base content ahead of the US midterm elections in November. Staying on trade, today’s meeting between US President Trump and EU Commission President Juncker could be decisive for broader risk sentiment. European car maker stocks will likely be in the eye of the storm, in light of US threats for tariffs on EU car imports if the talks fail to bear fruit.

Meanwhile, the yen continued to advance on Tuesday, closing higher against both the euro and the dollar amid continued speculation the BoJ may begin to reduce its massive stimulus dose as soon as at next week’s meeting. While there’s a lot of attention on this theme, it’s worth reiterating that the conditions the BoJ would like to see before withdrawing some stimulus are mostly absent. Inflation is still subdued, household spending is muted, the economy contracted in Q1, and while wages are showing some signs of life, they are still far from healthy levels. These make any near-term hawkish policy shift seem unlikely, something Japanese press noted overnight as well, reporting that seasoned BoJ watchers don’t expect any changes until October.

Elsewhere, aussie/dollar is down by 0.28% today, following Australia’s inflation data for Q2 overnight, which were a touch softer than expected.

Day ahead: German Ifo surveys and US new home sales due; Juncker-Trump meet

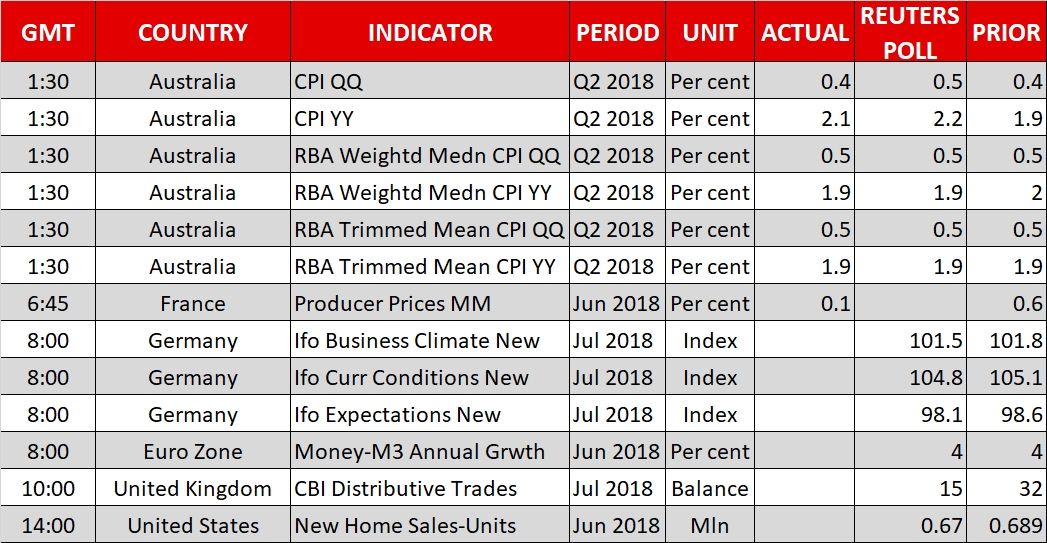

Wednesday’s calendar features the Ifo surveys gauging business sentiment in Germany, as well as new home sales data out of the US. In the meantime, a meeting between European Commission President Jean-Claude Juncker and US President Donald Trump is on the agenda.

The Ifo institute’s surveys gauging business morale in Germany, the eurozone’s largest economy, are due at 0800 GMT. The business climate index, as well as the ones on current conditions and expectations, are all expected to deteriorate in July. Specifically, the measure gauging the business climate is anticipated to record its eighth straight monthly decline and fall to its lowest since early 2017. The rising prospect for a trade war was one of the factors weighing on business sentiment in Germany in the previous months.

The ECB will be releasing monthly data on lending and money supply at 0800 GMT; the figures will pertain to the month of June.

The Confederation of British Industry’s distributive trades retail sales balance is projected to ease to +15 in July after jumping to a multi-month high of +32 in June; June’s print was helped by hot weather which was supportive of higher growth in British retail sales.

US new home sales for June will be made public at 1400 GMT. Sales are forecast to drop by 2.8% on a monthly basis after rising by 6.7% in May; the previously reported month’s sales were boosted by transactions in the south part of the country which climbed to a near 11-year high.

Meanwhile, the Juncker-Trump meeting in the White House will be attracting attention, with trade issues being on the table. Also of interest, will be discussions on NAFTA between Canadian Foreign Minister Chrystia Freeland and Mexican President-elect Andreas Manuel Obrador.

In emerging markets, a BRICS summit commencing in South Africa and lasting up to Friday will be watched for any important agreements between the parties involved.

In equities, Boeing (NYSE:BA), Facebook (NASDAQ:FB) and Qualcomm (NASDAQ:QCOM) are some of the big names reporting quarterly earnings today.

Of interest to oil traders will be weekly EIA data on crude oil inventories due at 1430 GMT.

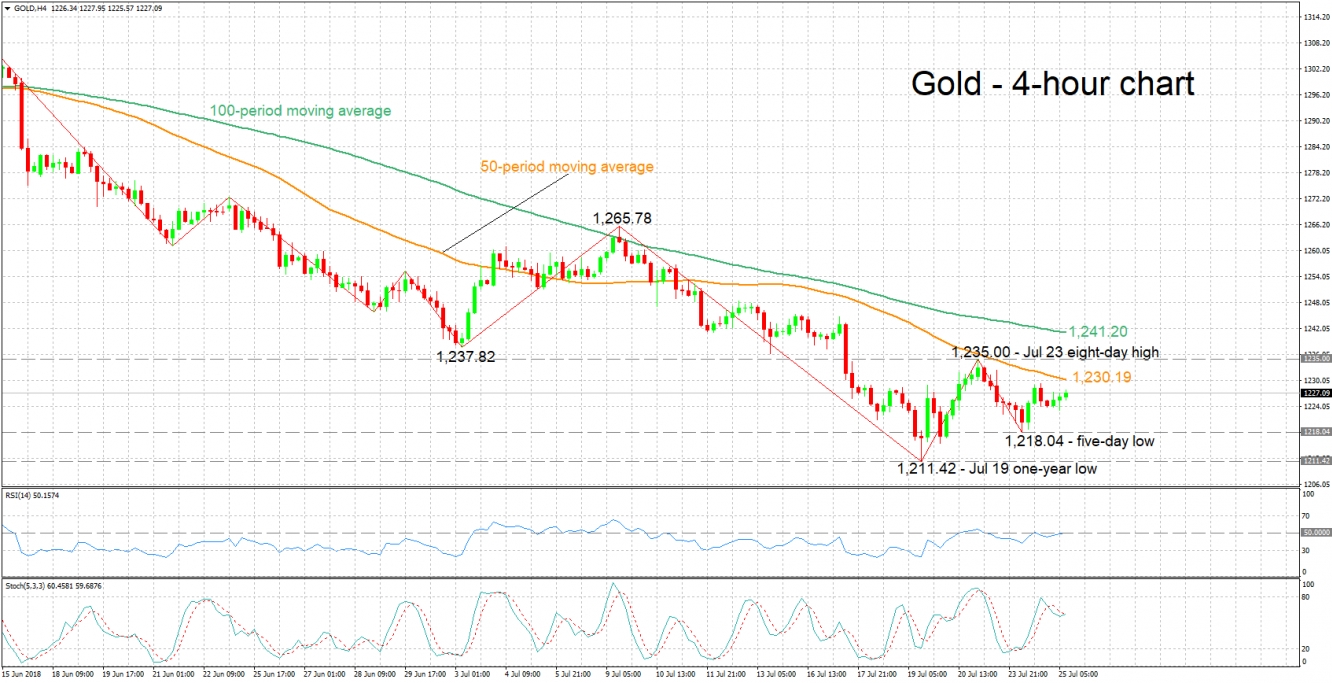

Technical Analysis: Gold looking mostly neutral in the short-term

Gold has gained a bit after edging closer to the one-year low of 1,211.42 hit earlier in the month on Tuesday. The RSI is largely moving sideways around the 50 neutral-perceived level, supporting the view for a predominantly neutral picture in the short-term. Turning to the stochastics, it is of note that the %K line has moved above the slow %D line. This is a bullish signal in the very short-term, though it is still early to conclude in that direction.

Should concerns over trade ease in the aftermath of today’s Juncker-Trump meeting, then the risk-on sentiment is likely to divert funds away from gold, pushing the precious metal lower. Initial support to declines may come around yesterday’s five-day low of 1,218.04, with steeper losses shifting the attention to the one-year low of 1,211.49 from July 19.

Rising trade concerns on the other hand, could boost the safe-haven perceived asset. Resistance to advances may come around the current level of the 50-period moving average at 1,230.19, with the regions around Monday’s eight-day high and the 100-period MA being eyed next at 1,235 and 1,2412.20 respectively.

Movements in the greenback can also affect the dollar-denominated metal; a weaker USD is supportive of higher gold prices and vice versa.