- Softer PCE data keep chances of another 50bps Fed cut elevated

- Fed Chair Powell speaks, ISM PMIs and NFP on this week’s agenda

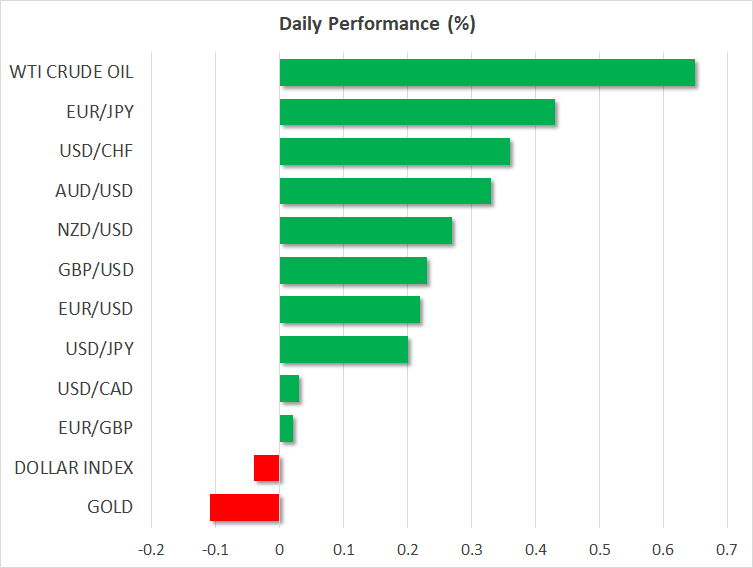

- Yen rally pauses after Ishiba says policy should stay accommodative

- Aussie, Kiwi, and Chinese stocks celebrate PBoC’s measures

Market Assigns Decent Chance for Back-To-Back 50bps Fed Cut

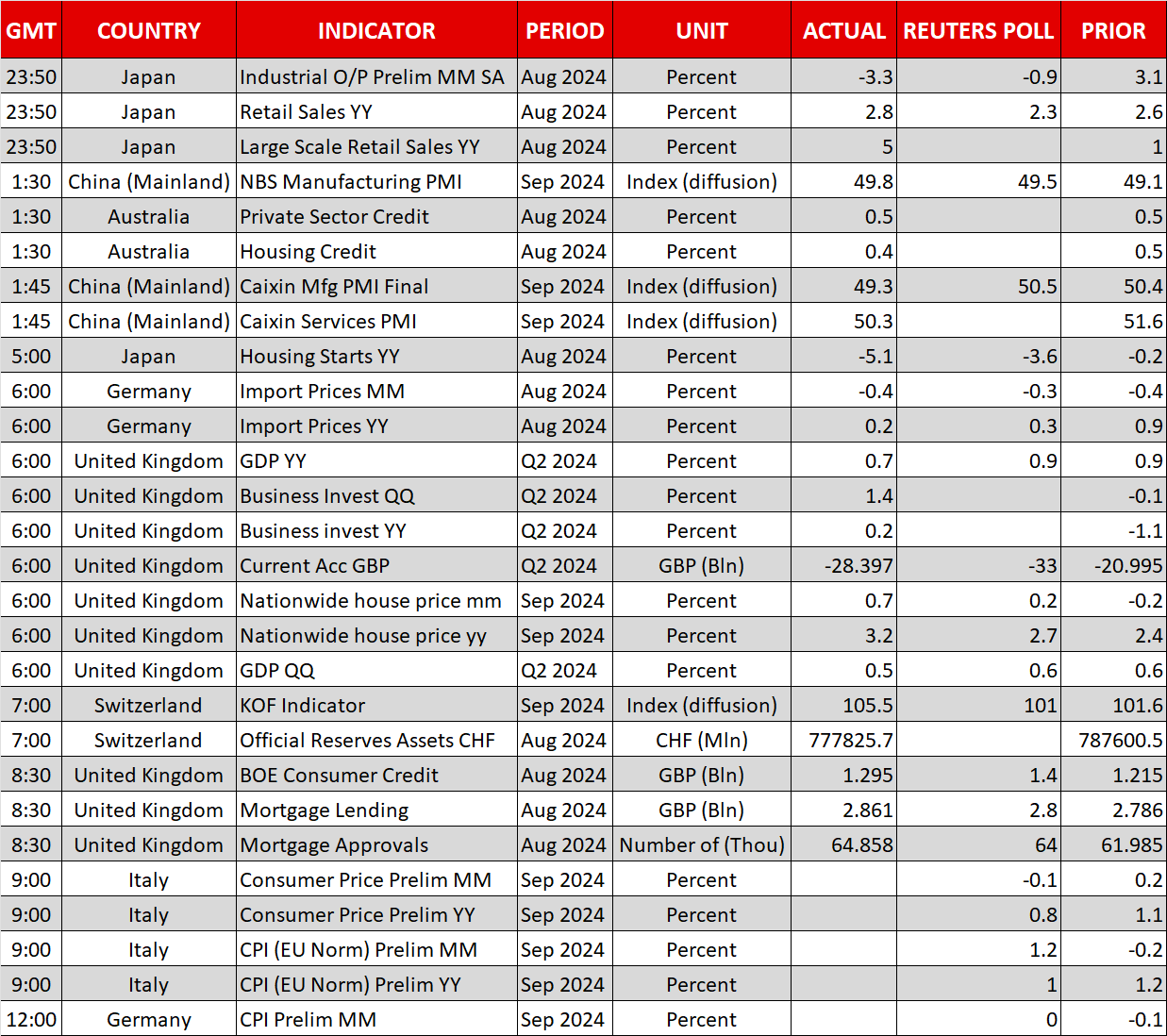

The dollar slipped against most of its major peers after Friday’s data revealed that the headline PCE price index slowed more than expected in August, although the more important core PCE rate ticked up to 2.7% y/y from 2.6%.

Perhaps the greenback weakened as the uptick in the core rate was expected and/or because this inflation data set was accompanied by softer income and spending numbers. This allowed investors to maintain their dovish bets with regards to the Fed’s future course of action. According to Fed funds futures, investors anticipate another 75bps worth of rate cuts by the end of the year, assigning a 54% probability for a back-to-back 50bps reduction in November.

As they try to figure out how the Fed will move forward, investors will focus on the ISM PMIs and the NFP jobs report this week, but today, they may pay attention to speeches by Fed Chair Jerome Powell and Fed Governor Michelle Bowman. Last week, policymakers Christopher Waller and Neel Kashkari clearly favored slower rate reductions going forward, and it remains to be seen whether Powell and Bowman will hold a similar view.

Yen Stabilizes After Ishiba’s Remarks, BoJ Summary on Tap

The Japanese yen skyrocketed on Friday as Shigeru Ishiba, a former defense minister, secured leadership of the ruling Liberal Democratic Party (LDP), and he will be approved as prime minister on Tuesday.

Ishiba was a critic of aggressive easy monetary policy in the past while his rival, Takaichi is known to be opposed to the Bank of Japan’s rate increases. The yen rallied as the probability for another 10bps hike by December rebounded to around 67%, but it steadied today after Ishiba said that monetary policy should remain accommodative. He also called for a snap election on Oct 27.

Tonight, during the Asian session on Tuesday, yen traders may dig into the Summary of Opinions of the latest BoJ decision for clues and hints on whether policymakers are indeed planning to hit the hike button one more time before the turn of the year.

China Rolls Out Stimulus, Aussie and Kiwi Climb Higher

The risk-linked Aussie and Kiwi have been cheering the stimulus measures by the People’s Bank of China (PBoC) to lower interest rates and inject liquidity into the banking system, with China’s stock market recording its best weekly performance in nearly 16 years last week.

Today, the Chinese PMI data for September revealed that factory activity shrank for the fifth consecutive month and that the service sector slowed by more than expected, which implies that more stimulus measures may be needed soon, perhaps from the fiscal side.

China’s Shanghai Composite added another 8% today, but it will remain closed for the rest of the week due to China’s week-long National Day celebrations, which begin tomorrow.

Wall Street Awaits Key PMI and NFP Data

On Wall Street, only the Dow Jones closed Friday’s session in the green after hitting a fresh record high. Both the S&P 500 and the Nasdaq slipped, with the latter losing the most.

However, despite the pullbacks, there is no indication that the latest bull run is over. Anything suggesting that the US economy is faring better than previously feared may encourage investors to further increase their risk exposure, even if this translates into fewer rate cuts moving forward. The ISM and the US employment report may be Wall Street’s next big tests.