FTSE 6146 -1

DAX 9798 +21

CAC 4428 +3

IBEX 8789 +25

Can the ASX sustain this rally? – Angus Nicholson

Markets continue to rally in Asia, although Chinese markets have given up their early session gains. US ADP employment bounced back overnight from its moderation in January, adding 213,800 jobs in February. This bodes well for the Nonfarm Payrolls number out on Friday. With the ISM services PMI out tonight, there does seem to be a snowballing of growing expectations that the Fed will have the space to raise rates in the second half of the year.

The resurgence in commodities prices, from oil to industrial metals, does also seem to be underpinning the positive moves in equities. Indeed, Dr. Copper, who has been a stalwart indicator of a major market turning point, seems to be moving up alongside the oil price. The other positive development is the ambivalence global markets are giving to disappointing Chinese data, which could be due to China selloff exhaustion or a mature understanding of the seasonal distortions around Lunar New Year. In any case, at some point markets will probably have to start paying attention again soon.

While this rally will inevitably have a pullback at some point, the forthcoming US NFP, China National Party Congress, ECB and BOJ meetings could all help support this rally in the near term. Of course, the markets currently look like they are pricing good news in from all of them, so an upset from any one could throw the rally off. WTI oil has not ended the day down more than 1% in two weeks, which seemingly does make it ripe for a reversal soon, although it looks like it will stay above US$30.

Source: Bloomberg. White – Shanghai Copper Futures, Green – Dalian Iron Ore Futures

In the wake of a little-changed RBA statement, very strong 4Q GDP and a resurgence in commodity prices, the Aussie dollar has broken through US$0.7300 to trade at its highest levels since 1 January. While momentum does look to be behind it at the moment, once it starts reaching its August 2015 highs in the range of US$0.7350-0.7400 I would be looking to fade the rally.

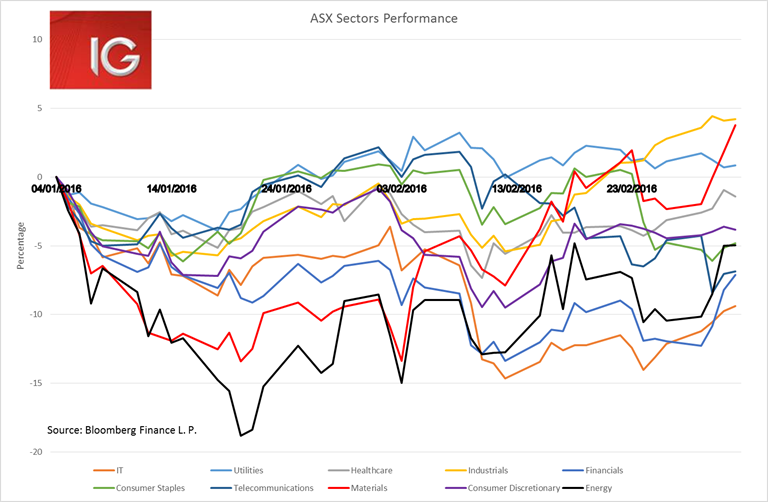

This risk-on rally has produced an incredible reversal in the Australian materials space. The return on the materials sector went positive year-to-date for the first time yesterday, and is now the second best performing sector after industrials. It is interesting that the energy space (-5% YTD) has not seen the same gains despite strong moves in the oil price. Much of the gains in the materials space have been driven by the change in sentiment towards BHP and RIO, but also a lot of shorts seemed to be waiting for the inevitable cut to the dividend before closing out their positions.

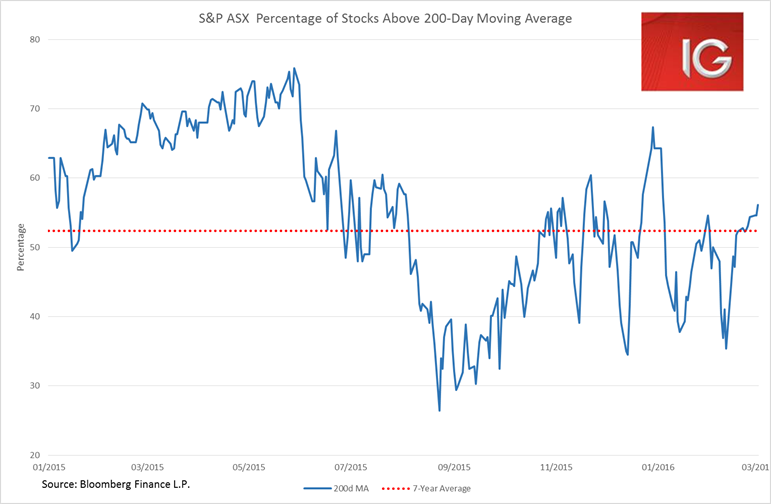

Market breadth measures, such as the percentage of companies above their 200-day moving average, are showing this rally is looking far more stable than that of late-January. 56% of companies are trading above their 200 DMA, however, the ASX has not sustained 60% of companies above their 200 DMA for more than a few days since May 2015. As the ASX moves above 5100 investors may well look to start fading the rally, particularly given it has been driven so much by the down-beaten commodities space.

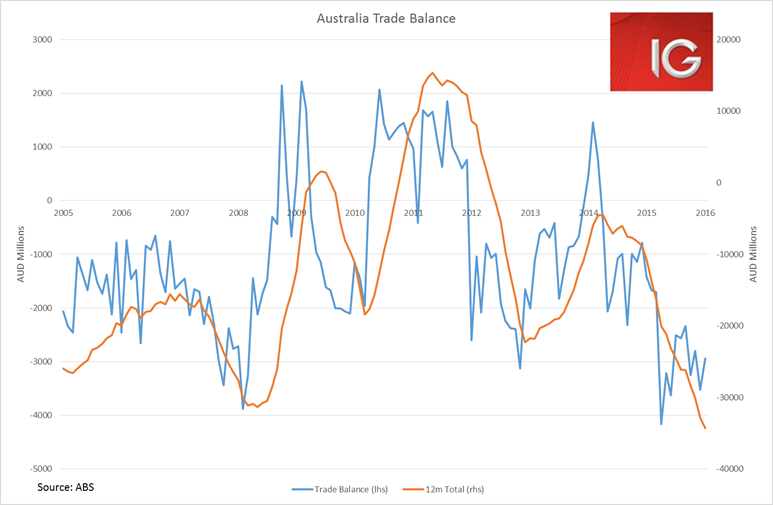

Aussie trade data today does look to be indicating a turning point for the trade deficit as well. This is positive for the Aussie dollar and supports the RBA’s reluctance to cut rates any further. We are unlikely to see the trade deficit fall back to AUD 4 billion as it did in April 2015. The trade deficit does look to be steadily improving, with the past couple of months all averaging around the AUD 3 billion level. If this trend persists through the rest of 1Q, net exports contribution should help support GDP for the quarter.