by Pinchas Cohen

- US and Aussie central banks reaffirm faith in economy – both currencies rise, Treasuries fall

- While Australia and China fall, South Korean equities make record highs

Australian shares resumed yesterday’s slide, once again weighed down by iron ore, the country’s largest export. The rising AUD only adds to the pressure.

The S&P/ASX 200 fell 0.27%, as iron ore plunged almost 8% to 499 CNY ($72.35440), the most in 3 months, on inventory concerns. Yesterday our Chart of the Day demonstrated the positive correlation between the two assets and showed that iron ore is a leading indicator for the S&P/ASX 2000.

The Shanghai Composite fluctuated: up 0.3% and down 0.4% until it finally settled, down 0.2% at 3127.369. This follows a 5% loss since early April on regulatory crackdowns against risky trading.

Recently, China, like the US, went through a soft patch of economic data. This may also be contributing to lower demand for iron ore, Australia’s top export. That falling iron ore is bad for the Australian economy is self-evident, but it may also be an omen for the Chinese economy, the commodity's largest importer. While focus has primarily been on an oversupply of the metal, decreasing demand by its top importer may suggest China's economy is contracting.

Meanwhile, China tries to calm investors, promising to prevent equity market fluctuation with cash injections. From a technical perspective, the Shanghai index closed below the 200dma for the first time since September 2016.

While the Australian and Chinese markets declined, and Japan’s markets were closed for the Greenery Day holiday, South Korea’s benchmark KOSPI stepped up.

It made two new new records today: a new all-time high and a record close, at 2241.24, which was also the high of the day.

Market heavyweight Samsung Electronics' (KS:005930) stock was up 1.3 per cent to a record high. When a closing price is near the highest price of the day, it demonstrates that investor confidence is very strong, as it indicates they are willing to remain exposed to risk even overnight.

However, to close at the very high, to not give even an inch, is indeed a ragingly bullish signal. This brings gains for the KOSPI in 2017 to 10.7%, putting it among the best-performing major Asian markets, behind India, Singapore and Hong Kong.

European stocks opened higher, thanks to renewed optimism on improving earnings reports, suggesting the continent’s economy is improving as well.

The Euro Stoxx 50 index is climbing for a third day, to 3606.86, its highest since August 2015. The Stoxx Europe 600 is up 0.29% at 390.49, while the FTSE 100 jumped 0.6% to 7280.70; both are heading higher after better-than-expected, first-quarter earnings from companies like HSBC Holdings (LON:HSBA) and Royal Dutch Shell (LON:RDSa).

Fed Chief Yellen and five other US regional central bankers are scheduled to speak on Friday. Perhaps they will provide some insight into the thinking behind leaving rates unchanged for now.

There is another game in town for the US as well; the country's fiscal outlook. The House is expected to vote later today on the most recent version of the Trump healthcare bill. Kevin McCarthy, the House Majority Leader, is confident it will pass; he says they have the numbers. Still, let’s not forget the Republicans earlier, unsuccessful struggles to get this bill passed.

Ahead of this Friday’s key official employment report, the monthly nonfarm payrolls release, yesterday's ADP report showed private payroll gains slowed in April.

All this only adds concerns to the lukewarm fiscal start to the year. Let’s wait to see what happens after this coming Sunday’s French presidential election.

Currencies

Both the yen and euro reached equilibrium, or at least a cease-fire, trading at 112.73 and $1.0886, respectively.

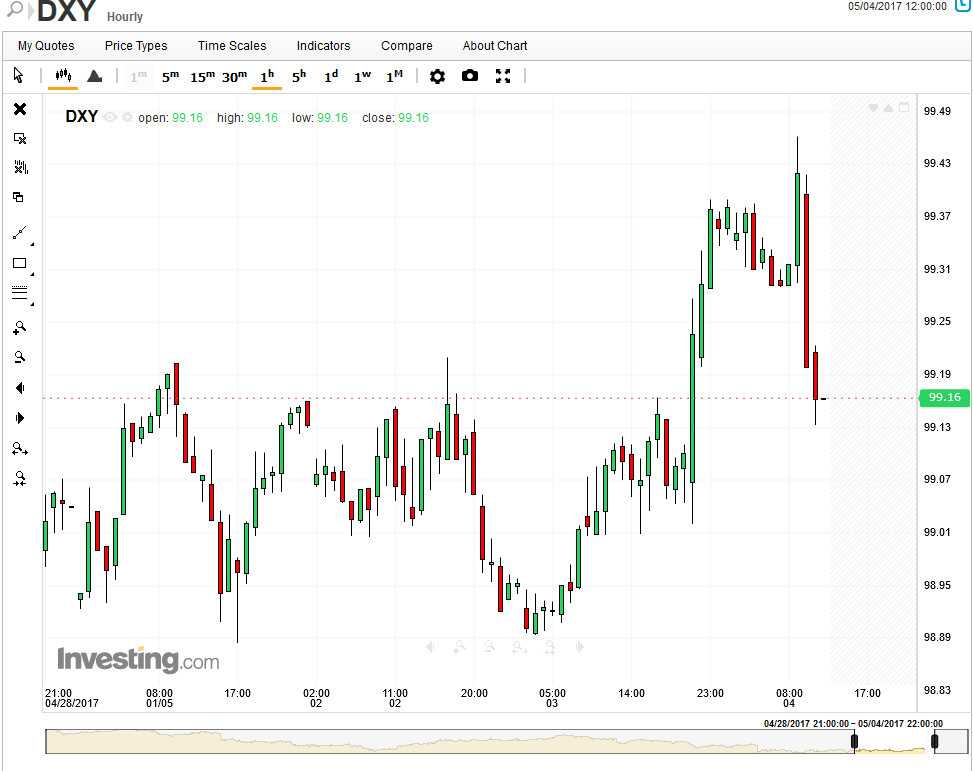

The US Dollar Index was up 0.24% at 99.462 but it has since fallen, now 0.08% since it opened at 99.151.

Bonds

After the Fed reiterated plans for gradual interest rate increases, yields rose. The 10-year Australian government bond rose 5 basis points to 2.64 percent and the equivalent Treasury rose 1 basis point to 2.33 percent.

Commodities

Iron ore fell almost 8% to $72.35440.

Copper futures fell an additional 0.3% after yesterday’s fall of 3.7%, its worst performance since 2015.

Nickel futures dropped 1.3 percent, following yesterday’s 3.3 percent drop. Lead fell 0.8 percent, aluminum fell 0.4 percent and zinc fell 0.6 percent. The London Metal Exchange LMEX Metals Index dropped 2.5 percent yesterday.

Oil fell 0.8% to $47.45.