- Outlook for U.S. pandemic death toll could hit 240,000 as NYC fatalities top 1,000.

- European lenders to halt dividends and share buy-backs

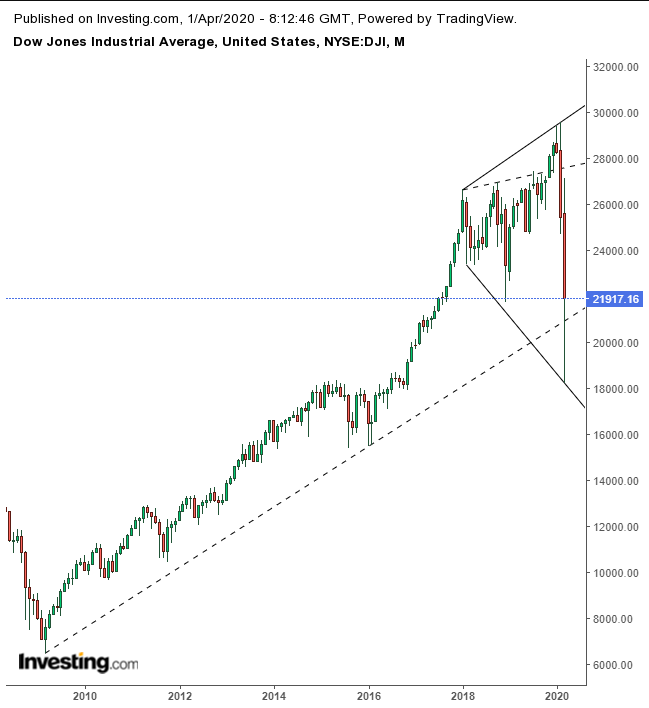

- Dow finishes worst quarter since 1987; broader market closes worst three months since 2008.

Key Events

U.S. futures for the S&P 500, Dow Jones and NASDAQ all tumbled on Wednesday, along with European shares and almost all Asian indices, as March, a brutal month for markets overall, came to a close, but coronavirus cases and fatalities escalated around the world. President Donald Trump's dire warning, delivered yesterday, that the White House was projecting the U.S. could be facing from 100,000 to 240,000 fatalities due to the global pandemic, weighed heavily on markets this morning.

The dollar and gold rebounded. Yields extended their decline.

Global Financial Affairs

Stocks began the first day of the Q2 2020 on a down note, following the worst overall quarter since the crash of 2008. Investors, whose nerves are already frayed, are now considering all the bolsters governments and central banks might provide to the financial system, against a market with no buyback support and fewer dividends, often driven by headlines that have—until now—only appeared in horror movies.

Contracts for the S&P 500 Index dropped as much as 3.6% after Trump warned the nation there were grim weeks ahead. The shocking reality was further exacerbated by the death toll in New York City, now the epicenter of the U.S. outbreak, where fatalities have already topped 1,000.

Bank shares pressured the pan-European STOXX 600 this morning, after the ECB last week called for a halt to dividend payouts and share buybacks, a call that was echoed yesterday by the Bank of England.

Most Asian markets declined, with Japan’s Nikkei 225 underperforming (-4.5%), followed closely by South Korea’s KOSPI (-3.94%). Australia’s ASX 200 wasn’t just the only index in the green (+3.58), it was also the mirror image of the worst performing benchmarks in the region, as investors pinned their hopes on the country's major banks.

On Tuesday, U.S. stocks fell, pushed lower by consensus that the pandemic has driven America's economy into recession and sealing the quarter as the Dow’s worst since 1987. The blue-chip benchmark saw a drop of 1.8% on the final day of the year's first quarter, during which it slumped 23%.

The 30 component, mega cap index has been developing a massive broadening pattern, which appears at market tops, in place since January 2018, as is struggles to remain above its long-term uptrend line since the 2009 bottom, when the longest bull market run in history began.

The S&P 500 fared little better, even after a furious, week-long 17% rally that came to an end on Tuesday. The NASDAQ 100 slipped the least among major indices, as dip-buyers targeted the cash-rich tech large caps that are its core listings. The small cap Russell 2000 plunged, losing 31% during the quarter, its worst performance based on data going back to 1979.

Yields, including for the U.S. 10-year Treasury note dropped for a second day.

They've been fluctuating at the intraday lows of March 11, after breaking the congestion of a return move to a bearish, rising flag.

The dollar bounced for the second time, above a level that could prove to be a channel bottom, if the price climbs over 100.50, establishing the trough that would turn the move into a pattern, with two rising peaks and troughs.

Oil is struggling to remain above $20 for a third session.

Supply and demand for crude appears to have found temporary equilibrium by the March 18 lows, ahead of another leg down in a downtrend, as major producers Russia and Saudi Arabia throw away production limits in favor of market share while a global pandemic continues killing demand.

Oil may not be the only commodity about to be influenced by Russia. Keep an eye on gold going forward.

Up Ahead

- ADP Nonfarm Employment data, announced later today is anticipated to have dropped sharply while the contraction in ISM Manufacturing is expected to have deepened.

- Weekly U.S. Initial Jobless Claims published on Thursday, are widely seen to continue to surge.

- Friday’s Nonfarm Payrolls release is forecast to plunge deeply into negative territory.

Market Moves

Stocks

- Futures on the S&P 500 Index dipped 2.9%.

- The Stoxx Europe 600 Index decreased 2.3%.

- The MSCI Asia Pacific Index fell 2%.

Currencies

- The Dollar Index increased 0.7 to 99.70%.

- The euro decreased 0.4% to $1.0988.

- The British pound declined 0.5% to $1.2354.

- The Japanese yen was little changed at 107.58 per dollar.

Bonds

- The yield on 10-year Treasuries dipped six basis points to 0.61%.

- Germany’s 10-year yield fell four basis points to -0.51%.

- Britain’s 10-year yield decreased four basis points to 0.312%.

Commodities

- Gold increased 0.9% to $1,590.65 an ounce.

- West Texas Intermediate crude was little changed at $20.47 a barrel.