by Pinchas Cohen

Key Events

Yesterday, US equities advanced for a fourth day, and the dollar surged 0.7 percent, completing a 1.4 percent reversal from Tuesday’s 91.62 low – the USD's lowest price since January 15, 2015, penetrating its trading range for the first time since May 2015, and Treasuries advanced.

US Q2 GDP data demonstrated that the world's largest economy grew in the second quarter by 3-percent, beating the 2.7-percent forecast, the fastest pace in two years for the US on increased household spending. This segment is the most sought after source of growth among developed economies, adding to the good news. As well, growth came from higher rates of business investment.

Additionally, the private sector ADP payroll report, released yesterday, indicated robust hiring in August with a 237,000 gain, beating the expected 185,000 number. The results were dominated once again by services, which gained 204,000; there were marked gains in construction and manufacturing jobs as well. The report comes out two days ahead of the government’s official, much focused-on nonfarm payrolls report, arguably the most significant economic release each month.

The S&P 500 Index climbed above its 50 dma yesterday, even after bearish trading earlier in the day was prompted by another bellicose tweet about North Korea from US President Donald Trump. Still, missile launch anxiety had clearly dissipated: prior to the two positive US data releases, Asian shares and European stocks were rising.

Even with the more bullish US growth story and pending the government’s employment expansion confirmation on Friday, the probability of a September rate hike has barely advanced—from 1.4 percent to 2.7 percent. What's likely to have the biggest economic sway on investors for the remainder of the year is what they expect the Fed will do in December.

Global Affairs

Today, even after data highlighted the endurance of the two largest economies in the world with China's release of its manufacturing and non-manufacturing PMI early this morning (last night in the US), Asian stocks were mixed after the US administration sent crossed signals on North Korean’s latest missile launch. While President Donald Trump is running out of patience with Kim Jong Un and dismissed the idea of negotiations, his defense chief, former Marine Corps general James Mattis said the country has not given up on diplomacy. Indeed, the country's top diplomat, US Secretary of State Rex Tillerson, together with Japanese Foreign Minister Tao Kana continue to pursue diplomatic channels.

Still, gold, the Japanese yen and Treasuries declined. Only the Swissy was flat. The dollar index is also flat this morning. While the dollar rose against five of the six currencies that make up the index, the euro’s 0.1 percent rise—with its 57.6 percent weighting in the basket—offsets the dollar’s advance.

It looks like investors have been willing to overlook, or ignore for now, any current geopolitical risk; shares rose in Japan, the very country whose sovereign airspace was invaded by the much reported upon ballistic missile.

By this morning's European open the mixed messages from the US administration were a thing of the past. Investors have been bidding up European shares.

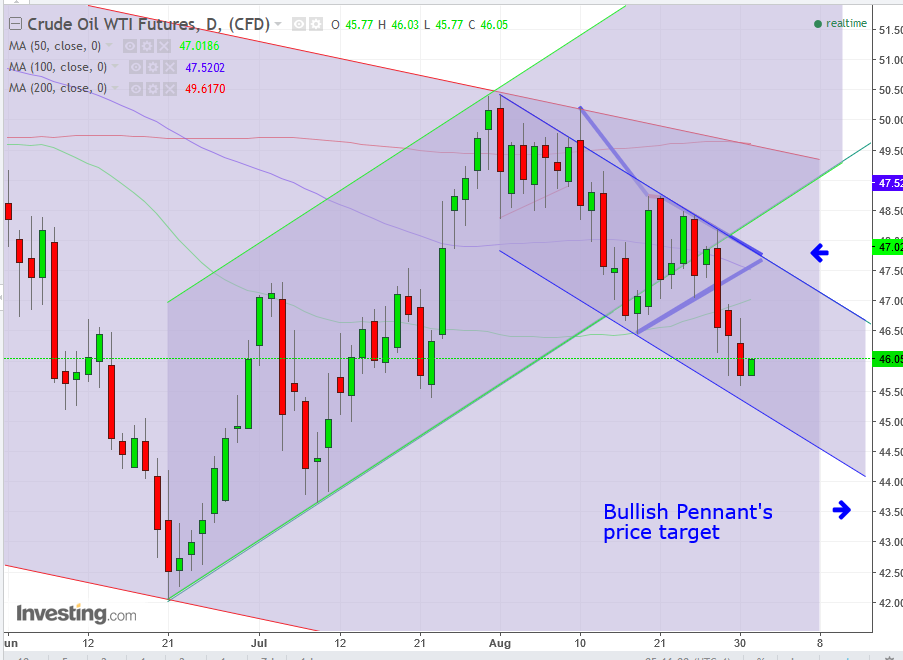

After oil’s 4.75-percent decline in three days, it seems to be confirming the support of Tuesday’s hammer. Yesterday’s close was a single cent below that support.

Nevertheless, it only suggests an upward correction within an established midterm downtrend since August, within a long-term downtrend since February. Fundamentally, Harvey continued to ravage the Gulf of Mexico coast, where more than half of the US refining takes place. The longer refineries remain offline, the less they will buy imported crude oil, which will pile up in inventory, keeping prices pressured.

Up Ahead

5:00: Eurozone – Inflation (August, flash), Unemployment (July): inflation expected to be 1.5% from 1.3% YoY, and core inflation forecast to be 1.3% from 1.2%. Unemployment expected to hold at 9.1%. A sign of continued growth will find investors in a willing mood after yesterday’s confirmation of global growth, via the US and China, the two biggest economies of the world.

8:30: US – Initial Jobless Claims (w/e 26 August): expected to rise to 236K from 234K.

Should yesterday’s big ADP expectation beat be translated into an upside surprise for the NFP release, the dollar should get a major boost after its two day rebound from its lowest point since January 15, 2015.

8:30: Canada – GDP (Q2): expected to be 0.7% from 0.9%. Perhaps the unexpected US economic rebound will be contagious and its northern neighbor will surprise as well, sending the loonie higher.

9:45: US – Chicago PMI (August): expected to fall to 58 from 58.9. Yesterday’s better-than-expected GDP number may have influenced this gauge. Such a confirmation would send dollar investors into a trading frenzy.

21:45: China – Caixin Manufacturing PMI (August): this private survey is forecast to see the index fall to 50.2 from 51.1. Yesterday’s official manufacturing PMI beat the expected 51.3 with a 5.17 read. Should that faster-than-expected growth be reflected by this release which focuses on smaller and medium sized companies, it would demonstrate broad-base economic growth, providing a significant boost to Chinese shares on the Shanghai Composite and the Hang Seng in Hong Kong. While China's yuan might rise against other currencies if the release is positive, it wouldn’t gain much versus the dollar and the euro, as they too have demonstrated growth.

Market Moves

Stocks

- Japan's TOPIX Index rose 0.6 percent at the close in Tokyo, paring losses on its first monthly drop since March.

- Australia’s S&P/ASX 200 added 0.8 percent.

- South Korea's KOSPI retreated 0.4 percent.

- Benchmark indexes dropped 0.6 percent in Hong Kong and fell in Shanghai as well, led by declines in banking stocks which had recently been surging.

- The Stoxx Europe 600 Index climbed 0.3 percent.

- The U.K.’s FTSE 100 advanced 0.2 percent.

- S&P 500 Futures gained 0.2 percent.

Currencies

- The Dollar Index gained 0.04 percent.

- The euro increased less than 0.05 percent to 1.1888 per dollar.

- The Japanese yen decreased 0.2 percent to 110.48 per dollar

Bonds

- The yield on 10-year Treasuries rose two basis points to 2.15 percent.

- German 10-year bund yields advanced one basis point to 0.37 percent.

Commodities

- Gasoline for September contract advanced for an eighth day, up more than 6.5 percent to $2.0079 a gallon. Earlier, the front-month contract touched the highest level since July 2015.

- West Texas Intermediate crude paired some of its 4.4-percent losses from the past three days with a 0.75 percent rebound to $46.12 a barrel.

- Gold declined 0.1 percent to $1,307.42 an ounce.