by Pinchas Cohen

Key Events

Today, global stocks opened on a shaky ground, as most Asian shares advanced on thin trading, with some help from a falling yen.

This week, investors are recuperating from fears of war with North Korea, US political volatility and recent European terrorist attacks, while at the same time, try to reassess their positions ahead of the central bankers summit in Wyoming. In the meanwhile, big name investors have begun reducing risk.

Global Affairs

While European, US futures, and the MSCI Asia Pacific Index advanced on thin trading, the S&P 500 halted its two-day decline, revealing that some traders are taking advantage of low price levels. Their behavior doesn’t necessarily mean that the market agrees with their assessment, nor does it prove that they themselves believe prices will rise. It’s possible, but unlikely, that the President Donald Trump’s speech outlining a new strategy for Afghanistan was more than a coincidence, but rather a cause for the buying spree.

Trading volume dropped on the S&P 500 after falling 15 percent lower than the 30-day average. For traders who follow astrological analysis, this volume drop coincided with the first coast-to-coast total solar eclipse in almost 100 years.

After a weekly advance for the dollar and decline for gold, investors sighed in relief as North Korean tensions dissipated, but today the Hermit Kingdom threatened the US again, warning America will suffer “merciless revenge” for ignoring Pyongyang’s warnings over annual military drills with South Korea. So far, markets have been ignoring this, but to be fair—investors have not been trading. We’ll have to wait until volume picks up and the market becomes efficient again..

In a LinkedIn post yesterday, Ray Dalio, the billionaire founder of the Bridge Water Associates, the world’s biggest hedge fund, shared that he’s reducing risk on growing uncertainty due to both internal (President Donald Trump) and external (North Korea) conflicts “…leading to impaired government efficiency.” On top of the concerns Dalio pointed out is ongoing weak US inflation rates.

The thin market is not only because of bad things that already happened, but perhaps because of something that has yet to happen—the annual conference of global central bankers hosted by Kansas City Federal Reserve Bank at Jackson Hole, Wyoming. The global economy is at a crucial intersection of monetary easing, which central banks are hesitant to change course amid stubbornly tepid inflation rates.

While the ECB grapples with a tightening after the euro has reached multi-year highs, potentially hurting exports, the focus is expected to be on the Fed. Although, it will probably not be on whether there is an additional hike this year—whose chances have deteriorated due to the continuously disappointing inflation—but on the likelihood of Fed balance sheet reduction occurring relatively soon.

Up Ahead

- Economic releases in Asia include Hong Kong July CPI and Taiwan unemployment.

- Indonesia’s central bank sets monetary policy.

- A raft of survey data will probably show euro-area growth slowed in the third quarter.

- Combined sales of new (Wednesday) and previously owned (Thursday) U.S. homes probably edged up in July from the prior month, indicating that a still robust real estate market is being held in check by rising property prices.

Market Moves

Stocks

- Japan’s TOPIX fluctuated before ending the local session less than 0.1 percent higher.

- South Korea’s KOSPI gained 0.4 percent.

- Australia’s S&P/ASX 200 rose 0.4 percent.

- Hong Kong’s Hang Seng rose 1.2 percent, outperforming other equity markets in Asia, on strong earnings results.

- Contracts on the Euro Stoxx 50 climbed 0.5 percent in early European trading.

- S&P 500 Futures added 0.3 percent as of 7:45 in London (2:45 EDT). The underlying gauge rose 0.1 percent on Monday.

- The MSCI Asia Pacific Index advanced 0.3 percent.

Currencies

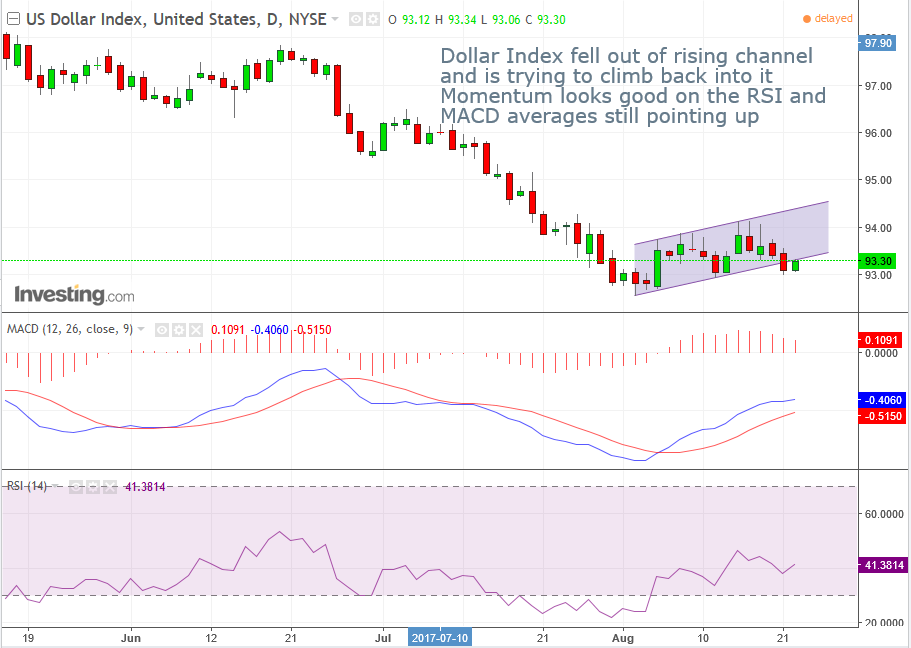

- The Dollar Spot Index was up 0.1 percent. It fell 0.3 percent on Monday.

- The yen lost 0.3 percent to 109.32 per dollar.

- The euro was trading at $1.798, down 0.1 percent, after climbing 0.5 percent in the previous session.

- The Australian dollar added 0.1 percent to 79.43 U.S. cents.

Bonds

- The yield on 10-year Treasuries rose about two basis points to 2.20 percent.

- The 10-year German bund yield added about one basis point to 0.41 percent.

- The Australian 10-year bond yield climbed almost one basis point to 2.65 percent.

Commodities

- West Texas Intermediate crude added 0.4 percent to $47.59, after tumbling 2.4 percent on Monday.

- Gold was down 0.5 percent to $1,285.85 an ounce, almost wiping out a 0.6 percent gain Monday.