by Pinchas Cohen

Key Events

Global stocks extended their declines from last week which was dominated by fiscal policy. This week, focus will shift toward monetary policy as Central Bankers will meet at Jackson Hole, Wyoming to undoubtedly a discuss what's on every participant's mind—the persistence of low inflation.

Global Affairs

The STOXX Euro 600 Index is set for a third day decline, with little market participation, following lower averages in Sydney, Tokyo and Seoul. US futures are following global stocks decline, suggesting American stocks will extend their politically induced declines from last week.

In addition to an impotent US fiscal policy, and a monetary policy that can’t seem to catch a break from non-cooperative inflation levels, investors must also worry about geopolitics, including the recent European terror attacks and fresh tensions with North Korea.

As a result of such, the safe havens gold and yen gained. However, in stark contrast to normal market moves, the dollar also advanced.

This year’s annual summit hosted by the Kansas City Fed at Jackson Hole, Wyoming will include the world monetary policy leaders—Federal Reserve Chair Janet Yellen and European Central Bank President Mario Draghi.

The central bankers must wrestle with finding the optimal path for interest rates. In the US, inflation is simply not picking up this year. Even though Europe is experiencing its biggest economic expansion since the Great Recession, it can’t operate in a vacuum, and must consider how inflation in the United States and its slower path toward increasing the interest rate would affect the Eurozone. Additionally, while the EU is enjoying a bullish outlook, they face a rising euro. The rising currency could potentially hurt exports, as they would become more expensive for non-EU countries.

In addition to any hints which may be provided on decision regarding interest rates, market participants will also listen for clues on Fed balance sheet reduction.

Up Ahead

OPEC’s full technical committee meets in Vienna today

Today, the price of oil opened higher but was overcome by selling and declined 0.1-percent. After failing what would have been a continuation consolidation, between July 31 and August 11, the price broke the wrong way toward the downside, to the 50 dma (green) at $46.46. The Friday surge stopped short of the previous consolidation, confirming its resistance. The price is expected to move on the 100 dma (blue) trajectory at the $48 price level, until it breaks decisively over the 200 dma (red) in the $50 area, or below the previously mentioned 50 dma.

Tomorrow at 5:00 EDT will be released the German ZEW Index (August): economic sentiment forecast to fall 17.1 from 17.5

The DAX has been trading in a short-term falling trend since June 20. On August 11, it bounced off the uptrend line it has been on since June 24, 2016, the day the Brexit vote results were revealed. The significance of this uptrend is confirmed by the 200 dma (red) that is retracing it.

However, although the price found support it stopped short of overcoming the short-term downtrend, and has turned back down. On Friday, we saw a bearish indication, a dead-cross execution, when the 50 dma (green) crossed below the 100 dma (blue.)

The price is fluctuating, and is looking for an opening for the price to move into; either the short-term downtrend line—with a break above 12400.00—or a longer-term uptrend line—with a break below 11800.00.

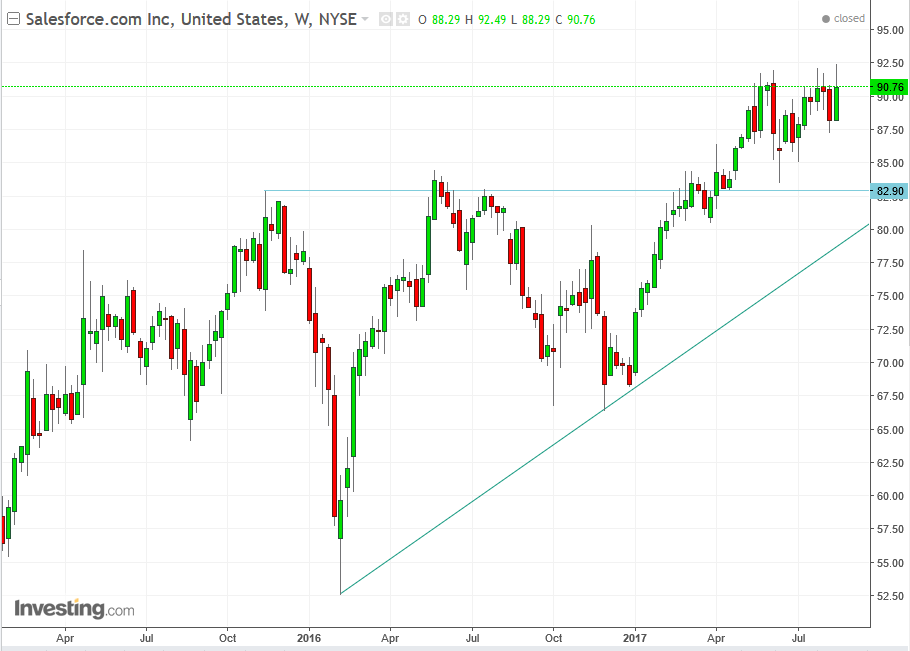

Salesforce is scheduled to report its second-quarter earnings results after the bell

While Salesforce (NYSE:CRM) outperformed the S&P 500 this year, 32 percent versus the 8 percent, it has been unable to overcome the $91 level since May.

Bulls would point out that on Wednesday the price registered a fresh record $92.24 close; bears would argue that the Bearish Engulfing pattern on the following day—by the resistance since May—renders it moot or even shows the bulls are in a weaker position.

Between November 2015 and March 2017 the price has been trading within a massive ascending triangle. In the beginning of April that price provided an upside breakout, the implications of which provided a $30 upside move to$113. The price pressure since May would be part of a return move, which can return toward the low $80’s.

The European Central Bank President Mario Draghi speaks in Germany on Wednesday

Mario Draghi is set to speak after minutes from the Governing Council’s July meeting released last week revealed that decision makers are still uncertain how to communicate upcoming changes in their policy settings. Previous changes have unintentionally caused unwarranted market fluctuations, such as when the ECB tried to distance itself from Draghi’s July press conference in a failed attempt to ease euro bullishness.

Market Moves

Stocks

- S&P 500 futures decreased 0.2 percent to their lowest in almost six weeks.

- The Stoxx Europe 600 Index sank 0.3 percent as of 9:30 a.m. in London (4:30 EDT).

- The MSCI All-Country World Index declined 0.1 percent, its lowest in almost five weeks.

- Germany’s DAX tumbled 0.5 percent.

- The UK’s FTSE 100 dipped 0.3 percent to its lowest in 14 weeks.

- Japan’s TOPIX fell 0.1 percent at the close with volume was about 16 percent below the 30-day intraday average.

- South Korea’s KOSPI lost 0.1 percent.

- Australia’s S&P/ASX 200 Index dropped 0.4 percent, with BlueScope Steel Ltd. tumbling as much as 23 percent after the company reported disappointing earnings.

- Hong Kong’s Hang Seng Index added 0.4 percent.

- China’s Shanghai Composite was up 0.6 percent.

- The MSCI Asia Pacific Index slid 0.1 percent.

Currencies

- The Dollar Index advanced 0.1 percent.

- The euro dipped 0.1 percent to $1.1747.

- The British pound gained less than 0.05 percent to $1.2871.

- The Japanese yen increased 0.2 percent to 108.96 per dollar, its strongest in almost four months.

Bonds

- The yield on 10-year Treasuries fell two basis points to 2.18 percent, its lowest in seven weeks.

- Germany’s 10-year yield declined one basis point to 0.40 percent.

- Britain’s 10-year yield decreased two basis points to 1.069 percent.

Commodities

- Gold advanced 0.3 percent to $1,288.39 an ounce.

- West Texas Intermediate crude declined 0.1 percent to $48.46 a barrel.