by Pinchas Cohen

Key Events

- Dow Jones hits new record high, flirts with 22,000

- Earnings of 77 percent of companies on S&P 500 gain 10 percent YoY

- Apple strategy shifts from iPhone to Services

- Equity investors grow cautious

- Oil falls below key $50 level

US equities rallied yesterday, with the Dow Industrials registering a record, as it continues to flirt with the 22,000 level. The rally was on continued earnings beats.

Asian stocks and US futures resumed yesterday's gains after Apple’s (NASDAQ:AAPL) Q3 2017 results boosted the stock, carried by positive overall sentiment from equity investors as corporate earnings continue to beat expectations. Earnings for the first quarter have risen in the first roughly 14-percent YoY along with an impressive 10 percent during the second quarter. According to JPMorgan, more than three-quarters of companies in the S&P 500 Index beat. Naturally, the S&P 500 tech sector was the biggest beneficiary, gaining almost 5 percent—more than double the underlying gauge.

Global Affairs

Apple

Apple provided guidance of $49-52 billion after iPhone sales surpassed 1.2 billion units sold. However, the company’s future revenue engine needs to come from an entirely different segment. Once most of its global smartphone markets become saturated, and upgrades and technological breakthroughs slow down to a trickle, Apple will have to find another way to make money.

Its salvation comes via services revenue—the segment that includes Apple Music, iCloud storage, apps, games, Apple Pay and AppleCare protection —which was up 22 percent this past quarter, generating $7 billion in revenue, an all-time record. Over the last 12 months, the services business has grown to become the size of a Fortune 100 company. As CEO Tim Cook said to Bloomberg:

“This is a milestone that we had projected to meet, but not this soon. The App Store continues to be a major driver of performance…”

Microsoft (NASDAQ:MSFT) is a good example of a company that once was a dinosaur but turned itself into a butterfly after dropping hardware in favor of software and the licensing and services revenue that they generate.

A key market for smartphone makers is China, which has the highest sales potential after the rest of the world has become flush with smartphones. The yearly decline of Apple sales in China is 10 percent, but that's actually good news, considering the decline the previous year was 14 percent.

However, a closer read shows that iPhone sales were actually flat, while iMac and iPad sales were healthy and the services business was extremely strong—once again, demonstrating the shift in Apple’s revenue even in an untapped market. Now, Apple is setting its sights on another high-potential market, India. The company is investing heavily in the region, in hopes that sub-continent's market will contribute more meaningfully to overall revenue.

Apple has registered strong yearly gains despite the iPhone being only 55-percent of sales, the smallest percentage for the device in the last 13 quarters, and down 70 percent from its record.

Equity Investor Caution Ahead

While equity investors are feeling pretty good about the economy, economic data has been languishing. The Fed seems intent on removing accommodation without any real economic support. On top of that, US political stability is chaotic.

Fundamental Caution

Since the beginning of the year the US has been plagued by a string of disappointing economic data, including lower consumer spending, a drop in dividend payments which is causing income to stagnate, a third straight month of slowing nominal spending and automakers posting mostly disappointing sales figures.

Can corporations grow profits in a vacuum, or are companies only providing good news, while keeping bad news under wraps, to be discovered later?

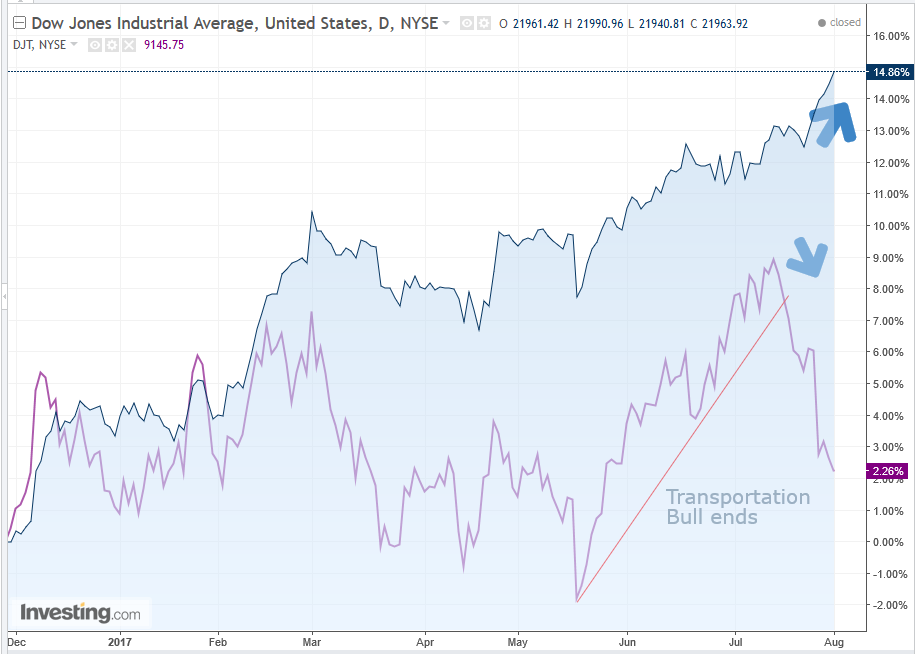

Technical Caution

Dow Theory is the oldest thesis in modern technical analysis. It was developed by Charles H. Dow, founder of the Dow indexes, the first stock indexes in the world, and co-founder of the Wall Street Journal. He theorized that a market can be considered bullish only when both the industrial and transportation indexes are in an uptrend. If business is truly good, it isn’t enough to manufacture things, those things must also be purchased. The Industrial index is manufacturing, while transportation reflects sales. Since the transportation index broke the uptrend, the industrial index’s uptrend is in question.

Oil

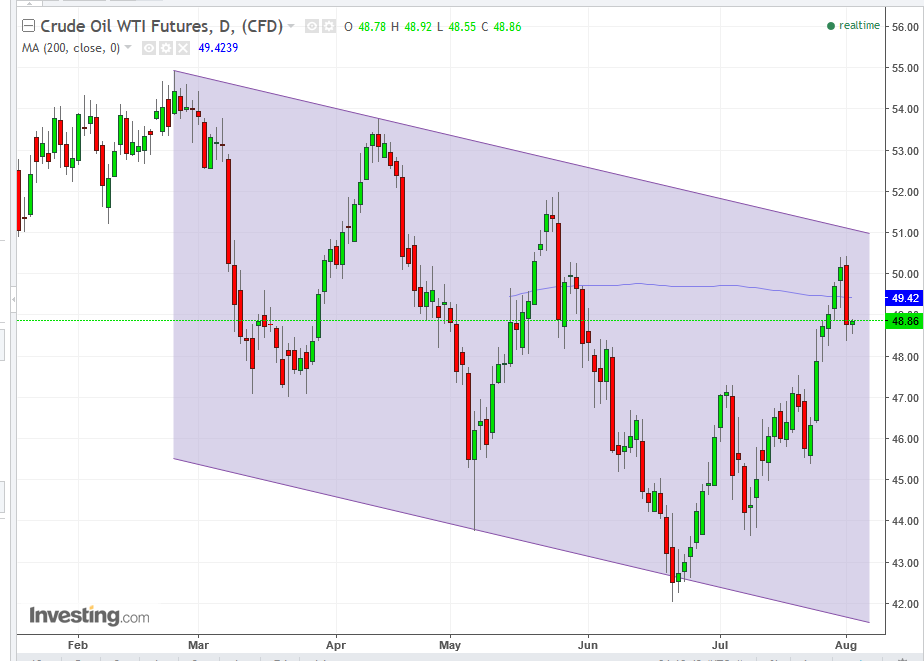

Fundamentally, oil fell back below the key $50 price level on a strengthening dollar and especially after US crude supplies increased by 1.78 million barrels last week. This is the first time since the end of June that API's crude build increased, while Cushing stockpiles rose by 2.56 million barrels.

Technically, the price reached the key $50 resistance, the 200 dma and neared the top of its falling channel, in whose trend it is expected to continue to trade.

Up Ahead

- The Reserve Bank of India is expected to ease policy – on (1) record low inflation, (2) a need for growth, (3) a difference between the RBI and real rates in which banks charge on loans and (4) the gap between the RBI’s policy rate and the rate path prescribed by the “Taylor Rule"—a measure of the desired level for interest rates based on output and the inflation gap. This is a measurement Indian policymakers have often referred to in the past—and is at its widest point since March 2015. The counter argument is (1) inflation is a risk on seasonally rising vegetable prices, but would still remain within target, (2) banks can decide to transmit the past rate cuts mentioned and (3) The RBI itself said it is comfortable with higher real interest rate.

- Brazil’s Congress votes Wednesday on whether to try President Michel Temer on corruption charges.

- Bank of England Governor Mark Carney may signal a more hawkish tone at the Central Bank's quarterly Inflation Report on Thursday. The BoE will likely keep rates on hold.

- U.S. nonfarm payroll data on Friday will probably show employers added about 180,000 workers in July.

Market Moves

Stocks

- Japan’s TOPIX gained 0.5 percent. Honda Motors (T:7267) shares jumped following the company’s higher profit forecast.

- Australia’s S&P/ASX 200 fell 0.4 percent.

- South Korea’s KOSPI added 0.2 percent.

- Hong Kong’s Hang Seng was 0.4 percent higher.

- China's Shanghai Composite was little changed.

- NASDAQ 100 futures climbed 0.7 percent as of 12:42 p.m. in Tokyo. Apple shares rose more than 6 percent in after-hours trading, putting the stock on course for a record high when regular trading starts.

- S&P 500 e-mini futures were up 0.1 percent.

- The MSCI Asia Pacific Index was little changed. Raw-material producers such as BHP Billiton (NYSE:BHP) that had been buoyed by the recent rally in commodities declined as the gain in resources stalled.

Currencies

- The kiwi slid 0.5 percent to 74.28 U.S. cents, on its jobs report.

- The euro climbed $1.1813 after slipping 0.3 percent on Tuesday. The single market currency rose to an 18-month high against the yen.

- The Dollar Index added 0.1 percent. It rose 0.2 percent on Tuesday.

Bonds

- The yield on 10-year Treasuries was at 2.27 percent after falling four basis points on Tuesday.

- 10-year Australian government notes saw yields drop two basis points to 2.70 percent.

Commodities

- West Texas Intermediate crude retreated from above $50, falling 0.8 percent to $48.75 a barrel. The contract fell 2 percent on Tuesday, the first decline in more than a week, after an industry report was said to show US crude inventories unexpectedly jumped.

- The Bloomberg Commodity fell 0.3 percent, extending a 1 percent decline on Tuesday.