- Global stocks, US futures tumble, investors flee to safe haven assets

- Europe’s STOXX 600 hits near 2-year low, completes top

- South Korean shares flirt with bear market

- Gold provides upside breakout

Key Events

European shares and futures for the S&P 500, Dow and NASDAQ 100 were all in deep red territory this morning after the global selloff worsened during the Asian session, as Saudi Arabia’s diplomatic isolation and renewed fears of trade disruption prompted investors to rotate out of equities and into safe haven assets such as the yen, gold and US Treasurys.

The European STOXX 600 slipped to its lowest level since December 2016, completing a massive, 17-month H&S top.

During Asian trade, regional benchmarks flashed red across the board, as equities gave up the gains of the previous two sessions, which had been spurred by Chinese policymakers' promises of broad economic stimulus. Hong Kong’s Hang Seng underperformed, tumbling 3.08 percent, followed by Japan’s Nikkei 225, which gave back 2.7 percent.

South Korea’s KOSPI lost 2.57 percent and is now flirting with a bear market, having dropped 19.65 percent from its January record.

Global Financial Affairs

Most US shares dropped yesterday after a volatile session. Losses in financials and energy stocks reversed a positive open—which had initially been buoyed by positive headlines from Italy and China.

FAANG stocks still managed to offset some of the losses, pulling the broader Technology sector higher (0.83 percent).

The S&P 500 slid 0.43 percent, closing below the 200 DMA for the first time in over a week. Nine sectors ended yesterday's session in negative territory, with more than three companies falling for every two rising. Consumer Discretionary (+0.4 percent) was the second best performer after technology.

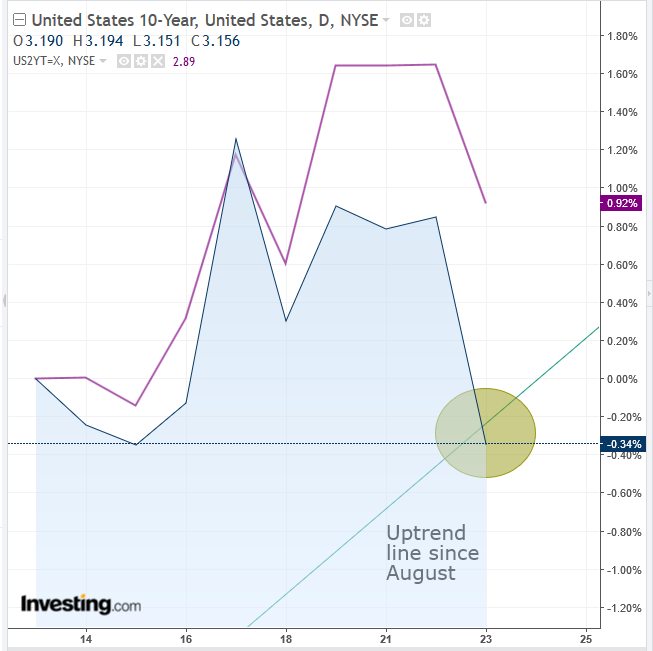

On the opposite side of the spectrum, Financials underperformed (-2.14 percent), after the yield curve between 10-year and 2-year US Treasurys hit its flattest level in over two weeks ahead of new debt auctions, suggesting a lower outlook for long-term interest rates and bank profits.

Energy shares, already weighed down by falling crude prices, were dragged lower by Halliburton's (NYSE:HAL) warning that fourth-quarter earnings would miss estimates amid ongoing weakness in the North American hydraulic fracturing market.

The Dow Jones Industrial Average underperformed, giving up 0.5 percent but holding above its 200 DMA. The industrial benchmark swung between gains and losses of more than 100 points, highlighting the choppiness in US equities as they struggle to recover from the recent selloffs even as earnings season gathers steam.

The NASDAQ Composite (+0.26) outperformed thanks to FAANG shares, while the Russell 2000 dropped 0.16 percent. Technically, the small cap index has found resistance by the 200 DMA, below where it remains for a third consecutive day.

After a long period during which investors seemed immune to geopolitical risk, there are now signs of a flight to safety, as we have highlighted with the technical breakdown of small caps listed on the Russell 2000. However, US GDP data, to be released later this week, as well as earnings from market favorites such as Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL), Microsoft (NASDAQ:MSFT), and Intel (NASDAQ:INTC) could provide investors with the motivation they need to resume their battle against a bear market.

Meanwhile, oil edged lower despite the looming November 4 deadline for US sanctions against Iran, after Saudi Arabia vowed to play a “responsible role” in energy markets, perhaps to ease tensions surrounding the killing of Saudi journalist Jamal Khashoggi.

Gold hit a three-month high. It broke out of a bullish pennant and crossed above the 100 DMA, suggesting bulls are prepared to realize the target of its ascending triangle-bottom.

Up Ahead

Earnings

- Twitter Inc (NYSE:TWTR) reports earnings Thursday before market open, with an EPS consensus of $0.05, from $0.02 percent the same quarter last year: will the report help the stock recover after it fared as the S&P 500's worst performer in the third quarter?

- Amazon is also scheduled to report Thursday aftermarket, with a $3.29 EPS consensus, compared to $0.52 for the same quarter last year.

- Alphabet is expected to publish results Thursday aftermarket as well, with a EPS forecast of $10.54, compared to $9.57 for the same quarter last year.

- For Intel, also due to release Thursday aftermarket, analysts expect an EPS of $1.15, from $1.01 the same quarter last year.

- Microsoft, reporting on Wednesday after market close, with a $0.96 estimate, from $0.84 the same quarter last year.

- McDonald’s (NYSE:MCD) announces earnings Tuesday before market open, with an EPS forecast of $1.98, rising from the $1.76 posted for the same quarter last year.

- Monetary policy decisions are due in Europe, Indonesia, Sweden and Canada. On Thursday, ECB policy makers could also confirm that asset purchases will end this year, reiterating their pledge to keep interest rates at record lows through summer 2019.

- US GDP figures, out on Friday, may show that growth has slowed in the third quarter, yet according to analyst forecasts it is still on its best pace since mid-2015.

Market Moves

Stocks

- Futures on the S&P 500 slid 1.1 percent hitting the lowest level in 16 weeks with their fifth consecutive decline.

- The STOXX Europe 600 fell 1 percent, reaching the lowest level in more than 22 months on its fifth consecutive decline and the biggest fall in more than a week.

- The UK's FTSE 100 fell 0.7 percent to the lowest level in seven months on the most significant fall in more than a week.

- Germany’s DAX fell 1.4 percent, reaching the lowest level in more than 22 months on its fifth straight decline and the biggest fall in more than a week.

- The MSCI Asia Pacific Index slipped 2.1 percent to the lowest level in more than 17 months on the largest fall in more than a week.

- The MSCI Emerging Market Index slid 1.8 percent to the lowest level in more than a week on the biggest fall in more than a week.

Currencies

- The Dollar Index fell 0.01, percent, giving up an earlier 0.15 percent gain.

- The euro slid 0.1 percent to $1.1457.

- The British pound climbed less than 0.05 percent to $1.2966.

- The Japanese yen gained 0.4 percent to 112.38 per dollar.

Bonds

- The yield on 10-year Treasurys dropped five basis points to 3.15 percent, the lowest level in more than a week on the greatest tumble in almost four weeks.

- Germany’s 10-year yield fell two basis points to 0.43 percent.

- Britain’s 10-year yield fell three basis points to 1.493 percent, the lowest level in almost six weeks.

- The spread of Italy’s 10-year bonds over Germany’s rose six basis points to 3.0983 percentage points.

Commodities

- West Texas Intermediate crude fell 0.4 percent to $69.09 a barrel.

- Gold advanced 0.8 percent to $1,232.08 an ounce, the highest level in 14 weeks on the biggest gain in more than a week.