-

Dollar attempts to extend its two-day climb

-

Treasury yields top out

-

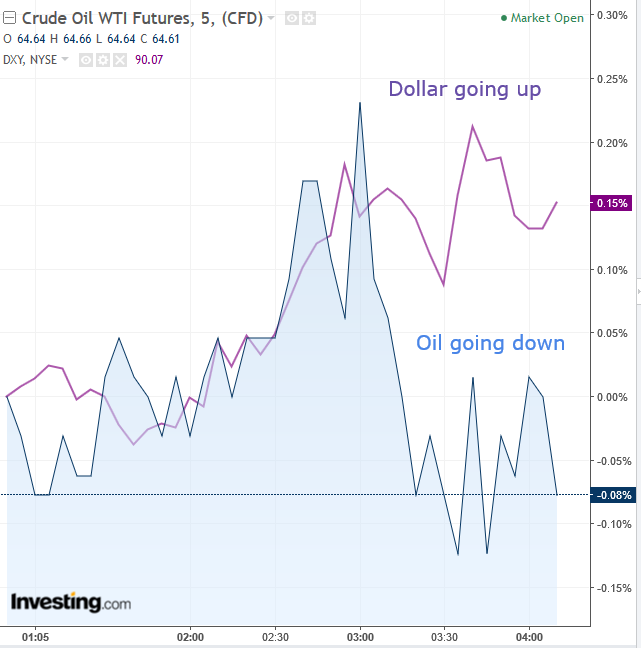

Stronger USD wipes out oil gains

-

Wednesday’s equity decline led by Energy, not Technology

-

Chinese shares outperform, potentially signaling a bottom

-

Fresh Canadian GDP data may to help USD/CAD complete H&S top

Key Events

US futures rose alongside European stocks on Thursday, after a mixed Asian session. S&P 500 and NASDAQ 100 futures are hovering in positive territory, providing a potentially optimistic note for the final US session at the end of a messy quarter.

The STOXX Europe 600 is set for a straight third day of gains, with most sectors in the green and automakers leading the pack. Earlier in Asia, Japan’s TOPIX gave up a 0.77 gain to close just 0.23 percent higher, as a strengthening yen which weighed on domestic stocks. South Korea’s KOSPI climbed 0.73 percent.

Mainland Chinese stocks outperformed. The Shanghai Composite soared 1.25 percent. Hong Kong’s Hang Seng turned a 0.77 percent loss into a 0.36 percent gain.

Australia’s S&P/ASX 200 was the only major Asian benchmark to decline. The Australian index slipped 0.5 percent, extending Monday’s dip, which had sent it into a trend reversal on posting a second lower peak.

The dollar may be on track to continue paring earlier losses this morning, after posting a two-day 1.2 percent surge on Wednesday—its best two-day advance since late October. A penetration above 91.00 would signal a bottom reversal.

Yields on the 10-year Treasury slipped to 2.765, extending a decline since the February 21, 2.957 high. The 10-year note seems in fact to have completed a Descending Triangle top, which suggests that yields are heading toward 2.65.

This may be good news for US equities, which earlier this year took a beating when Treasury yields reached a 4-year high, which in turn increased the odds for higher rates. Easing yield levels complement the stronger dollar by backing newfound investor optimism in the US economy after yesterday's higher-than expected fourth quarter GDP reading.

An alternative explanation for sliding yields: investors could be rotating out of risk trades and into safe haven assets. However, both gold and the yen are falling this morning, suggesting investors are not necessarily parking their capital in safe havens.

It should be noted though that both these assets possess a negative correlation with a stronger greenback, so the hypothesis that yields are benefiting from a rotation out of equities is still valid.

This morning's stronger USD is also weighing on oil, which had previously climbed on expectations that OPEC and NOPEC would extend supply cuts to the end of 2018.

Global Financial Affairs

US stocks continued to erase Monday's gains on Wednesday, erasing the rally which had been the strongest one-day surge in five years. Investors, however, may find some reassurance in the fact that yesterday's slide wasn’t led by the Technology sector (-0.67% ), but rather by Energy shares (-1.95%), perhaps indicating that the very source of the recent selloff is receding.

Traders have been dumping technology stocks this week after an array of negative news hit the sector. This was compounded by stretched valuation, since tech shared had jumped 32 percent over the past 12 months. After cashing in all they could from the sector, investors are now operating on a first in-first out strategy.

China’s outperformance among the major Asian indices this morning, considering the lingering fears of a trade war and the recent harsh Chinese rhetoric aimed at the US, seems to have been ignored by bullish investors in Chinese equities, perhaps today's best indicator for a potential bottom off the February lows.

Up Ahead

-

Canada’s GDP is expected to remain flat for the month of January MoM, while declining on a year-on-year basis. The loonie has been consolidating this month in the shape of a H&S top, after a 7 percent advance from the beginning of February.

-

Both US Personal Income and Personal Spending are expected to remain flat, at 0.4 percent and 0.2 percent MoM, respectively.

-

Chicago PMI is expected to climb March to 6.21 from 61.9

Market Moves

Stocks

-

The STOXX Europe 600 Index advanced 0.3 percent, to the highest in more than a week.

-

Futures on the S&P 500 Index gained 0.2 percent.

-

The MSCI All-Country World Index climbed less than 0.05 percent.

-

The UK’s FTSE 100 advanced 0.2 percent to the highest level in more than a week.

-

Germany’s DAX jumped 0.3 percent to the highest level in a week.

-

The MSCI Emerging Market Index climbed 0.3 percent.

-

The MSCI Asia Pacific Index increased 0.1 percent.

Currencies

-

The dollar index is flat, paring a 0.2 percent decline

-

The euro climbed less than 0.05 percent to $1.231.

-

The British pound declined 0.1 percent to $1.4057, the weakest in more than a week.

-

The Japanese yen advanced 0.2 percent to 106.65 per dollar.

Bonds

-

The yield on 10-year Treasuries decreased one basis point to 2.78 percent, the lowest in more than seven weeks.

-

Germany’s 10-year yield increased one basis point to 0.51 percent, the first advance in more than a week.

-

Britain’s 10-year yield advanced one basis point to 1.366 percent, the biggest gain in more than a week.

Commodities

-

West Texas Intermediate crude increased 0.6 percent to $64.74 a barrel.

-

Copper rose 0.9 percent to $3.03 a pound, the highest in more than a week.

-

Gold decreased 0.1 percent to $1,323.74 an ounce, the weakest in more than a week.