Did Friday’s job data have you looking for a new track?

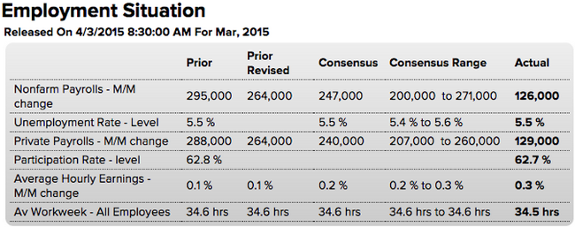

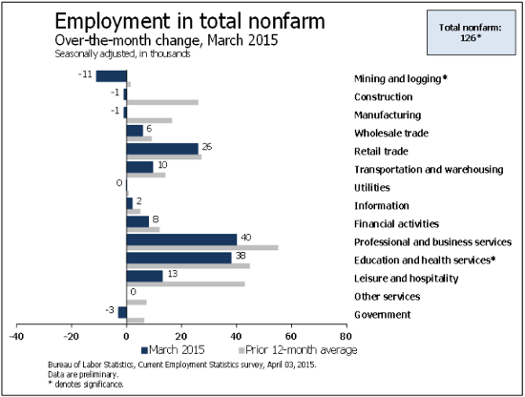

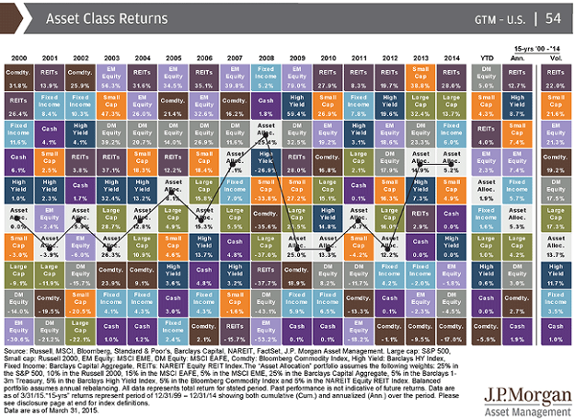

The March employment data was weak; there is no real way to sugarcoat it. Is this the start to a new trend for the U.S. or just a weather and energy impacted single data point that can be overcome? While the cash markets were closed for equities, the futures traded the news quickly and sold stocks while buying bonds and foreign currencies. Investors have given up consideration of a June rate hike by the Fed and now are setting their sights to September or beyond. Clearly, we are in need of more data to analyze, and luckily for investors, the freight train of numbers arrives this week as the April earnings season gets under way. If you are looking for an alternate track, pay attention to international equities and bonds. If the U.S. data pauses, the US dollar could weaken creating an opportunity for equity investors to accelerate their buying overseas. Making returns on both the equity and the currency could really fire up active investors. Go back and review just how cheap some of those European companies are right now relative to U.S. stocks. And if you really want to dumpster dive and bet on a falling dollar, go dig into the Emerging Market stocks.

Yeah, Friday’s numbers were ugly. Hope you were dyeing eggs with the kids instead…

(@Econoday)

Oil sector job losses are running through the Mining line. The negative trend will continue as companies there are not done right sizing their operations…

After the report, the U.S. 2-Year yield fell back to 0.50%. Not something U.S. equity investors would prefer to see…

But as Josh Brown reminds us, the economy and the stock market are not always perfectly linked…

@ReformedBroker: Q1 2015:

Best Economy:

S&P 500 +0.4%

Worst Economy:

DJ Euro Stoxx 50 +16%

Nikkei 225 +10.1%

Shanghai Composite +15.9%

Economy does not equal Stock Market

China. Wow. Is the breakout telling us that in 6-9 months China will be again expanding?

The 1st Quarter of 2015 is now in the books… How did your Asset Classes perform?

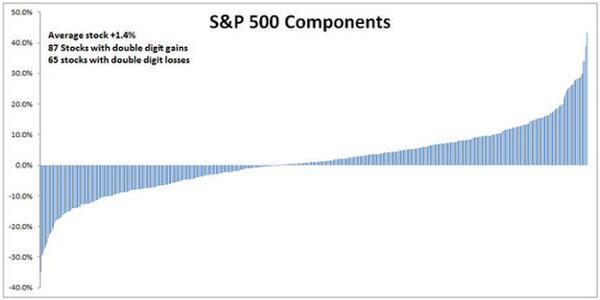

The 1st Quarter was also a very good environment for Stock pickers…

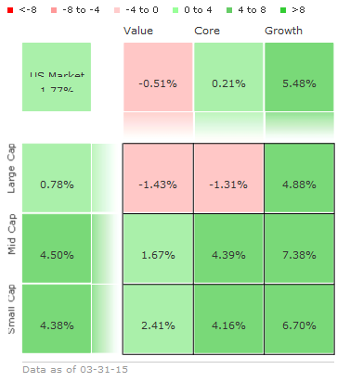

Morningstar’s Mutual Fund Style Box also shows the variance in returns for the Q1…

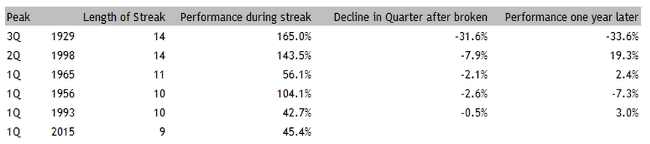

The S&P 500 Quarterly win streak lengthens. Its end does not always indicate a crash…

Below is a list of the longest quarterly win streaks in S&P composite history (the S&P 500 starts in 1957) going back to 1900. There are five other times that quarterly win streaks have lasted longer than this one. The median decline in the quarter that the streak is broken is just 2.6%. The median change over the next twelve months is actually positive 2.4%. The end of the streak signaled the end of a bull market in two of the five instances (1929 and 1956), although the 1956 bear market just barely qualifies as a bear.

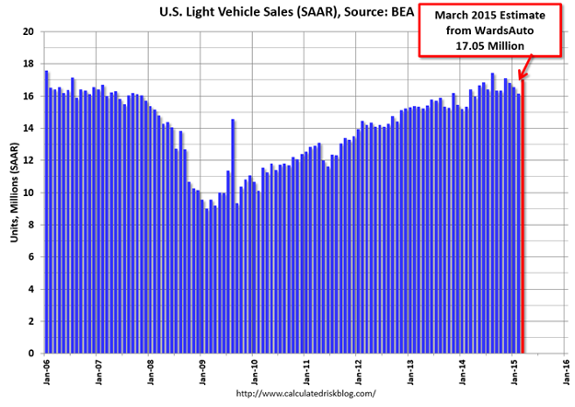

Strength in the U.S. Consumer was validated last week by Auto Sales > 17m units…

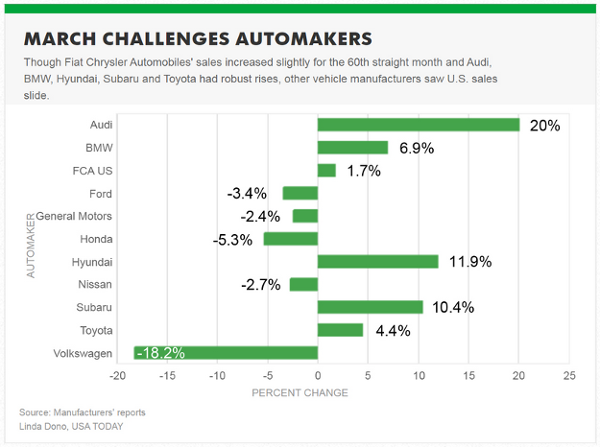

And looking closer, the Foreign automakers seem to be making gains with the U.S. Dollar strength…

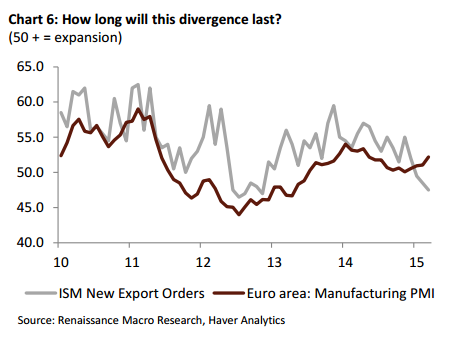

Further, last week’s Manufacturing data showed that Europe is gaining strength beyond just auto sales…

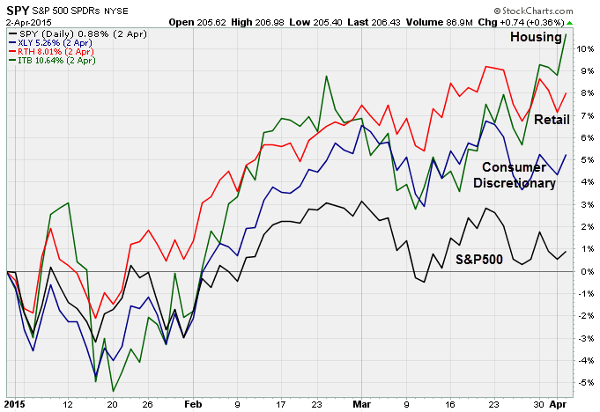

For sector investors in the U.S., Consumer stocks must be a rising theme in your portfolio…

The stars continue to line up for Housing and Supplier investors…

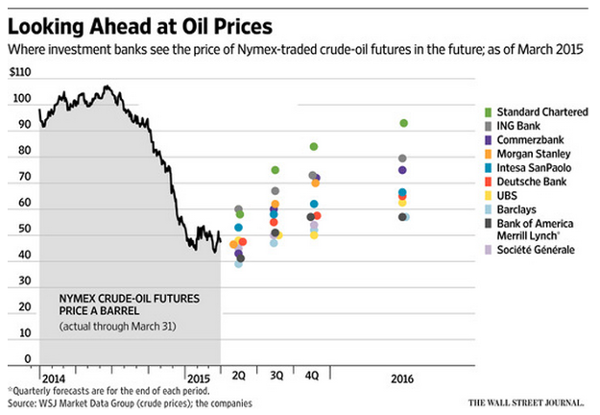

A falling U.S. Dollar will also buoy Oil & Gas prices which will further entice Energy stock bottom fishers. If you are in need of some Oil price estimates to motor your Super Tanker through, look at these…

The price of oil has just closed its third consecutive quarter of price declines, and experts diverge on where it’s headed next. Major banks see WTI, the U.S. oil benchmark, ending the year anywhere between $52 to $84 a barrel. The range for Brent, the global marker, is similarly big – from $55 to $90 a barrel. On Wednesday Brent was trading around $55 a barrel and WTI was around $47 a barrel.

Chicago municipal bond investors have missed the bond rally. A good time to double check that your other Munis are using realistic pension return assumptions…

Some Chicago bonds have largely missed out on a bond-market rally due to the concerns. The price of a Chicago 30-Year bond sold in March 2014 has risen 2.7% over the past year, compared with a 22% jump in the price of a similar-maturity U.S. Treasury bond. The yield on the Chicago bond decreased from 6.3% at the time of sale to 6.1% when it last traded in mid-March, while the 30-year Treasury bond decreased from 3.6% to 2.5% over the same period. Yields fall when prices rise.

The pension gap in Chicago has some analysts warning the city could in a decade or more face the same fate as Detroit, which also had pension shortfalls before it filed for bankruptcy protection in 2013. Although Chicago’s economy is more robust, some investors said Chicago needs to address its pension situation

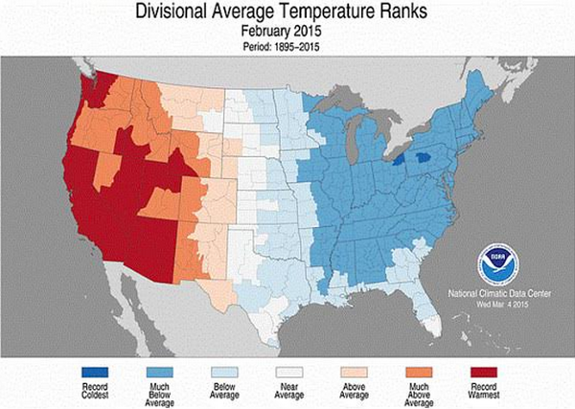

For those fed up with the Winter of 2015, where will the U-Haul trucks be heading?

Probably not California. Here is this weekend’s most read story…

“You just can’t live the way you always have,” said Mr. Brown, a Democrat who is in his fourth term as governor. “For over 10,000 years, people lived in California, but the number of those people were never more than 300,000 or 400,000,” Mr. Brown said. “Now we are embarked upon an experiment that no one has ever tried: 38 million people, with 32 million vehicles, living at the level of comfort that we all strive to attain. This will require adjustment. This will require learning.

Let the Language Wars begin…

Parlez-vous Java? Sprechen Sie Python? At least four states — including Washington, home of Microsoft Corp (NASDAQ:MSFT). — have either passed or considered measures that would delight high school students who have trouble rolling their r’s. Rather than taking Spanish to satisfy their foreign language requirement, they could take a computer language… Proponents say such an approach will help students get jobs and businesses compete internationally. By 2020, companies across the U.S. will have 1.4 million job openings requiring computer-science expertise and just 400,000 college graduates to fill them, according to Code.org, a Seattle-based advocacy group for tech education.

Interview of the Week…

“When I go to a car show, I see all these guys with their Lamborghinis. I drive up in this plywood and fiberglass movie prop and people go nuts. It’s nothing but happy. In the past few years, no matter what troubles have come along—business problems, divorce problems – I always think: Yeah… but I own the Batmobile! And that makes everything OK.”

(Jeff Dunham, 52, a comedian/ventriloquist from Los Angeles and Las Vegas)

Disclaimer: The information presented here is for informational purposes only, and this document is not to be construed as an offer to sell, or the solicitation of an offer to buy, securities. Some investments are not suitable for all investors, and there can be no assurance that any investment strategy will be successful. The hyperlinks included in this message provide direct access to other Internet resources, including Web sites. While we believe this information to be from reliable sources, 361 Capital is not responsible for the accuracy or content of information contained in these sites. Although we make every effort to ensure these links are accurate, up to date and relevant, we cannot take responsibility for pages maintained by external providers. The views expressed by these external providers on their own Web pages or on external sites they link to are not necessarily those of 361 Capital.