The bounce has stalled and now it's a question as to whether the swing low from February is one to be defended, or is simply a swing low in a measured move lower; a move which could see 2018 lows tested—although this would be a big stretch and a likely 'worse case' scenario. Again, just to reiterate, the 2009 low is a generational (55 year+) low and the rally which emerged is one which will see long (long) term gains.

This is a sharp move down, but it won't last. Markets may move sideways for an extended period, which will 'feel bad' but is ideal for those looking to accumulate a position over time—such as in a pension or 401K.

With that in mind, we have to deal with the present. The Coronavirus is here to stay (where are the anti-Vaxxers now...). We have a Chinese economy which is still trying to come to terms with the infection and the eventual economic fall out. We have a UK and U.S. economy led by the most incompetent group of 'leaders' for whom fake news won't be a defense against nature. Africa won't have the resources to deal with a widespread outbreak, Latin America is a mess and will similarly struggle. The EU is too busy fighting the war within. And the economic impacts will be felt for a number of quarters.

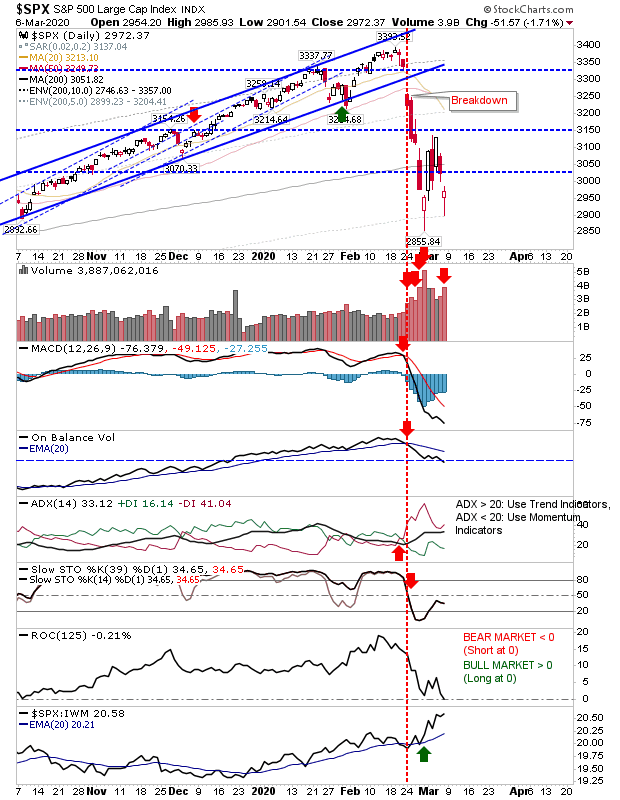

As for markets, the S&P managed a second 'bullish' hammer on higher volume—even if this volume ranked as distribution. Technicals are net negative, although relative performance vs Small Caps is sharply higher. Whatever money is available to invest is flowing into the S&P.

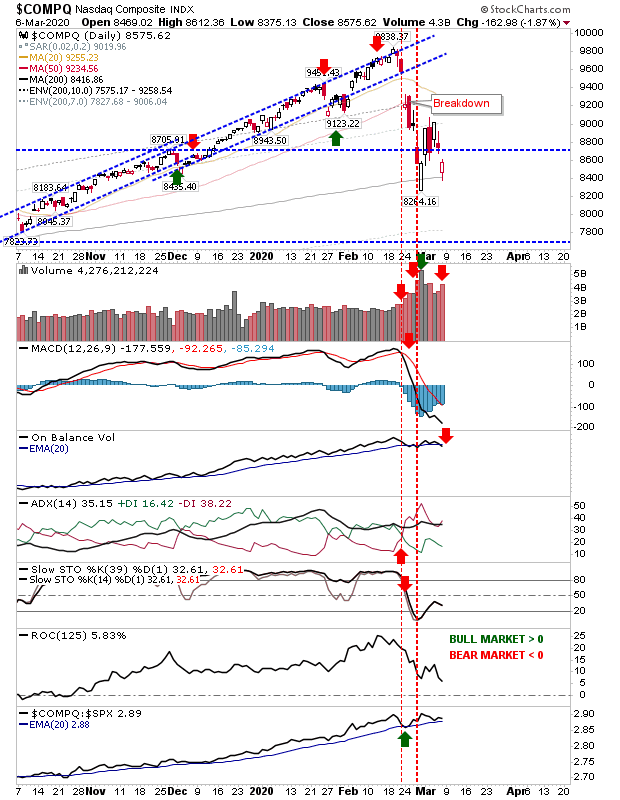

The NASDAQ was able to adopt a more traditional defense with a successful test of the 200-day MA. If there is a caveat it's that the test of the 200-day MA came too soon after the last one. Given the significance of the 200-day MA as a major support level, you don't want to see this tested very often and want a powerful move off it...something we haven't seen here.

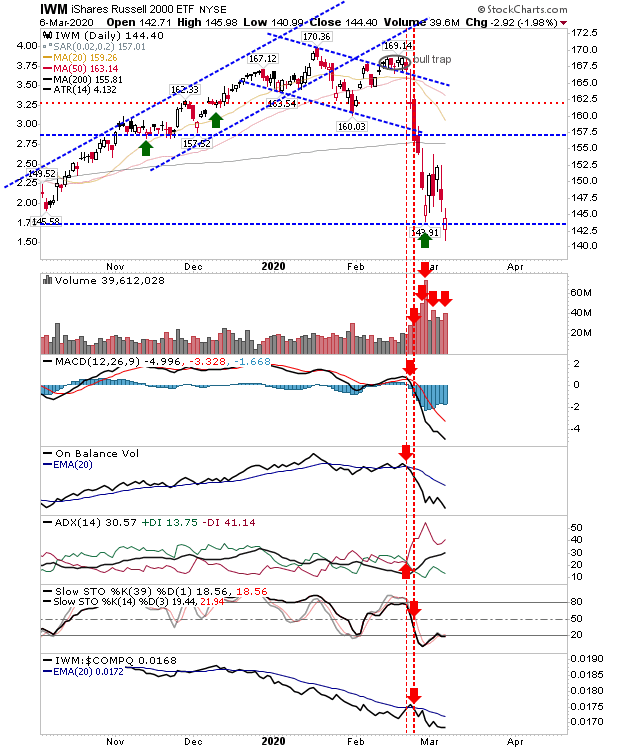

A sign of what may be to come is the Russell 2000 (via iShares Russell 2000 ETF (NYSE:IWM)). Unlike the S&P and NASDAQ it has already undercut its February swing low on higher volume and given the finish on a 'neutral' spinning top it suggests the downside is not done.

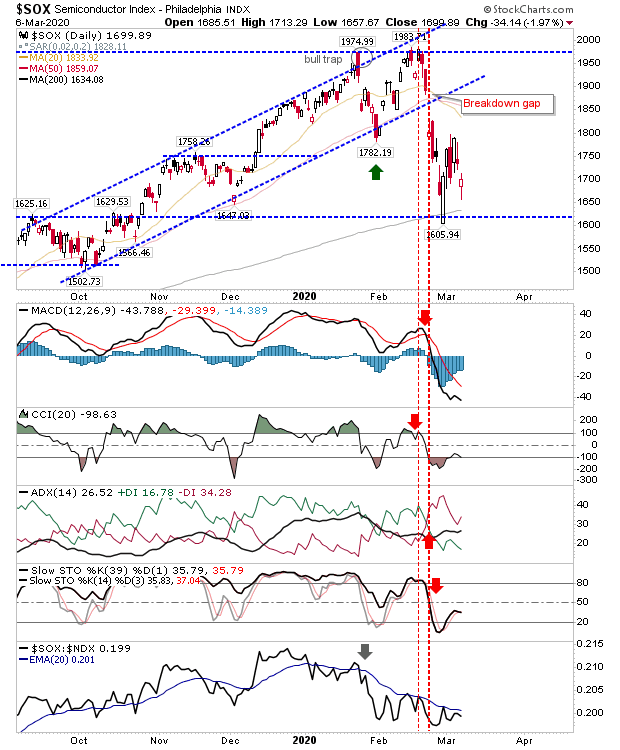

The Semiconductor Index influence on the NASDAQ could help the latter. Relative performance against the NASDAQ 100 is improving but with business expansion likely to slow over the next 12 months I suspect we are going to see larger than expected losses in Semiconductors.

For this week, it will be about defending the February swing lows and looking for indices to establish a workable swing low. It still feels a little early to establish a low, but if indices get 10-15% below their 200-day MA then there will be in 'strong buy' territory no matter what the news.