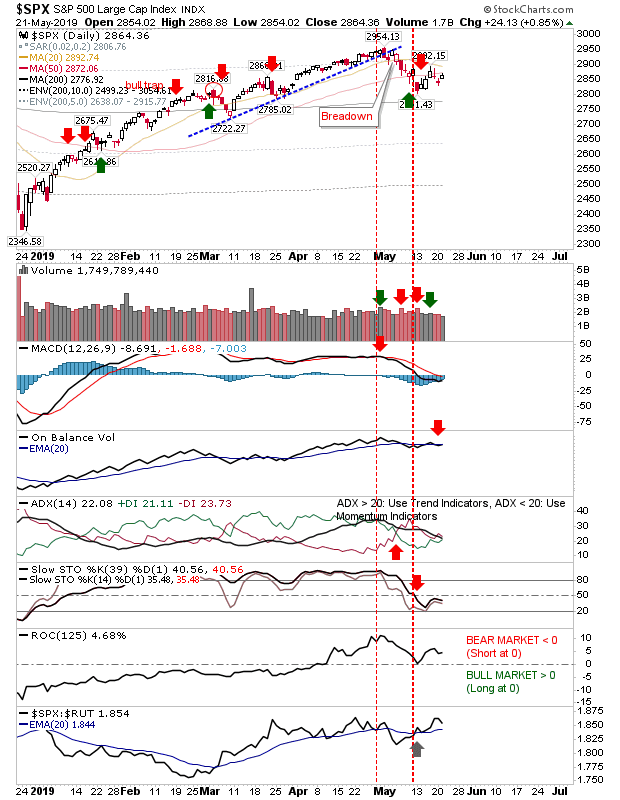

Markets made minor gains yesterday, but the action of the last few days has not managed to clear the consolidations created near the moving averages.

In the case of the S&P 500, the index is trading around the 50-day MA. Volume was lighter on the upside but technicals are net bearish but not oversold. If this is to be a swing low there isn't much room for maneuver and bulls need to follow through higher over the next few days.

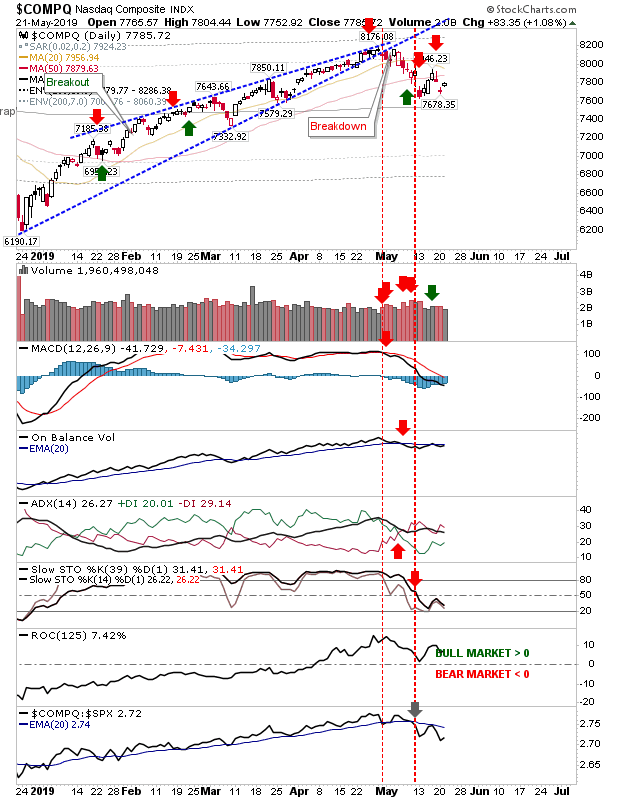

It was a similar story for the NASDAQ Composite with technicals also net bearish.

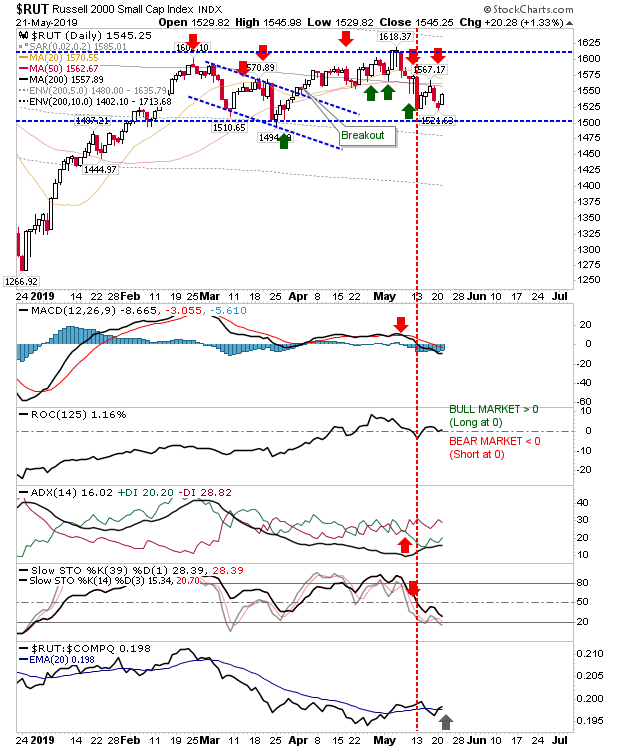

The Russell 2000 tried to do a little more on the upside but remains range bound. On the good news side, relative performance is improving which offers a chance it's preparing for a lead-out break move higher. Although getting past 1,618 is still some distance off.

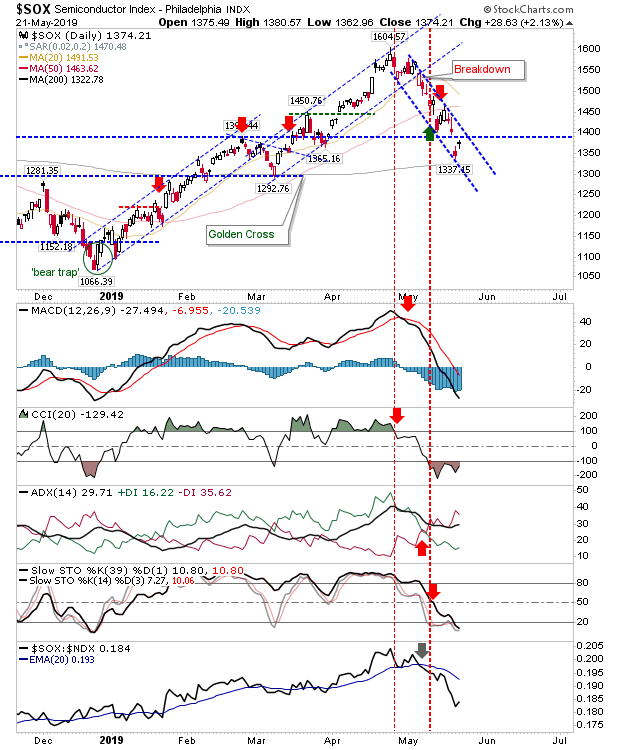

For bears, the Semiconductor Index is the one to watch. After undercutting 1,400 support on Monday in a test of the 200-day MA, Tuesday's response was fairly tame. 1,400 remains resistance and this index is suffering significant underperformance relative to the Nasdaq and Nasdaq 100.

For Wednesday, the split divide is to watch action in the Russell 2000 (for bulls) and Semiconductors (for bears). It does look like markets are building consolidations from their advances earlier in the year - which is a hold scenario for current longs and a wait-and-see for shorts.