Technical Analysis

Positive Data Bullish For NIKKEI

Japanese retail sales and housing starts increased in February. Will the NIKKEI continue rising?

Recent Japanese economic data were positive on balance: while the Tankan index for big manufacturers sentiment softened in the first quarter 2019 from the previous three-month period, retail sales inched up 0.2% over month in February after 2.3% decline in January, and housing starts rose 4.1% from 1.1% over year in February. And while services sector expansion slowed a bit in March as Nikkei Services PMI ticked to 52 from 52.3 in February, the manufacturing sector contraction slowed. Most of the decline was due to weaker foreign sales to China and Taiwan. But international trade prospects have been improving lately with China’s Vice Premier Liu He arriving in Washington on Tuesday for a continuation of high-level talks held last week in Beijing after U.S. Chamber of Commerce executive’s comment “ninety percent of the deal is done, but the last 10% is the hardest part” about talks' progress so far. Positive data are bullish for NIKKEI.

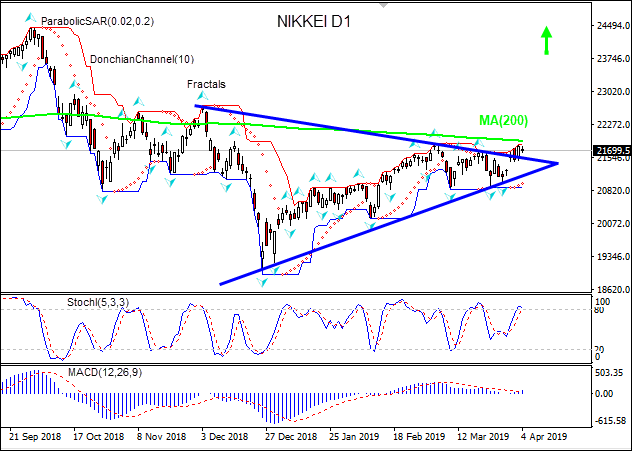

On the daily time frame the Nikkei: D1 is rising after hitting 19-month low in the end of December. The price has risen above the resistance line, this is bullish.

-

The Parabolic indicator gives a buy signal.

-

The Donchian channel indicates uptrend: it is widening up.

-

The MACD indicator gives a bullish signal: it is above the signal line and the gap is widening.

-

The Stochastic oscillator is in the overbought zone but is set to decline.

We believe the bullish momentum will continue after the price closes above the upper boundary of Donchian channel at 21834.2. This level can be used as an entry point for placing a pending order to buy. The stop loss can be placed below the fractal low at 20870.8. After placing the order, the stop loss is to be moved every day to the next fractal low, following Parabolic signals. Thus, we are changing the expected profit/loss ratio to the breakeven point. If the price meets the stop loss level (20870.8) without reaching the order (21834.2), we recommend cancelling the order: the market has undergone internal changes which were not taken into account.

Technical Analysis Summary

- Position Buy

- Buy stop Above 21834.2

- Stop loss Below 20870.8

Market Overview

- US stocks advance fifth straight session

- Dollar falls on disappointing ADP (NASDAQ:ADP) report

US stock market extended gains on Wednesday as China’s Vice Premier Liu He was scheduled to meet with U.S. Trade Representative Robert Lighthizer and Treasury Secretary Steven Mnuchin. The S&P 500 gained 0.2% to 2873.40. The Dow Jones Industrial Average added 0.2% to 25218.13. Nasdaq Composite index rose 0.6% to 7895.55. The dollar weakening accelerated as payroll services firm ADP’s estimate of new jobs in march fell short of forecasts. The live dollar index data show the US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, fell 0.2% to 97.10 and is lower currently. Futures on US stock indexes point to mixed openings today.

DAX 30 Outperforms European Indexes

European stocks ended higher on Wednesday. The EUR/USD joined GBP/USD’s climb and both are currently higher. The Stoxx Europe 600 gained 1% led by auto and miner shares. Germany’s DAX 30 jumped 1.7% to 11954.40, France’s CAC 40 advanced 0.8% and UK’s FTSE 100 added 0.4% to 7418.28 as British parliament passed a law that compels Prime Minster May to ask for an extension to the Brexit deadline if a no-deal departure is looming.

Shanghai Composite Still Ahead Asian Indices

Asian stock indices are mixed today. Nikkei added 0.05% to 21724.95 as yen resumed its climb against the dollar. China’s stocks are mixed ahead of China’s Vice Premier Liu He scheduled meeting with president Trump: the Shanghai Composite Index is up 0.9% while Hong Kong’s Hang Seng Index is 0.3% lower. Australia’s All Ordinaries Index gave back all of previous session gain closing 0.8% lower as the Australian dollar continued gaining against the greenback.

Brent Down

Brent futures prices are extending losses today. Prices fell yesterday after data showed US crude stockpiles jumped by 7.2 million barrels last week. June Brent crude slid 0.1% to $69.31 a barrel on Wednesday.