It started with the S&P 500. It made a new all-time high at the start of last week. The Dow quickly followed a couple of days later into record territory. A large cap led rally.

There were questions which index would come next from there. But Monday the Nasdaq 100 cleared its first hurdle in the path to a new high. That left only the Russell 2000. So what about the Russell 2000? Is it ready to make the move? It actually looks like it might be in the on deck circle.

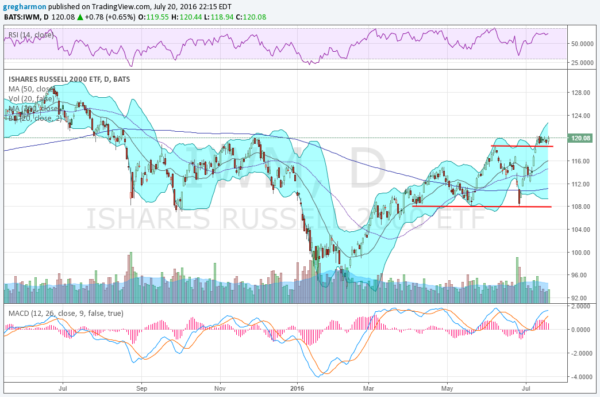

The chart below shows the Russell 2000 ETF (iShares Russell 2000 (NYSE:IWM)) since its all-time high in June 2015. A steady decline brought it down more than 25% to the February low. That left a deep hole to fill. A 28% drop takes a 38% gain to erase it. And since February the Russell 2000 has been working on that.

The initial run higher stalled at the end of April. A small pullback and then another surge higher established a higher high in June. The pullback from there set up a new range between 108 and 118.50. It moved in this range until pushing over the top to start last week.

Since then it has consolidated the move above the breakout level. It is up 28% from the February low, just another 10% to recover the all-time high. A break of this range to the upside could lead it there quickly. The Measured Move out of consolidation would target 127.

A secondary Measured Move would look higher to 130. momentum is bullish and strong. The RSI is in the bullish range and the MACD rising. The Bollinger Bands® are also opened to the upside to allow it to run higher. Following the S&P 500, DOW and Nasdaq 100, a move higher in the Russell 2000 could be a Grand Slam!

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.