Last week the Nasdaq 100 was testing some important price levels. There were questions about whether the Nasdaq 100 would be the next index to make a new all-time high. I noted in Technical Limbo in the Nasdaq 100 that the ETF for the Nasdaq 100 (via PowerShares QQQ Trust Series 1 (NASDAQ:QQQ)) was he only major index that did not make a new all-time high in 2015. Even though the Nasdaq 100 did, the QQQ did not.

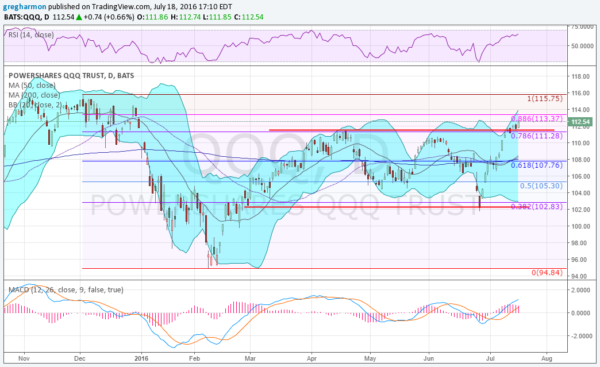

There were two very important price levels that came up for the QQQ. And without breaking above those levels the QQQ would remain in limbo. The first was a channel break the range it has been trading in since March. Last week peeked over the top of the range and Monday the follow through cemented it. One hurdle is cleared, but there still remains one more hurdle.

The momentum indicators support more upward price action toward that hurdle. The RSI is in the bullish zone and rising and the MACD is also positive and rising. The Bollinger Bands® are opening to the upside to allow a move higher. A drift up to 115.75 will be the next test for the QQQ. A push through that can start the assault on the oldest prior all-time high level, from 2001.

DISCLAIMER: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.