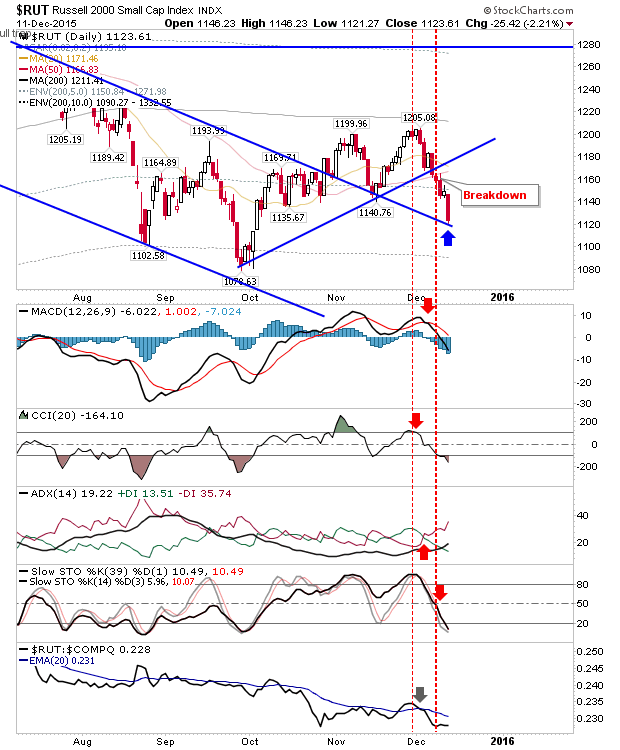

The Russell 2000 took a big hit on Friday, generating a loss of over 2% as the index stayed within the 85% percentile of weak prices going back to 1987. This is a five month stretch of underperformance for this index and is an opportunity for buy-and-holders to accumulate Small Cap shares. From a trade perspective, the Russell 2000 is down at former declining channel resistance and potential support.

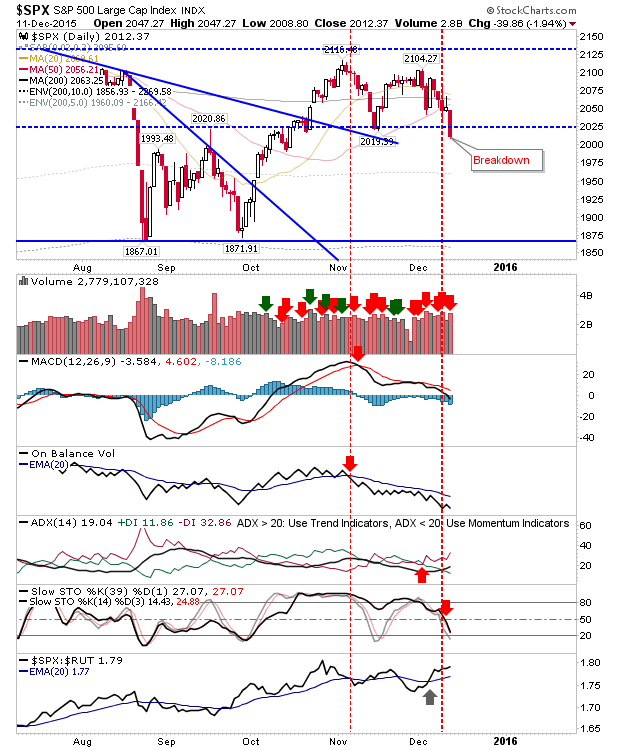

The S&P pushed below 2,025 support, knocking out the swing low of 2,019 on higher volume distribution. Technicals are net bearish despite what may turn into a 'Golden Cross' between 50-day and 200-day MAs. Next major support is at 1,867.

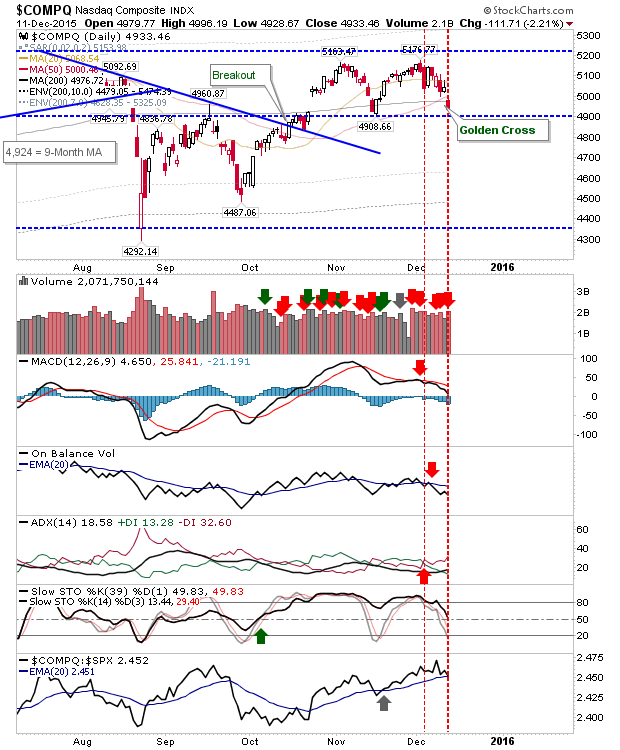

The NASDAQ undercut the 'Golden Cross' between 50-day and 200-day MAs. However, there is a key level of support around 4,900 which may offer a near term oversold market a place to rebound from.

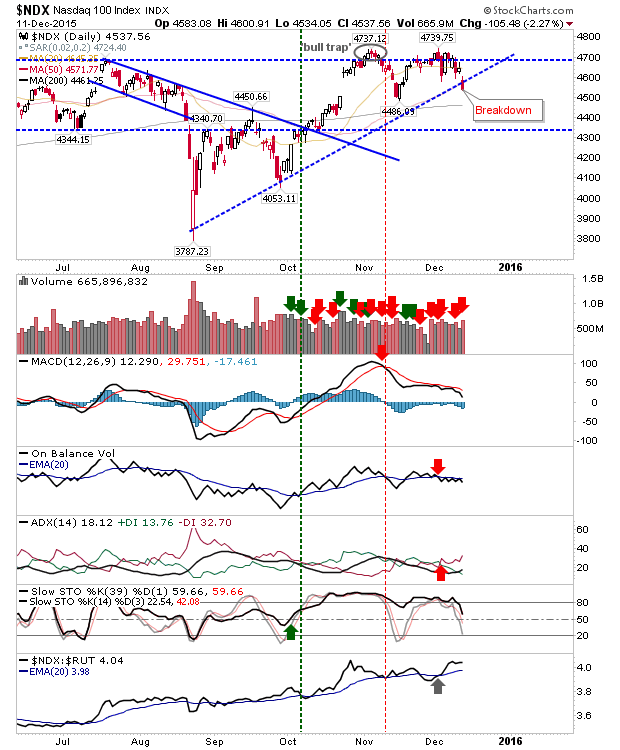

The NASDAQ 100 has a mix of bullish and bearish conditions. The NASDAQ 100 is one of the few indices to remain above its 200-day MA and the November swing low and is enjoying good relative performance against other indices. However, bears may look to the rising trendline break as an opportunity.

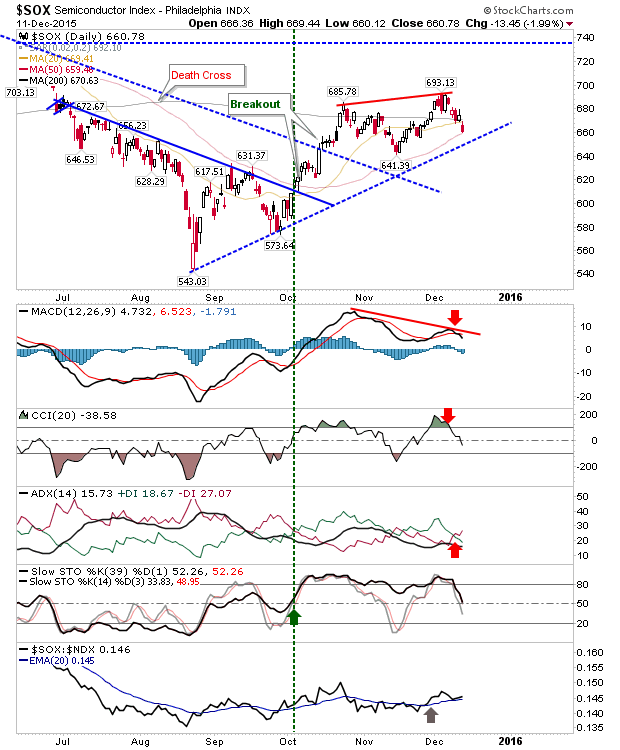

The Semiconductor Index is mapping a bearish divergence between price and MACD. Intermediate length stochastics are holding just above the bullish mid-line and is leaning on the 50-day MA for support. It could be an interesting long play for today, but the bearish divergence is one to be mindful of.

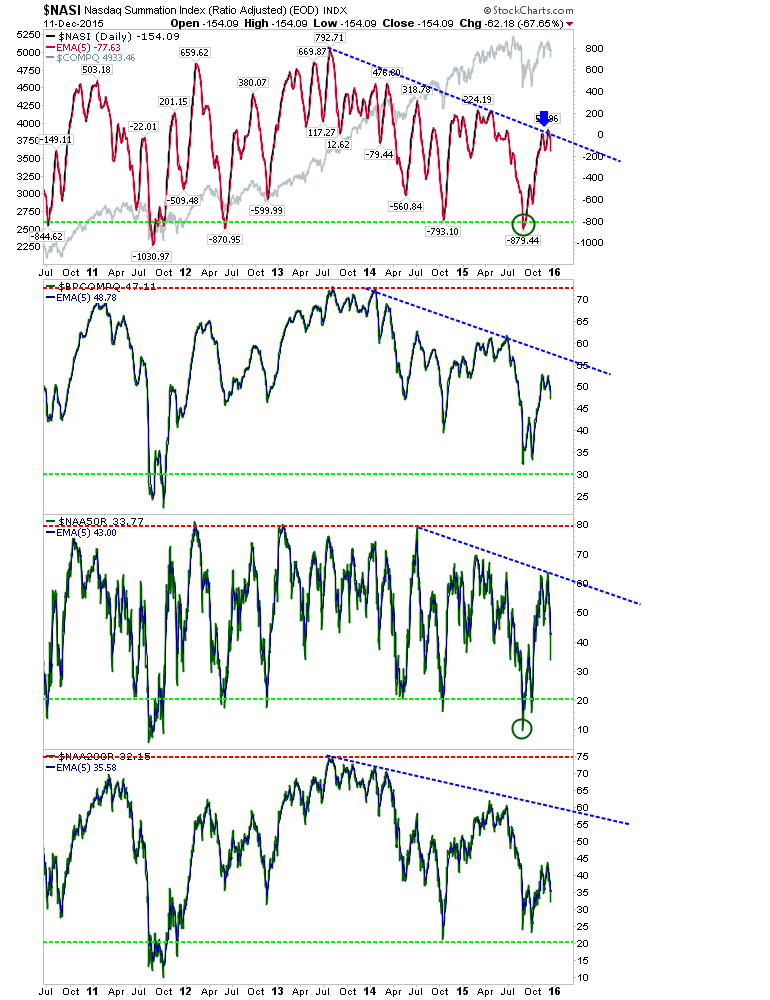

NASDAQ breadth is reversing off resistance and hasn't reached a level commonly associated with a swing low. The NASDAQ Summation Index is furthest away from an oversold condition, which is a little worrying for bulls, and certainly buyers looking for long term opportunities.

Bulls looking for a trade later today may look to the Russell 2000 and may find long-term value in leading Small Caps stocks. Bulls looking for long terms plays in Large Caps and Techs may have to wait, although the NASDAQ 100 could be a trade for bulls. Shorts will already be committed, and those looking to join in will need to be flighty as the whipsaw risk is high.