Yesterday's action saw bears attempt another day of selling, but buyers were able to bring markets to recovery by the close of business. Volume climbed to register as distribution, but the end-of-day recovery softened the blow. Today offers a chance for bulls to arrest what has been a sequence of down days.

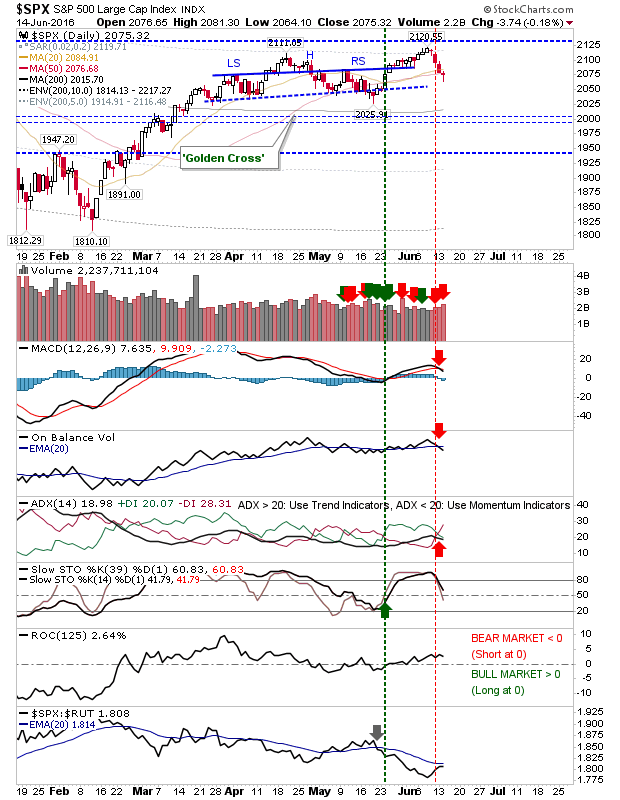

The S&P finished below the 50-day MA with technicals all net bearish. The 'doji' candlestick is a positive and a stop below yesterday's lows offers a chance for bulls looking for a trade low.

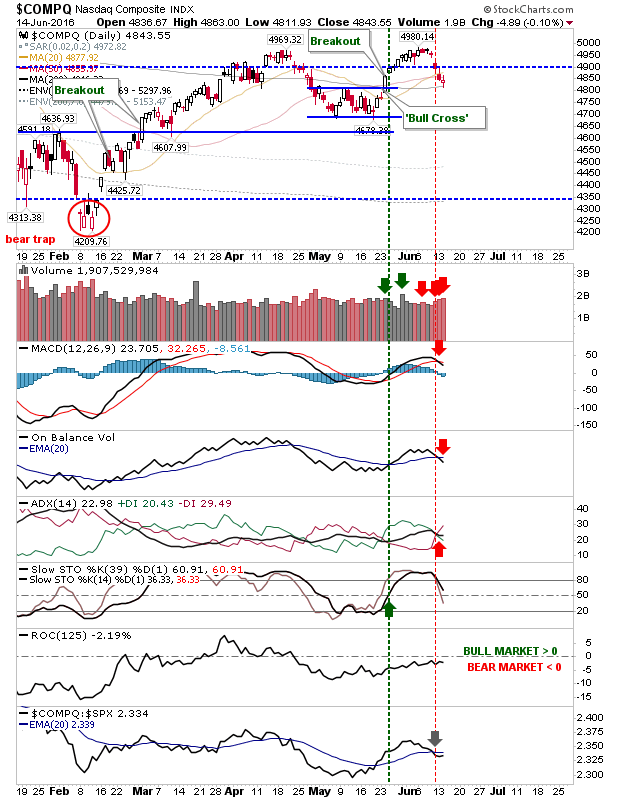

The NASDAQ had a closing 'spinning top', which is a classic neutral candlestick, but also finished just above its 200-day MA. Again, if bulls were to make a stand, yesterday's close is a good place to start.

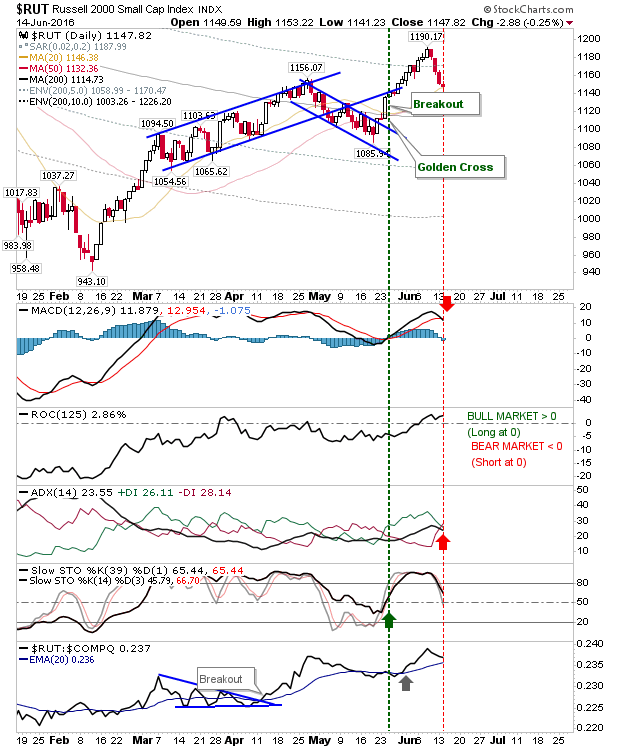

The Russell 2000 suffered the hardest sell-off last week, leading relative performance to drop back a little. It's still the best performing index, but this leaves it vulnerable to further profit taking. Technicals are edging bearish, but haven't gone full net bearish. It doesn't look as natural a 'buy' as the NASDAQ, but its leadership qualities should make it the better long-term prospect for bulls.

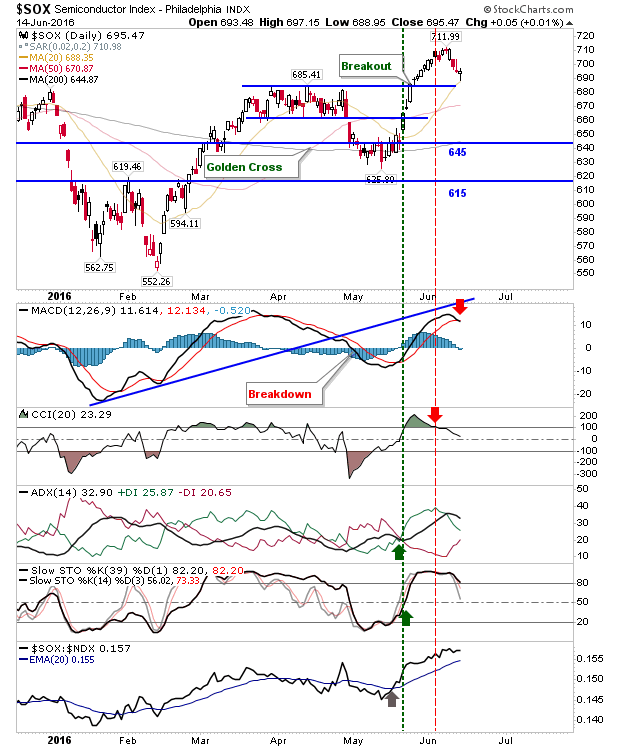

The best index again looks to be the Semiconductor Index. It was able to finish with a 'bullish hammer' after a tag of its 20-day MA. The index is outperforming against the NASDAQ 100 and with the presence of converged support from April's trading range, there is a good chance this could return higher.

For today, look for positive pre-market action to get the trading juices going. A bullish response would appear favoured, but should losses emerge, keep an eye on the S&P, which is running out of near-term support levels.