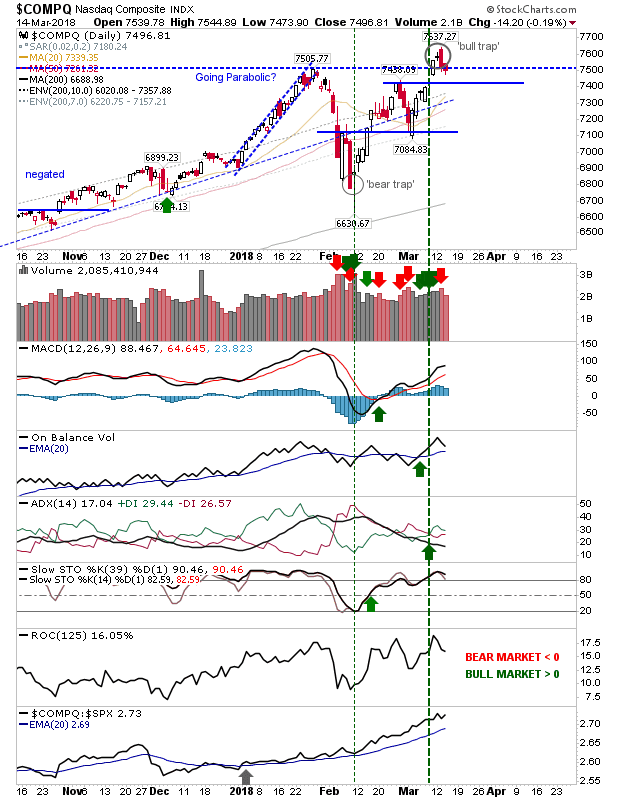

A second day of selling brought the indices back towards support yesterday. The index looking most vulnerable with the potential to 'bull trap' is the NASDAQ. I'm not sure enough damage has been done to confirm this but another day's selling would probably be enough.

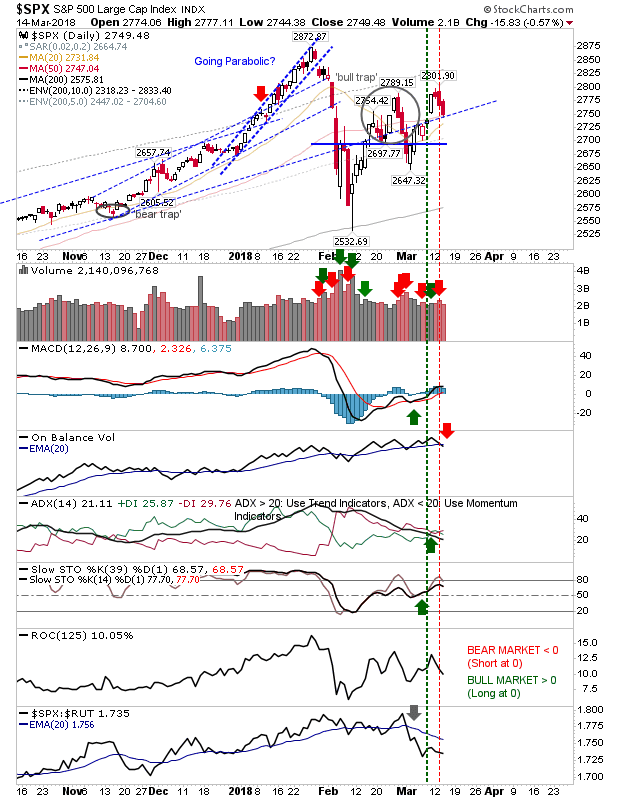

The S&P flashed a 'sell' trigger in On-Balance-Volume which left it at former channel support. The index is effectively caught in a trading range which ranks recent selling as noise.

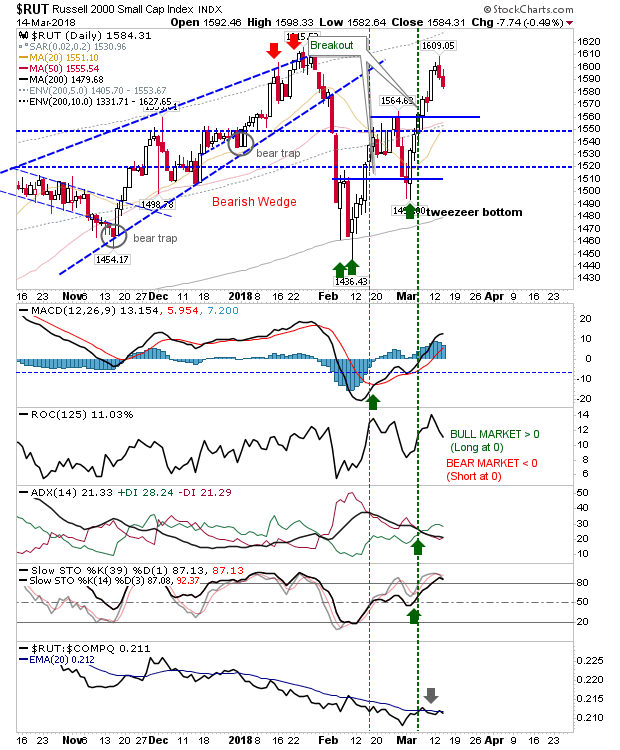

The Russell 2000 eased back from a challenge of all-time highs but not enough to reverse the earlier break of the swing high. Watch the index closely, buyers may find joy if there is a spike low towards 1,565. Shorts can fish around the next rally to 1,609 but don't be hanging on to short-side plays if there is a powerful push above 1,610.

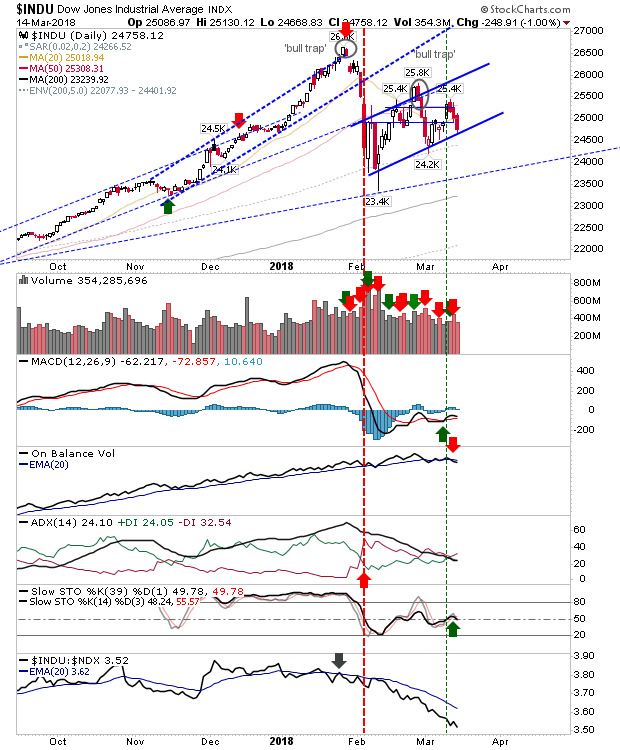

Shorts playing the Dow Industrials may want to take partial profits on the test of rising 'bear flag' support. Things could get a whole lot better for shorts if there is another down day today—this would break 'flag' support and open up for a larger move lower.

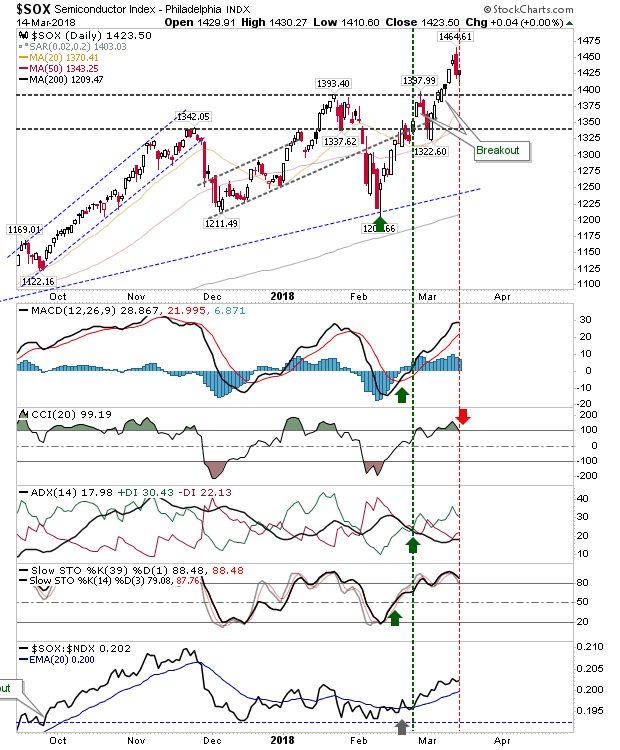

The Semiconductor Index did well to make back early losses. This index looks the one to best reward bulls; moves down to 1,400 can be bought until there is a sustained close below 1,390.

For today, bears have the Dow Jones Industrial Average and possibly the NASDAQ to work with. Bulls can look to the Semiconductor Index and maybe the Russell 2000.