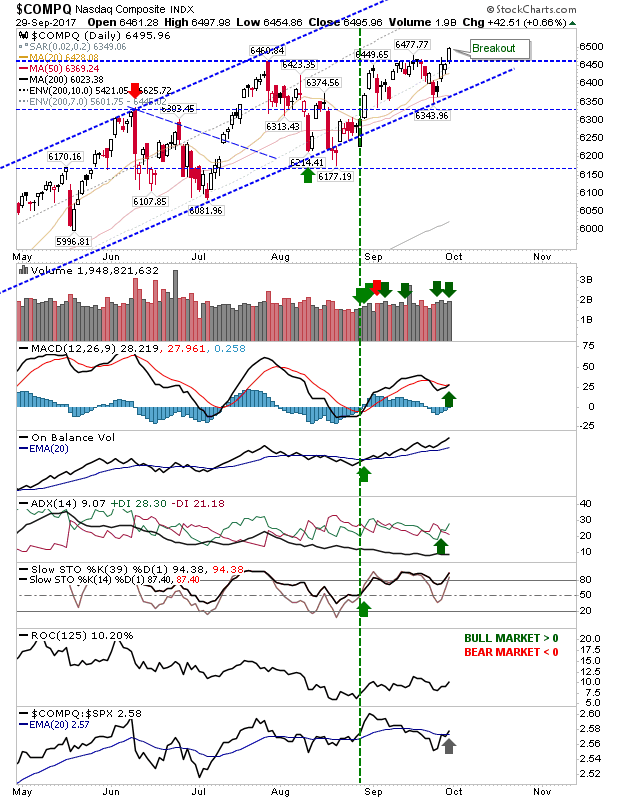

It had been slow in coming but Friday delivered on last week's promise. Friday offered a solid clean break of resistance for the NASDAQ on higher volume accumulation. It was a textbook breakout accompanied by a MACD trigger 'buy'. The only concern bulls will have for the coming week is a 'bull trap' marked by a two-bar reversal.

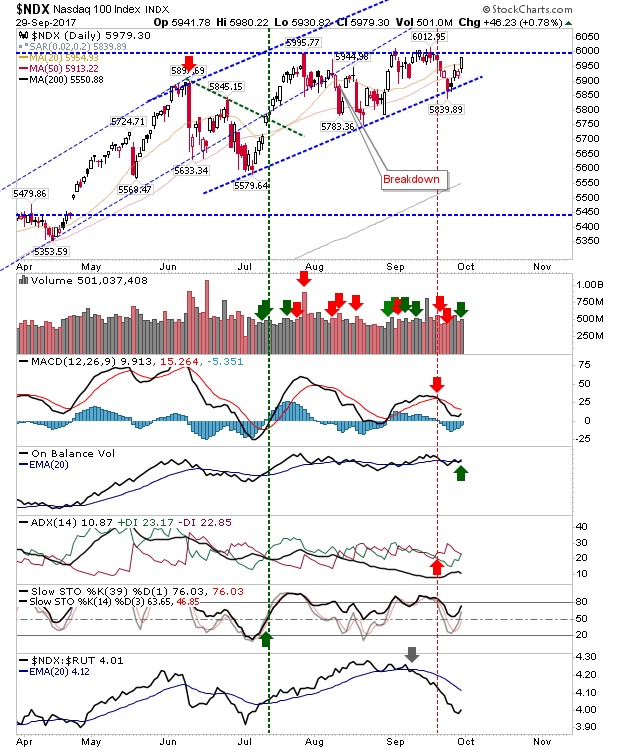

The NASDAQ 100 did well but not enough to push the breakout. Volume registered as accumulation and there was a weak On-Balance-Volume 'buy' trigger. This coming week could be when the NASDAQ 100 joins the NASDAQ beyond 6000.

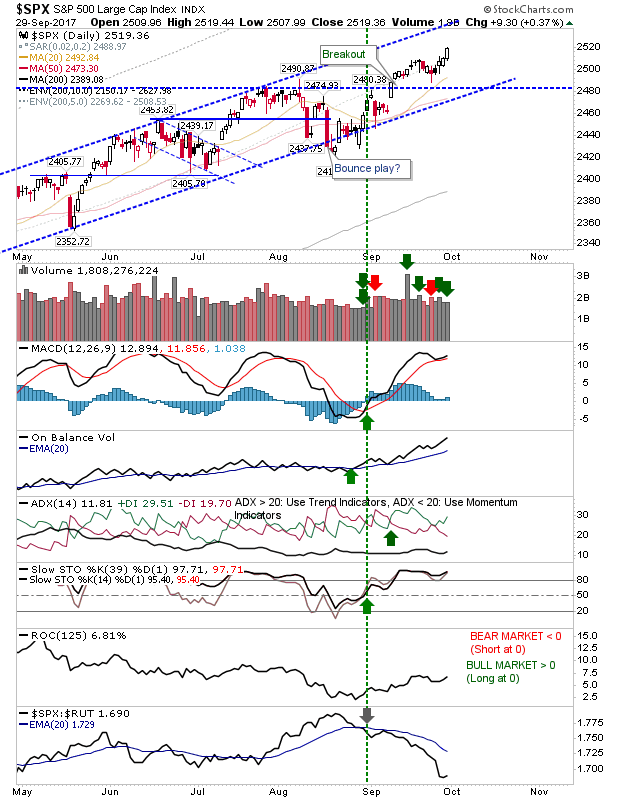

Sleeper play-of-the-week went to the S&P. I wasn't expecting much from the index but it delivered with good supporting technicals. Momentum players can be looking for a move to projected channel resistance with no direct overhead resistance to contend with. The only disappointment is the sharp underperformance relative to other indices (on the plus side, when in the ascendancy it will benefit from money rotation into 'safe' Large Cap stocks).

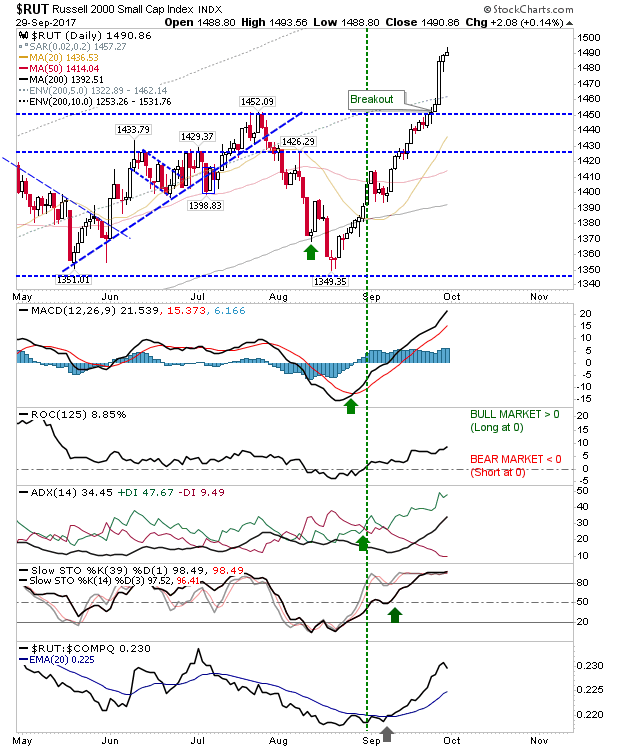

The Russell 2000 did most of its hard work earlier in the week and it only managed small gains on Friday; going forward, any support test of the breakout will likely take a couple of weeks given how far it has moved from such support. Any tag of 1,450s should be bought with a stop on a loss of 1,450. Relative performance remains good.

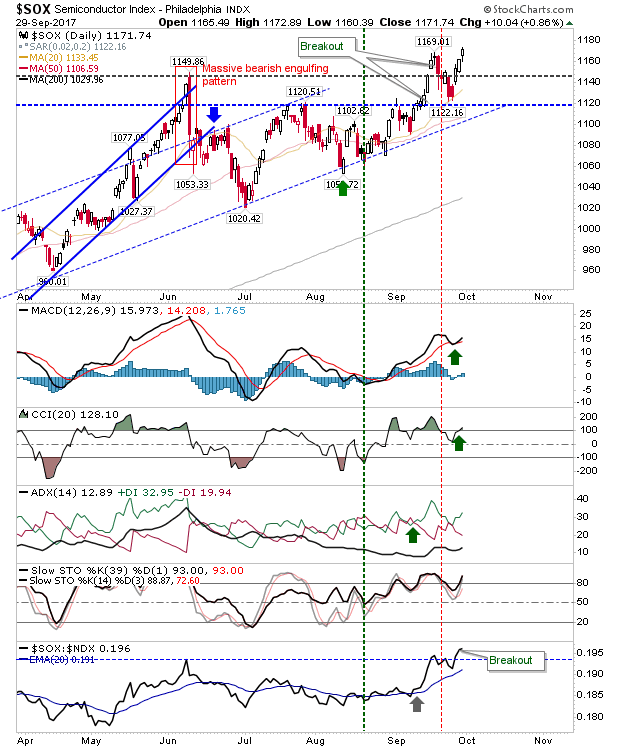

The Semiconductor Index recovered from what had the look of a 'bull trap' as Friday saw new highs. This is good news for both the NASDAQ and NASDAQ 100 with an additional breakout in resistance in the relative relationship against the NASDAQ 100. Signs look good for further gains.

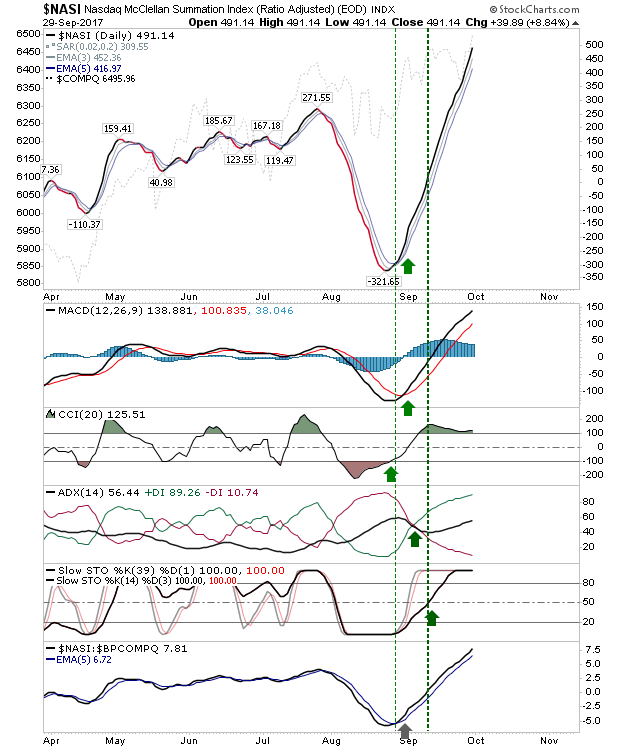

Supporting NASDAQ breadth metric, the NASDAQ Summation Index has offered a smooth ride higher but in the 500s it will now find itself approaching an area typically associated with reversals in the NASDAQ. However, with the NASDAQ having just broken resistance, will this mean the risk of a 'bull trap' is now higher?

For Monday, watch for a 'bull trap' in the NASDAQ. Momentum long players may find the best opportunities in the S&P but those looking for value should see if the Russell 2000 starts to come back and confirm 1,450.