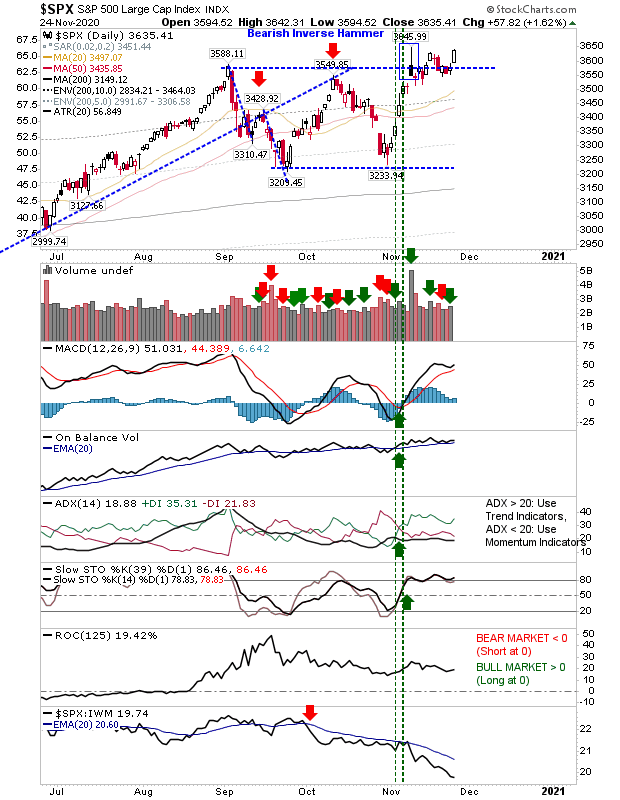

Important day for the indices Tuesday, with the S&P again pushing into the spike high of the Bearish inverse hammer. Volume climbed to register an accumulation day as buyers found some footing on the back of bullish net technicals.

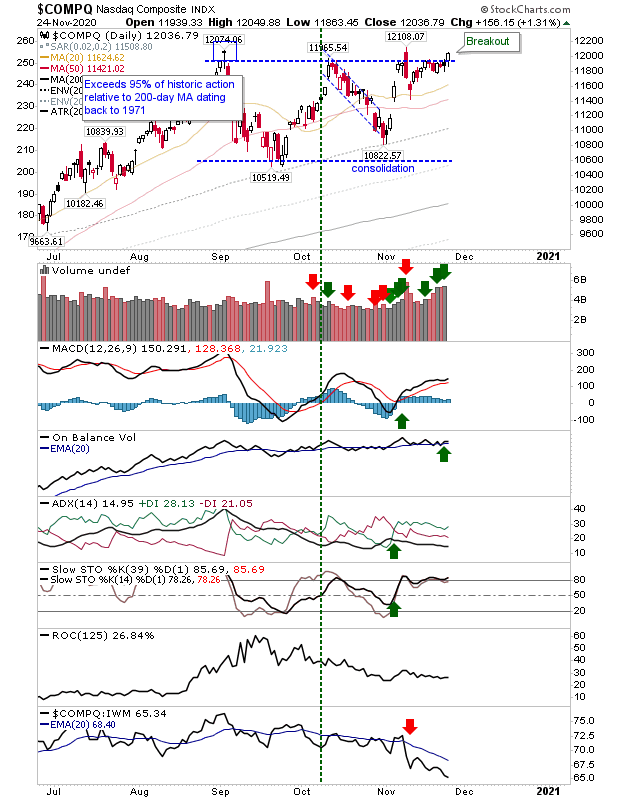

In recent days, volume has been rising steadily along with pressure on resistance. While yesterday did register a breakout of sorts, the action did lay the groundwork for more gains.

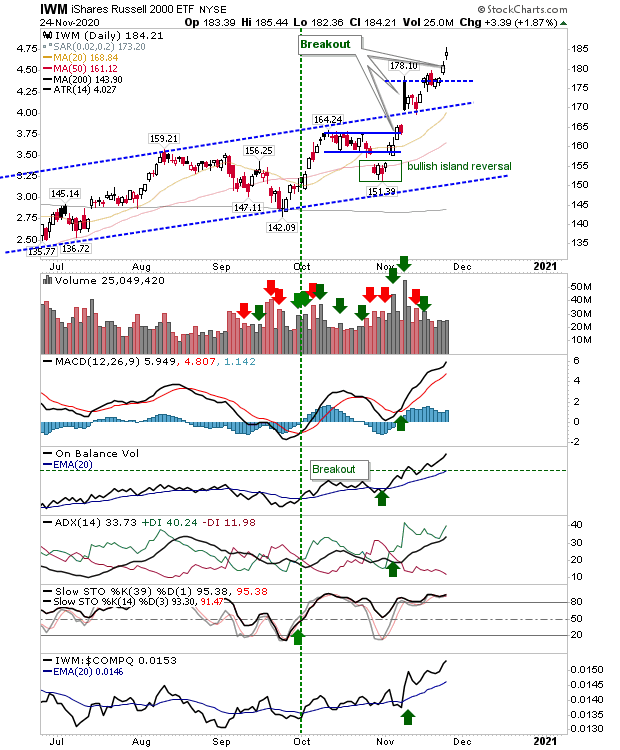

In both cases, relative performance deteriorated despite these gains. The reason for this was the Russell 2000 (via IWM). It has well and truly negated whatever bearish implications were in play from the bearish black candlestick in early November. This is healthy market action for the broader market, not just the Russell 2000.

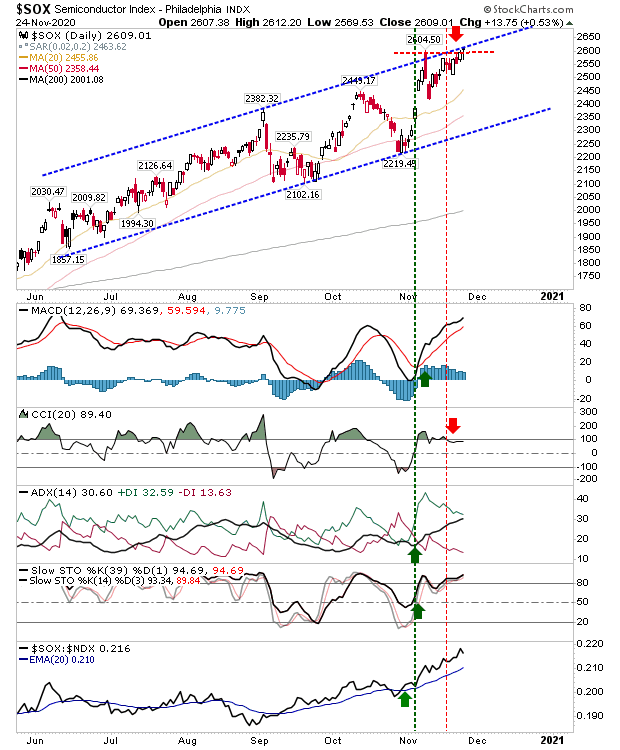

The Semiconductor Index is up against channel resistance, although any channel resistance should be viewed as weak as it restricts the potential for an acceleration in the rally. Aggressive players could look to a shorting opportunity at converged resistance of the November swing high and channel resistance. What strength there is in the Semiconductor Index is good for the NASDAQ and NASDAQ 100.

With Thanksgiving this week, it will probably be a case of holding the status quo into next week. Thanksgiving Friday is often a chance for a bit of a feel-good rally. Not expecting much for today but let's see.