The NASDAQ 100 has finally caught up with the S&P 500 and Dow Jones Industrial Average. The latter two essentially rallied unabated to new daily all-time highs from their recent March lows, while the NDX was stuck between 13000 and 14000. This sideways price pattern complicated my interpretation of the charts and misled me on the actual underlying price pattern. But as I tell my premium members, “Please remember, my work is ~70% reliable and ~90% accurate. Thus, be realistic and do not expect perfection and zero bad calls in a dynamic, stochastic, probabilistic environment.”

Thus, as the index marched to new ATHs recently, I had to abandon my more bearish stance that it would first revisit these March lows before heading higher. Instead, my preferred Elliott Wave Principle (EWP) count suggests the index is completing its 3rd of a 3rd wave: grey minute wave-iii of green minor-3. See figure 1 below.

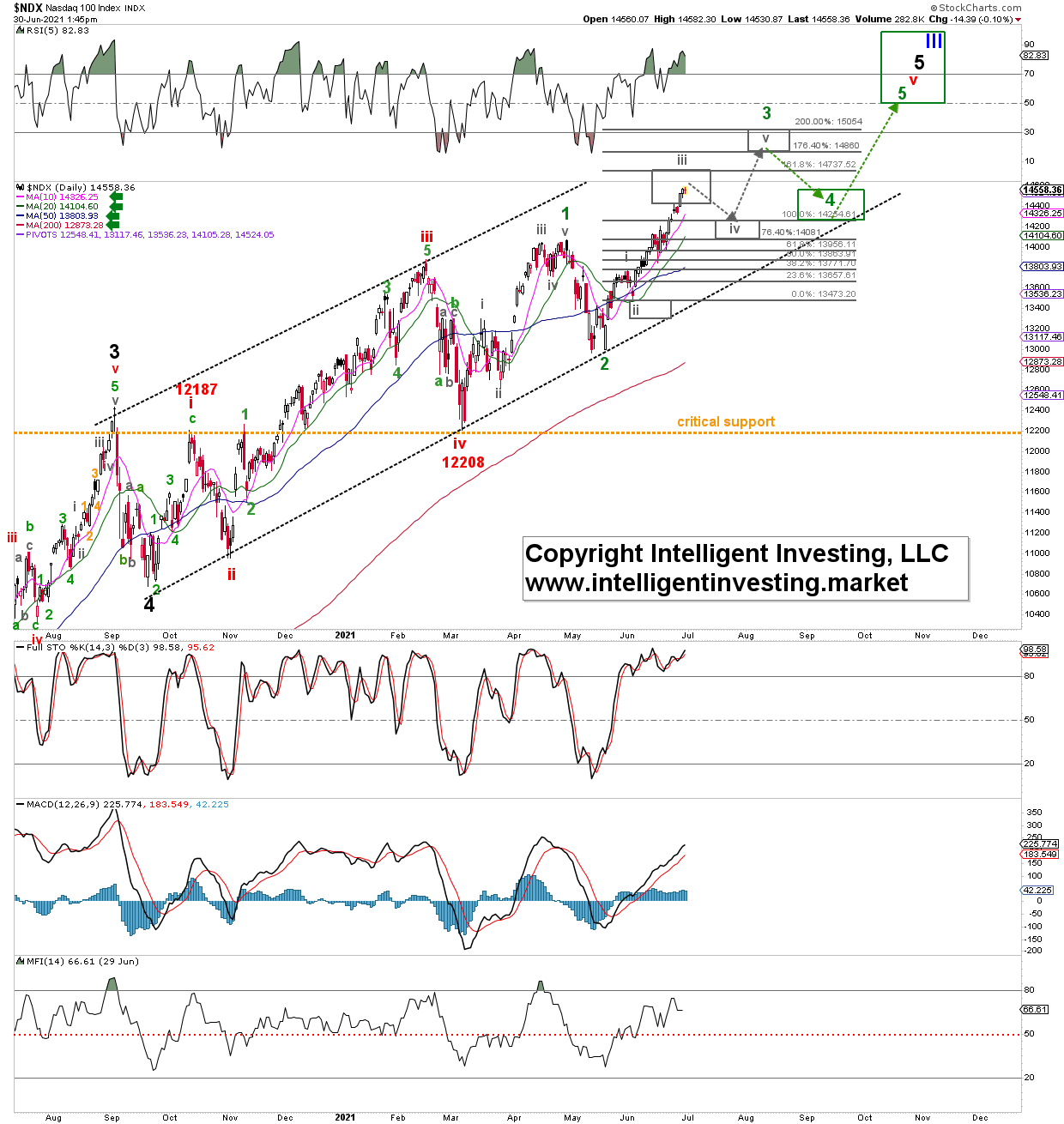

Figure 1 NDX100 daily candlestick chart with EWP count and technical indicators.

The index has now reached well inside the ideal wave-iii target zone and should start a correction, wave-iv, soon targeting ideally NDX 14081-14255 before rallying again. See the outlined Fibonacci-based anticipated EWP path in Figure 1.

Namely, based on historical evidence, we know 3rd waves typically reach the 1.382 to 1.618x Fibonacci-extension of the 1st wave, measured from the 2nd waves low. This is all “textbook,” but the market can essentially do anything, i.e., extend, truncate, correct more in time (sideways) than in price, etc. Thus, we only have an anticipated road map, which needs to be tracked daily to see if the index makes a detour, short-cut or takes the scenic route. When the market departs, nobody knows which exact course it will take, but we have a reasonable expectation, i.e., a blueprint. Thus, all we can do is “anticipate, monitor and adjust if necessary.”

My recent anticipation, see here, was proven wrong, and I am adjusting as necessary. It is as simple as that. Based on the EWP rules, we know that if the index can hold above NDX 13770, it can move higher to 15,000-16,000. A severe warning for the outlined bullish path is already on a break below NDX 14080. A move below Monday’s low (NDX 14400) will tell us the anticipated smaller wave-iv is under way. It should hold NDX 14080. As usual, please remember in bull markets, downside disappoints and upside surprises. To prove the point, the index even surprised me as I was looking for lower prices first.