Over the past many months, I have kept you updated on the NASDAQ 100's smaller Elliott Wave Principle (EWP) waves using daily charts.

For example, 12 days ago, I wrote:

“If the bulls are not careful, the April 28 top could already have been the green wave-5… . Namely, if the index trades below the … 13,297 high made March 16 going forward without creating a new all-time high first, then the current decline cannot be a 4th wave any more … because in an impulse wave, 4th and 1st waves cannot overlap according to the EWP rules. Only in a diagonal is such overlap allowed. See here. [But] these are unreliable structures. Instead, I would, therefore, like to focus on … the index has completed a larger 3rd wave top and is now completing a larger 4th wave, back down to ideally around the mid-12,000s. Then one final wave-5 should commence before the index is finally ready to wrap up the rally that started March 2020 and March 2009.”

Since the regular NASDAQ had already overlapped with its March 16 high when writing my May 5 article, the NDX followed suit on May 11. Therefore, my focus on the mid-12,000s was appropriate, as the NDX is now trading at the high-12,000s to low-13,000s. Combined with last update’s “Then one final wave-5 should commence before the index is finally ready to wrap up the rally that started March 2020 and March 2009,” I have a nice lead in to my big picture review of the NDX as the index is, inn my opinion, carving out a significant top over the coming weeks to months. See Figure 1 below.

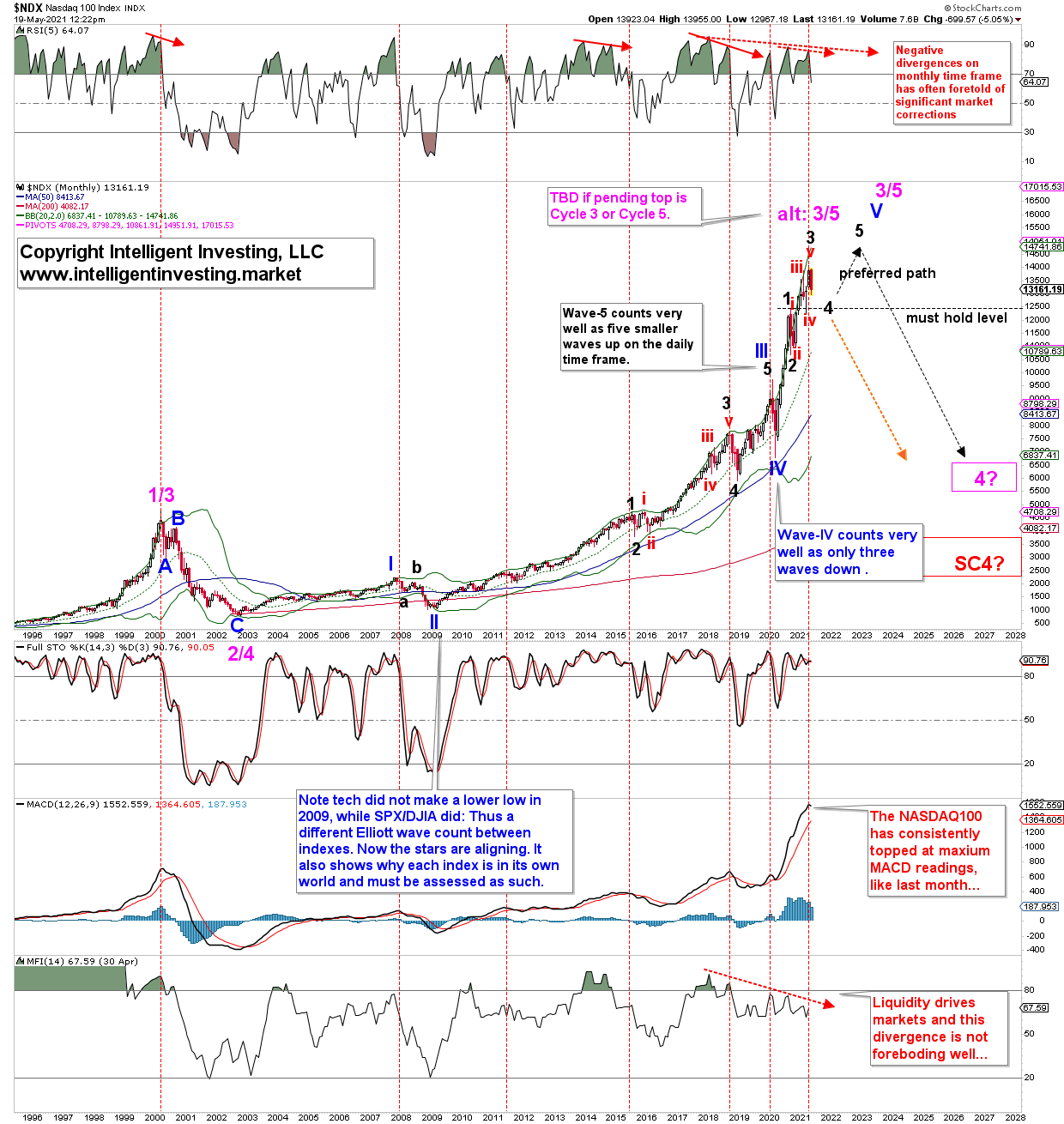

Figure 1 NDX 100 monthly candlestick chart with EWP count and technical indicators.

Figure 1 contains a lot of information, so please take your time to digest it. There are several warning signs from a technical indicators’ perspective. From the top to the bottom of the chart:

- The monthly RSI5 is negatively divergence: higher prices on less strength (dotted red arrows). In the past, this always leads to deep corrections or even a bear market (solid red arrows).

- The index topped on maximum MACD readings both for significant corrections and the 2000-2002 bear market. The MACD topped recently (dotted red vertical lines).

- The Money Flow Index (MFI14) monitors liquidity and (despite the Fed’s massive firehose of late) it last peaked in late-2017. Liquidity drives markets, and when it dries up, it means buying pressure is subsiding. And when buying dries up, only selling is left.

Although divergence is only divergence until it is not, the many instances where it mattered in the past must give any trader and investor pause and assess the current upside potential versus downside risk from the short to the long term.

From an EWP perspective, it is yet unclear if the 2000 high was Cycle wave-1 or Cycle-3. If the former, then the pending top is Cycle-3, and the subsequent correction “only” a Cycle-4 wave should bring the index back to the most around the 2018-2020 lows (purple box). It cannot overlap with the 2000 high. If it does, then the 2000 high was a Cycle-3 wave, the 2002 low a Cycle-4 low, and the top, now or a bit later, Cycle-5 of Super Cycle-III. The ensuing bear market will then be of the same degree as the 1929-1932 bear market and, ideally, bring the price back to the price levels last since in the early-2000s (red box).

Either way, the index must hold the March 2021 lows as we advance to allow for the preferred path to unfold (black dotted arrows). If it cannot maintain those levels, then the NDX will enter a multi-year bear market (orange arrow), either the Cycle-4 or Super Cycle-IV wave. In a bull market, a 3rd wave is always followed by a 4th wave, which is then followed by a 5th wave. Thus, the index is now simply running out of waves, and the technical indicators are starting to confirm this.

Note, the chart is on the monthly timeframe, and all divergences I pointed out are, therefore, of even more significance than those on a daily chart.