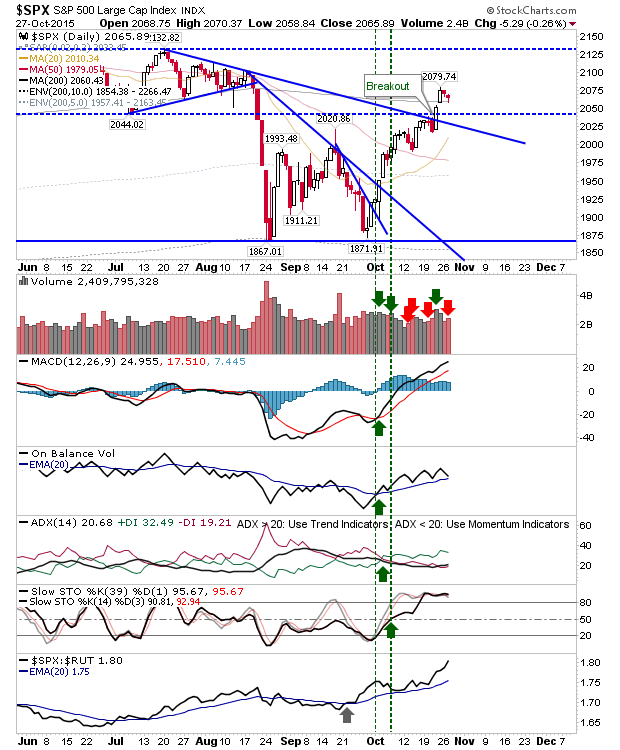

The last couple of days have seen tight action which has helped consolidate gains. The biggest change has come with some of the relative moves in the indices. The S&P has added to its relative out-performance, particularly against Small Caps. It's perhaps the only point of weakness given the importance of Small Cap leadership in sustaining bull trends.

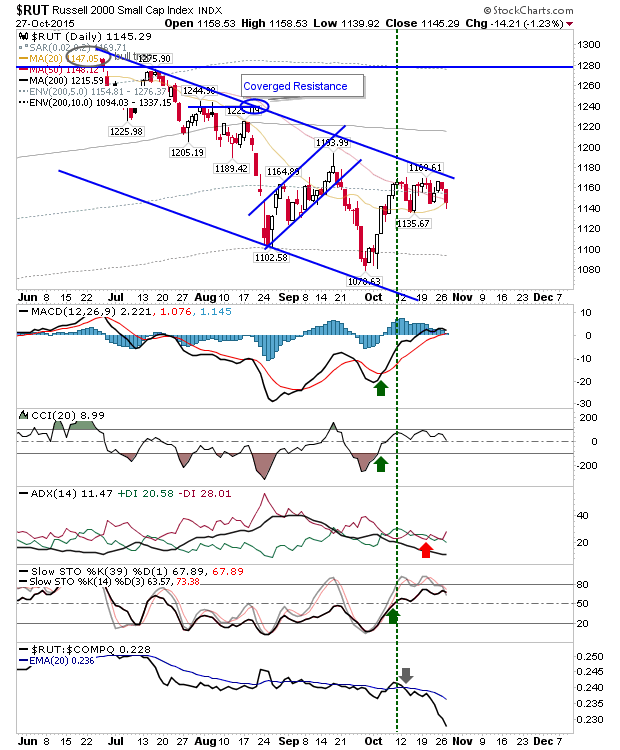

Small Caps gave up more ground yesterday, losing over 1% in a day which saw little change elsewhere. Losses took the index below both 20-day and 50-day MAs—and this for an index which has struggled since summer highs. Bears have the most to gain here as its struggle against Large Cap and Tech indices intensifies.

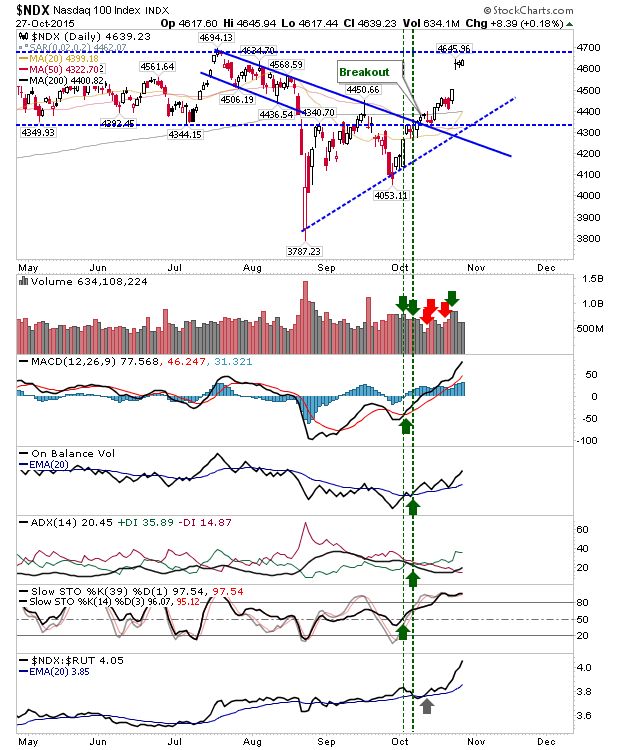

The NASDAQ has traded in a very narrow range, holding gains. But it's the NASDAQ 100 which had the best of it yesterday. The index is knocking on the door of new highs as its relative performance jumped sharply against lead indices. Santa could come early for this index.

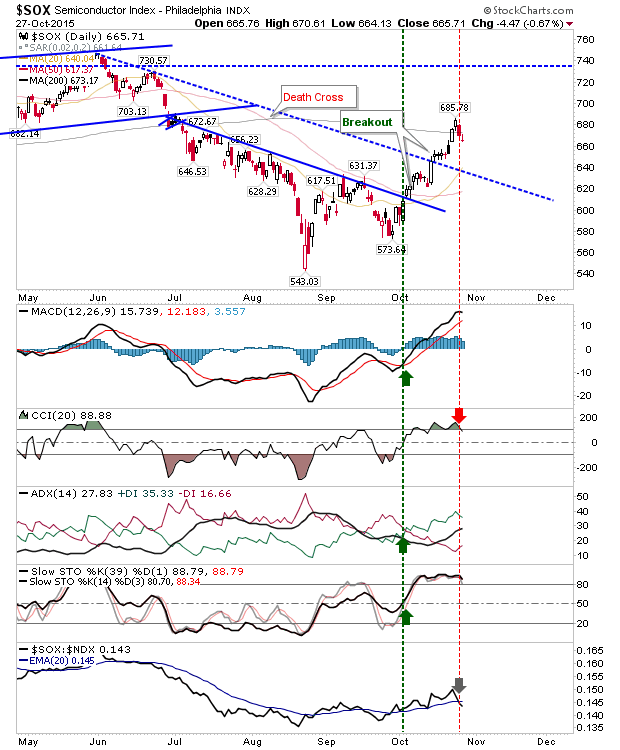

The Semiconductor Index has done well to come back to its 200-day MA, but the last couple of days have seen some profit taking. The NASDAQ 100 would benefit from continued strength in this lead economic index, but there has been a relative shift in performance between these indices.

Today comes down to a fight between bulls looking to push new highs in the NASDAQ 100, and bears looking to turn the screw in the NASDAQ 100. It's hard to see the rally in Tech Indices and Large Caps continuing without Small Caps' participation, so buyers better turn up soon in the latter index.