Investing.com’s stocks of the week

A quick look of the markets since my last post points to the rude health of more speculative issues while more conservative 'blue chip' stocks glide sideways.

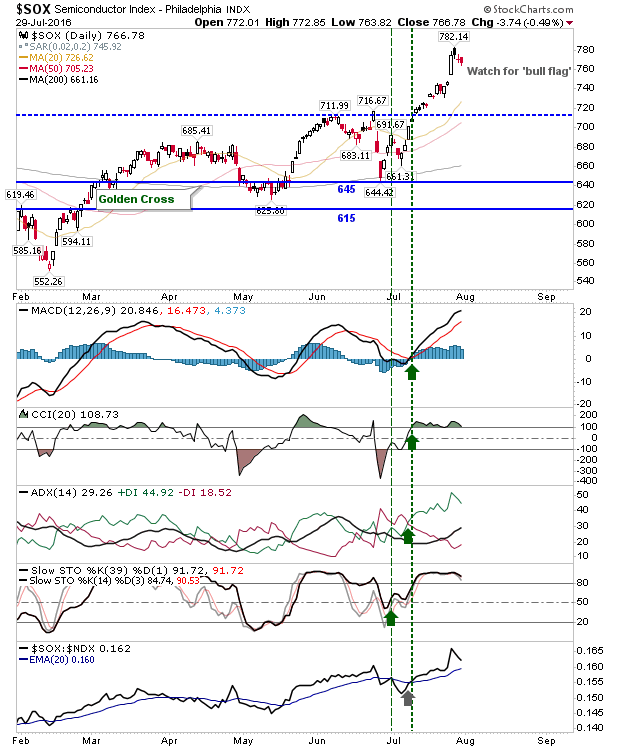

Semiconductors have had an excellent summer. This is a key economic bellwether and points to improved business conditions, helped by cheap copper prices. The burst higher over the early part of last week is consolidating its gains near the large white bar highs. This should also offer a boost to NASDAQ and NASDAQ 100 stocks.

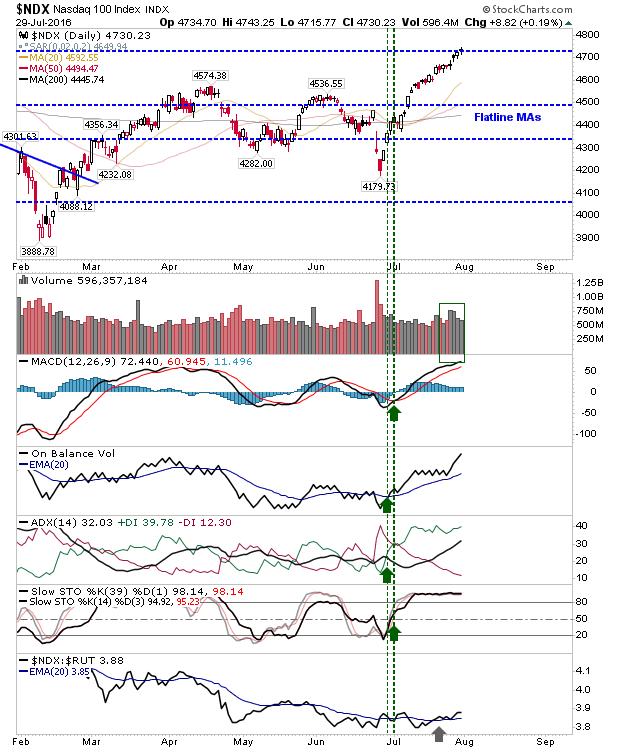

The NASDAQ 100 has emerged from a period of sideways action (note sideways moving averages), which has coincided with a healthy uptick in relative performance against the Russell 2000. Since the Brexit vote, this index has made modest steps higher without offering any pullback opportunity. How long this can continue remains to be seen, but it does find itself at resistance from Winter 2015.

The next pullback might give the kicker for a big push higher; look to 20-day and 50-day MAs for this opportunity.

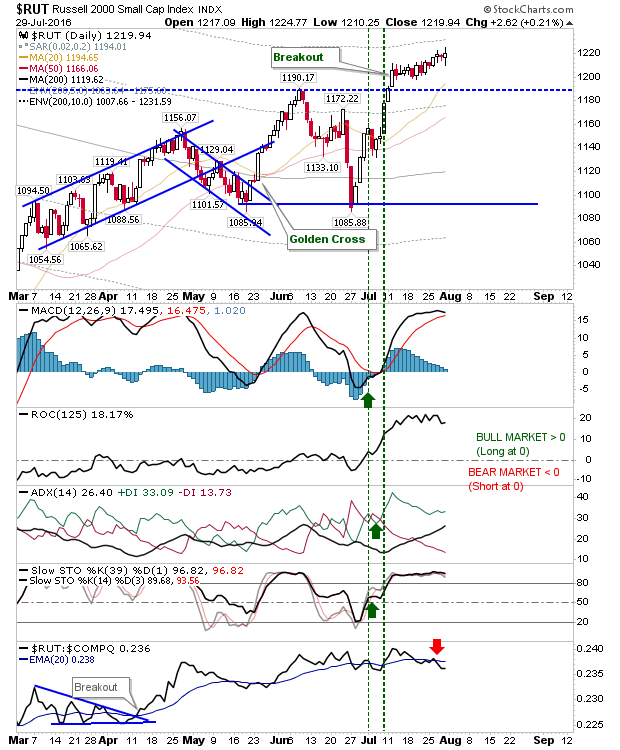

The Russell 2000 has just started to lose the advantage it had enjoyed over the Spring period. There has been a relative shift towards NASDAQ and NASDAQ 100 stocks which may encourage further selling here. The index had suffered over 2015 so it's going to be a little harder for it to make the ground it lost to Large Cap and Tech indices. A pullback to 1,160s and/or 50-day MA may offer value buyers a fresh opportunity to jump in.

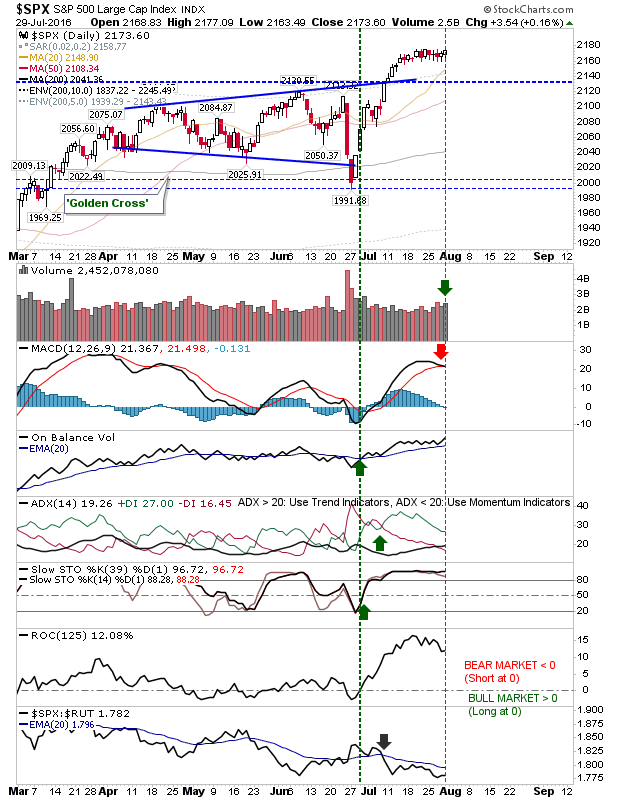

I have left the S&P until last. It has done little over the last couple of weeks other than lose relative ground against the NASDAQ/NASDAQ 100 and even the underperforming Russell 2000.

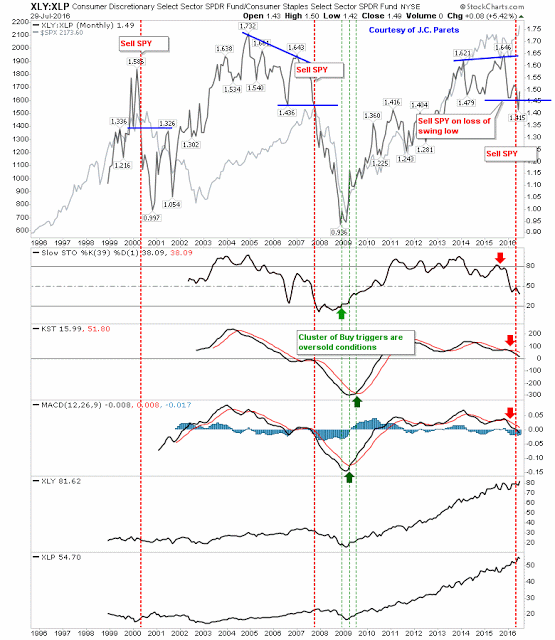

As a word of caution, the relative performance of consumer discretionary to staples (Consumer Discretionary Select Sector SPDR (NYSE:XLY):Consumer Staples Select Sector SPDR (NYSE:XLP)) still offers worries for longs. If you are a buy-and-hold investor there isn't a clear buying opportunity here. Technicals are all on 'sell' signals.

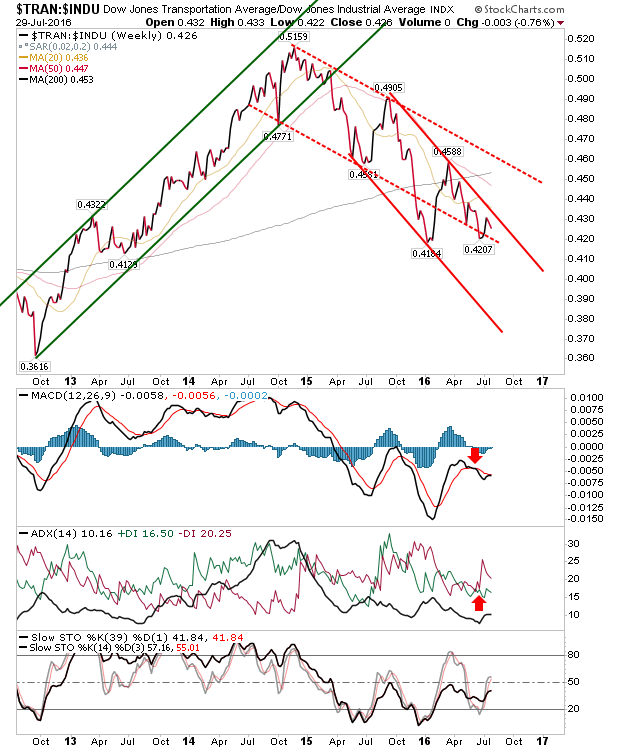

And Transports are firmly in negative territory despite relatively low oil prices. An 'old-school' economic bellwether.

So, if a short term trade there isn't a reason (as of yet) to sell long positions, but if a long-term buy-and-hold here hasn't been washed out - other than what we saw in January/February of this year - there's still reason to be active in the market.