Investors were optimistic when November trading opened. October had just produced the best monthly returns in a year.

Interest rates were still low, even if the Federal Reserve was starting to warn that it was time to get ready for "normalized" rates—a polite way of saying interest rates would rise next year. Employment was growing with jobless claims falling and wages moving higher.

Excitement accelerated as the major averages kept closing at new highs. The NASDAQ 100 Index was up as much as 4.6% for the month on Nov. 19.

But mid-month, inflation worries—centered around rising gasoline prices, higher food prices, skyrocketing housing costs—began to weigh on stocks. Then, suddenly, this past Friday, after news of a new, possibly vaccine-resistant COVID-19 variant, Omicron, emerged, the bottom appeared to fall out of the market.

Ongoing Omicron Worries; Faster Tightening On Tap

Equities slumped again on Tuesday to finish out the month.

That occurred in part after the Financial Times, on Monday, was told by Moderna (NASDAQ:MRNA) CEO Stéphane Bancel that existing immunizations may not be as effective against the Omicron variant as they have been against other strains. Investors rapidly retreated back to risk-off positions after fears had briefly subsided during Monday trading.

Perhaps a bigger market catalyst however, was Fed Chairman Jerome Powell, who pointedly told the Senate Banking Committee on Tuesday that the Fed wanted to rein in inflation and would start the clock ticking toward a first-rate hike earlier than expected.

As a result, yesterday saw another nasty bout of selling. When markets closed to finish out November, the selling had wiped out monthly gains for the Dow Jones Industrial Average and the S&P 500 and substantially trimmed returns for the NASDAQ Composite and NASDAQ 100.

Nonetheless, barring a December disaster, stocks are poised for a strong 2021 performance. The S&P 500 is up 21.6% year-to-date. The Dow has gained 12.7%, and the NASDAQ is higher by 20.6%. The NASDAQ 100 is up 25.2%.

The selling pressure since Friday reflected the following unknowns:

1. How dangerous the variant might actually be and whether existing vaccines would continue to be strong enough protection. Investor jitters were visible via cruise-line stocks, airlines and other travel related names.

Even entertainment giant Disney (NYSE:DIS) got hit. Shares of the company finished Tuesday down 2% to $144.90 after hitting a 52-week low of $143.11.

2. When exactly and how is the Fed going to make its move to beat down inflation?

The short answer to the central bank question: Powell told a Senate hearing Tuesday—shocking markets in the process—that maybe the economy is too hot. So, the Fed will first stop buying bonds to help support the economy, the Fed chair said. The process, known as tapering, is scheduled to end this coming spring.

Once the Fed stops buying bonds, the Central Bank will then start to raise rates. How soon afterward and how high rates may go is not clear. Wall Street doesn't see huge rate increases because that could derail everything.

For the record, the benchmark 10-year Treasury note closed at 1.477% on Tuesday, well off its Mar. 30 peak of 1.766%.

Powell's very deliberate comments should not have surprised. He had said after the Fed's early November meeting that the central bank was going to get out of pumping billions of dollars a month into the economy.

Post-Powell's testimony on Tuesday it was hard to find a rising stock. Apple (NASDAQ:AAPL) was the top Dow stock on the day. Merck (NYSE:MRK) had a small gain. But energy and financial stocks were the day's weak performers and sectors.

Energy shares fell because crude sagged. The story for the month was no better, with West Texas Intermediate falling 21% to $66.18 per 42-gallon barrel during the month, surprising traders who had speculated oil could hit $90 a barrel or more. (Still, retail gasoline held steady at $3.39 a gallon, according to AAA's Daily Fuel Gauge Report.)

Many other commodities were lower too, including cotton, down 7.3%. But coffee jumped 13.9% to $2.324 a pound.

Even Bitcoin was hit by the November sell-off, peaking at $68,925 on Nov.10 and falling 17.1% over the rest of the month to $57,144.

Don't cry too much for crypto players however, Bitcoin is up 97.3% on the year.

Semiconductors, technology and homebuilding were the sector leaders. Laggards included energy, aerospace, commodity stocks and biotechs.

Splits And Spinoffs Ramp Up; IPOs Escalate

Another unexpected development during November: four mega cap companies either announced they were going to break up their businesses or completed the effort: IBM (NYSE:IBM) completed its Kyndryl (NYSE:KD) spin-off, while Toshiba (OTC:TOSYY), Johnson & Johnson (NYSE:JNJ) and General Electric (NYSE:GE) announced they were heading toward business splits. The idea is that breaking up the companies will unlock heretofore hidden value.

None of the four got much reward for their decisions. Newly split IBM/KD stocks fell 6.4% and 48%, respectively. General Electric shares fell 9.4%. JNJ shares were off 4.3%; their breakup won't come until 2023. Toshiba's U.S. shares were off 7.9%.

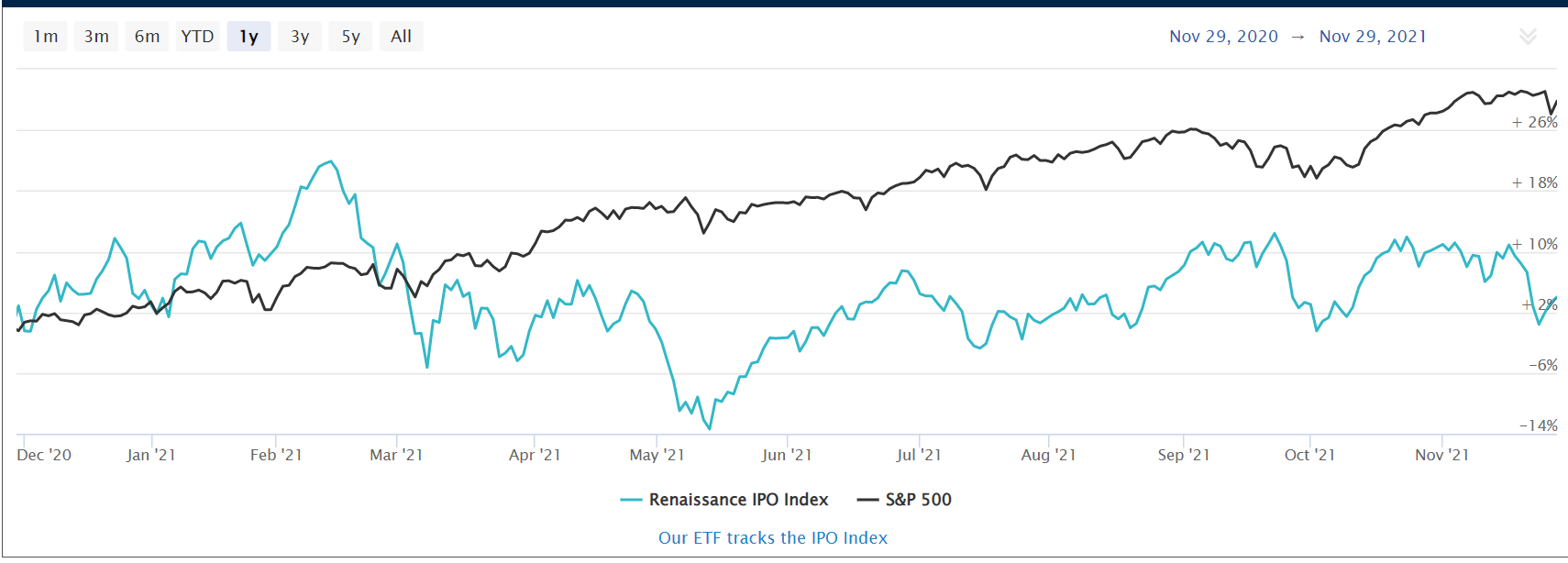

The initial-public-offering market was highly active. Renaissance Capital says 388 companies have gone public via traditional IPOs. Another 558 have gone public by merging with special purpose acquisition companies (SPAC). Both are at record levels. That said, many IPOs have struggled once they debuted on public markets.

The Renaissance Capital IPO Index was off 5.6% in November, after a 6.6% gain in October.

Chart courtesy Renaissance Capital

For the year, the index is down 7.67%. Renaissance also sponsors an exchange-traded fund, Renaissance IPO ETF (NYSE:IPO), that buys shares in companies that have gone public. The ETF was off 8.1% in November after a 6.6% October gain. For the year, the ETF is down 2.3%.

There was one big exception: electric truck maker Rivian Automotive (NASDAQ:RIVN) went public on Nov. 9 at $78 and ended the month at $119.76 up 55%.

Its market cap of $105.8 billion is bigger than General Motors (NYSE:GM) and Ford (NYSE:F) even though it has minimal production and faces heavy investments needed to build production facilities. Still, the shares were up 53% in the month.

Rival Lucid Group (NASDAQ:LCID), which aims to sell luxury electric cars, was up 42% in November after a 43% gain in October. The company had gone public in July via a SPAC merger. Since then, the shares have doubled.

Here's what else an investor might want to know about market activity during November:

Large-cap stocks were the market's biggest drivers. Chipmaker NVIDIA (NASDAQ:NVDA), a key supplier to the burgeoning infrastructure surrounding cryptocurrencies, added 27.8% on top of a 23.4% gain in October. Apple was up about 10.35% after a 6% gain in October. Microsoft (NASDAQ:MSFT) added 5.9%. Costco Wholesale (NASDAQ:COST) rose 9.7%.

Who's on top? Apple once again. The iPhone/iPad colossus reclaimed the title of most valuable U.S. stock from Microsoft, which had become number 1 on Oct. 29. Apple's market cap hit $2.629 trillion. Microsoft was at $2.527 trillion. Amazon (NASDAQ:AMZN), Google-parent Alphabet (NASDAQ:GOOGL), and Tesla (NASDAQ:TSLA) also sport market caps of more than $1 trillion. Facebook-parent Meta Platforms (NASDAQ:FB) topped $1 trillion on June 28 but dropped back below $1 trillion the next day.

Smaller-cap stocks were pressured at month's end. The S&P 600 small-cap index and the S&P Midcap 400 fell back 2.4% and 3.1%, respectively, for the month. But the declines came after the small cap index vaulted to a 6% gain at the beginning of the month. The mid cap index was up as much as 4% in November before falling back.

Signs of market stress? Barchart.com's daily calculation of net-new-52-week highs and lows has been negative for nine straight sessions. Tuesday's market activity produced 29 new highs and 673 new lows.

Investors paid attention when indexes became too pricey. The major benchmarks—Dow, S&P 500, NASDAQ and NASDAQ 100—pulled back whenever their relative-strength indices moved above 70, which occurred on multiple days in early to mid-November. RSI measures price momentum.

Top five S&P 500 stocks for November

- Qualcomm (NASDAQ:QCOM) +35.72%

- Advanced Micro Devices (NASDAQ:AMD) +31.72%

- NVIDIA +27.81%

- Xilinx (NASDAQ:XLNX) +26.92%

- Dollar Tree (NASDAQ:DLTR) +24.19%