Investing.com’s stocks of the week

Markets started Friday strong - challenging resistance - but were unable to press this advantage. Many indices closed lower, leaving 'black candlesticks' which are typically bearish when formed at 'swing highs' but still favor weakness even in the absence of the swing high setup.

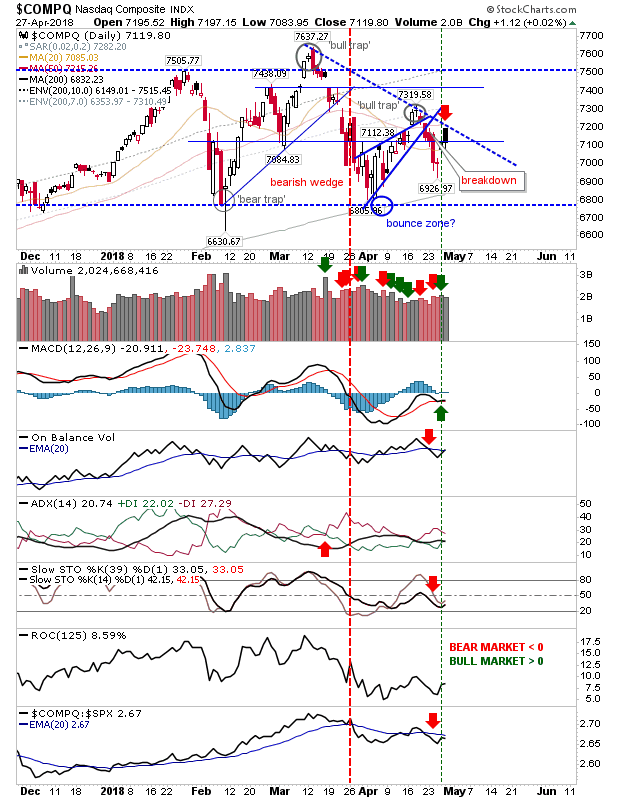

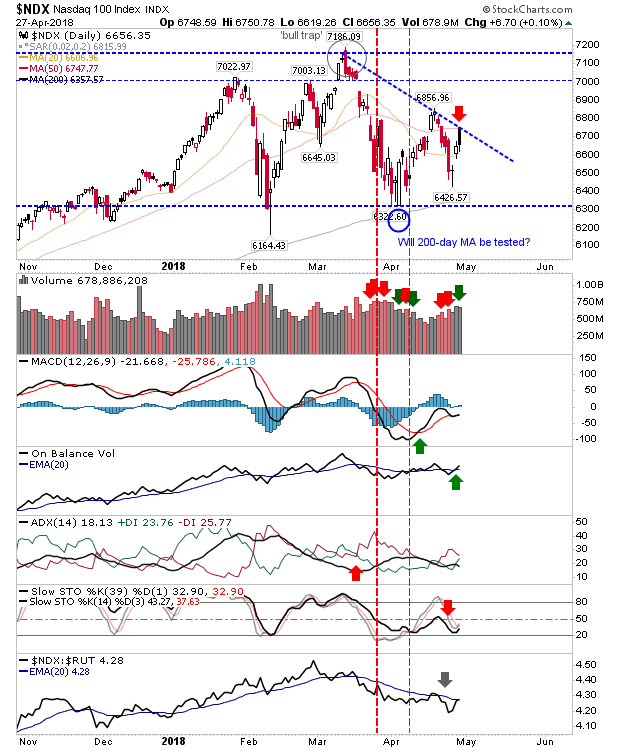

The 'black candlestick' for the NASDAQ at resistance suggests a move towards the 200-day MA but for this to happen there needs to be an immediate downside; any recovery has a strong chance of negating the 'black candlestick'.

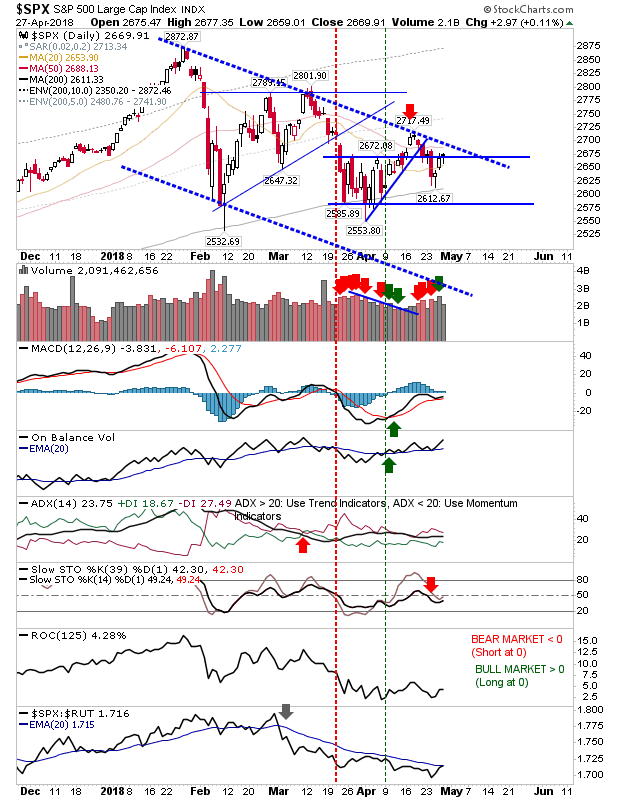

The S&P did not finish so weak. There was no 'black candlestick' but instead a low key doji may offer itself as upside

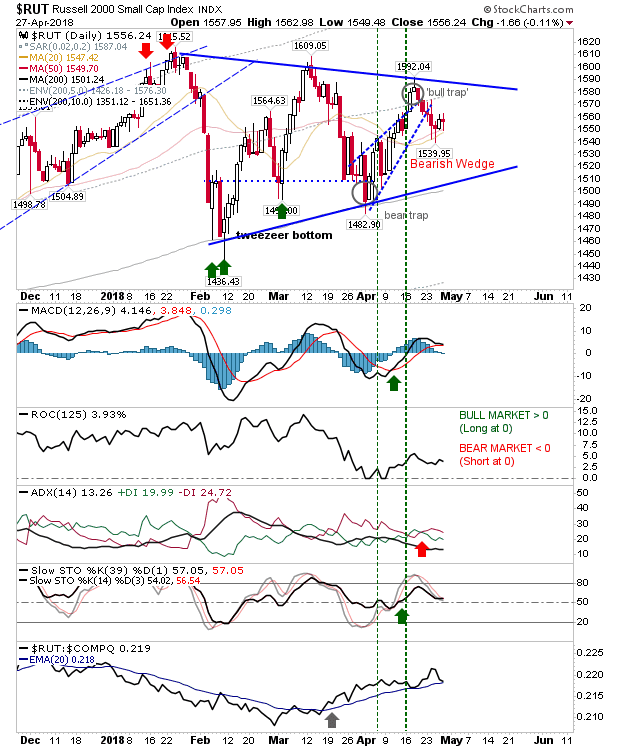

The Russell 2000 is hugging its respective 20-day and 50-day MAs without rocking the boat either way. It may be edging in favor of bulls because its holding these moving averages—a strong start on Monday would open up for a challenge of triangle resistance and potentially negate the bearish wedge 'bull trap'.

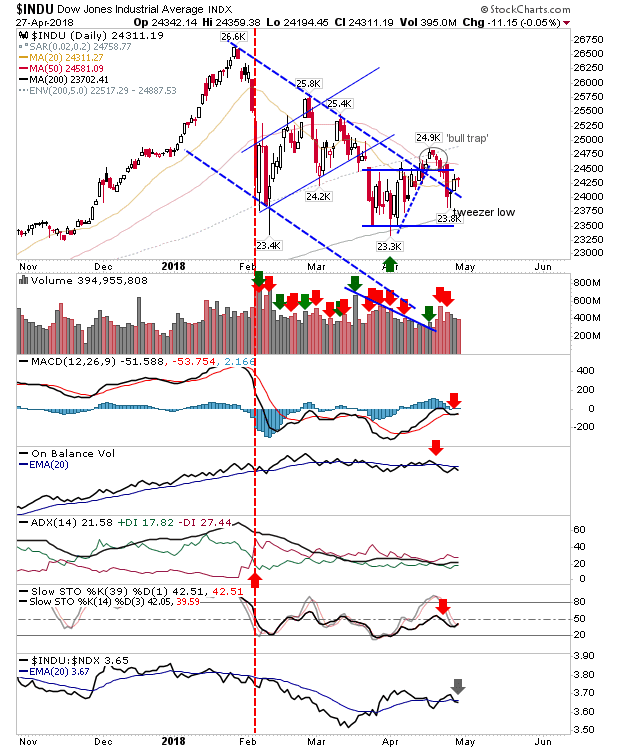

The Dow Jones Industrial Average is holding to its mini-tweezer low which set up the return above the downward channel; it's a decent long setup with the 200-day MA also available for support / risk measured off the tweezer bottom.

The NASDAQ 100 is on the bearish side of the fence. The 'black candlestick' tagged declining resistance with the 50-day MA as additional resistance.

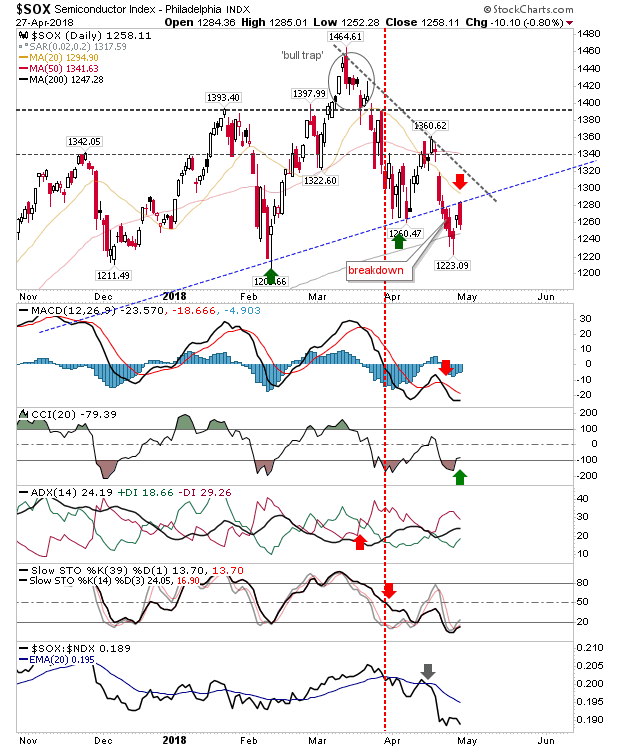

The weakest index is the Semiconductor Index. The index is not close to declining resistance (which other indices have tested or are close to testing), it's struggling in its bounce off its 200-day MA, plus it reversed off long-term support - now resistance. A loss of 1,220 could see a rapid acceleration in its losses, on top of what it has already lost off its highs.

For today, shorts can focus on the NASDAQ, NASDAQ 100 and Semiconductor Index. Longs can look to the Dow Jones, S&P and potentially the Russell 2000; although the latter index can go either way.