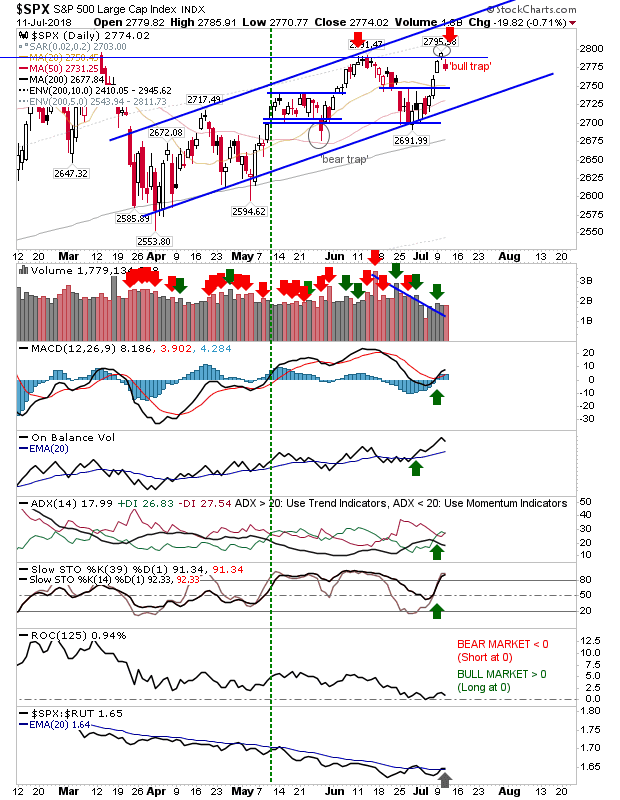

It was by no means a disaster yesterday, but there was an ominous feel to Wednesday's close. Bulls had used the momentum built by last week's gains to make a run at all-time highs but profit takers and shorts used this as an opportunity to get out/build a position. It's a typical stage 1 reaction to a resistance test but now it's a question if there is enough sideline interest from bulls to drive a break to new all-time highs and force shorts to cover.

The S&P left a small 'bull trap' on low volume. Technicals are net bullish, so if bulls can come back and reverse the 'bull trap' it would nicely set up a run to test newly drawn channel resistance. But for now, shorts look favored.

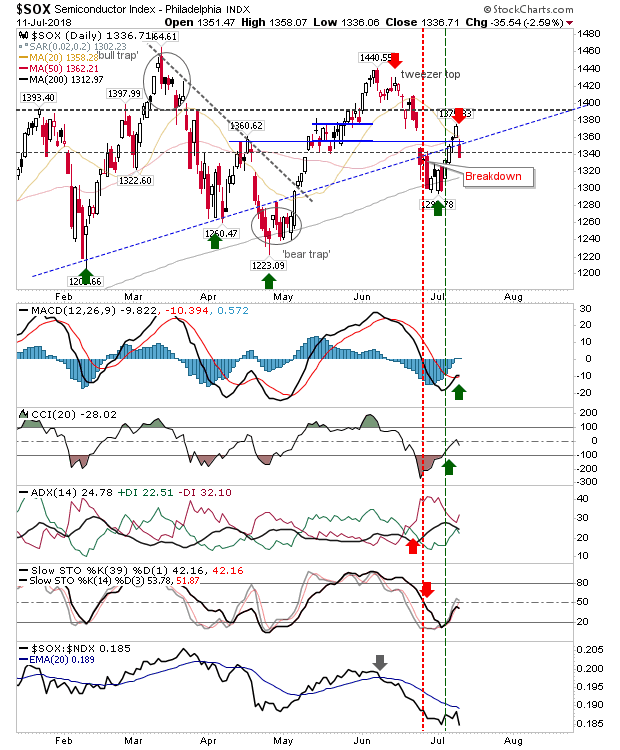

The Semiconductor Index had thrown an unexpected surge Tuesday but bears were having none of it and the index dropped below key support. Technicals are mixed and the 200-day MA is again the support level, but to survive three tests in four months looks unlikely.

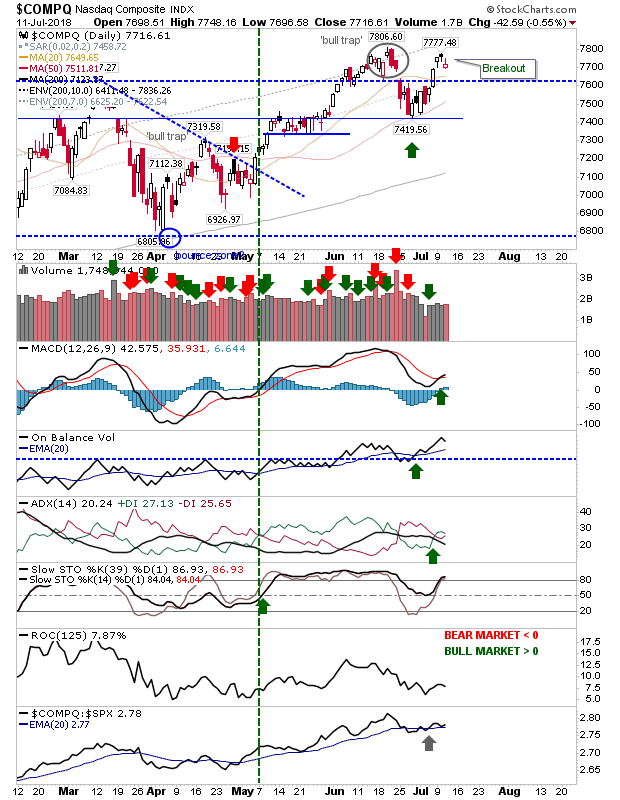

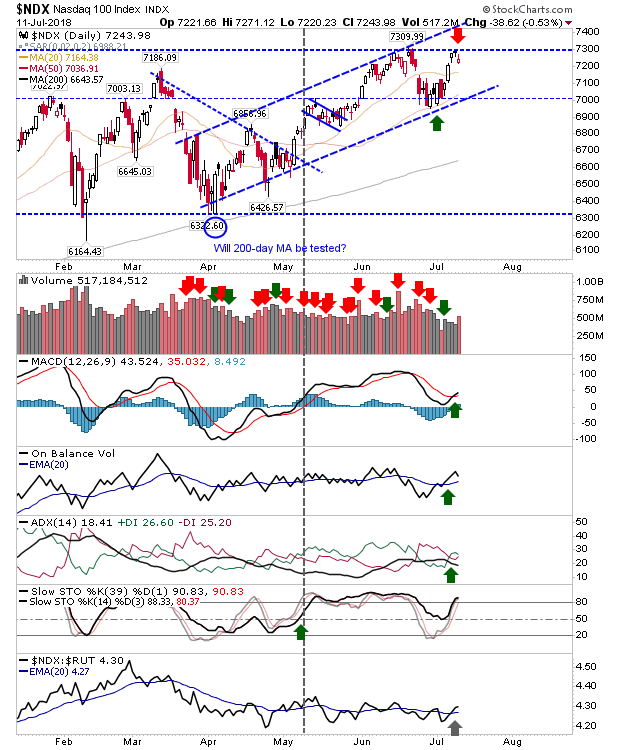

Tech indices are still holding their breakouts but weakness in the Semiconductor Index won't help. The NASDAQ and NASDAQ 100 are both net bullish and have plenty of support even if the Semiconductor Index does not.

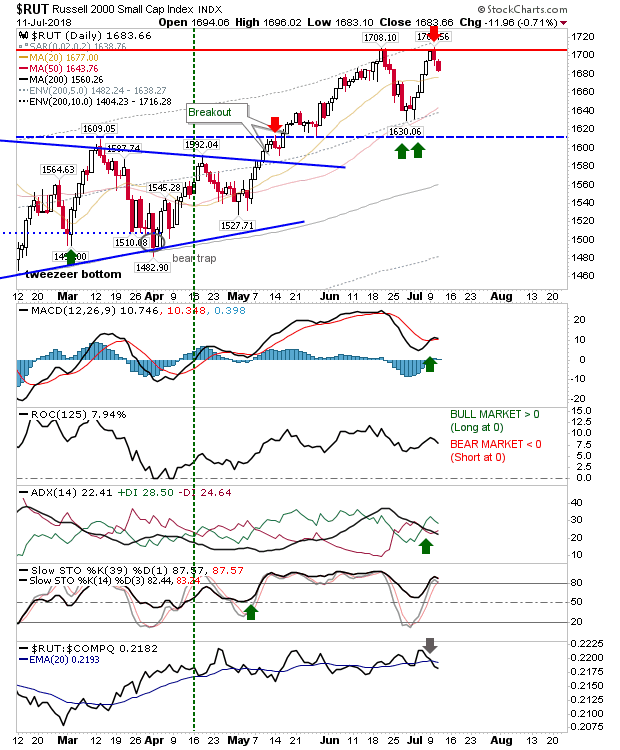

Finally, the Russell 2000 took the second day of losses after a picture-perfect reversal at resistance. Don't be surprised if this morphs into a trading range using 1,610 support.

For today, it's about bulls sticking close to resistance and mounting a return challenge to make new all-time highs. If there is a fresh day of losses it will be about looking at support of 50, 200-day MAs and/or horizontal support marked by Spring swing highs for non-Large Cap indices.