US Stocks Close Higher As Financials Rally

US stock indices ended higher on Thursday as Syria tensions eased after President Trump tweeted that a missile strike was not imminent. Dow rose 1.2% to 24483.05. The S&P 500 added 0.8% to 2663.99 led by financial stocks up 1.8%. The NASDAQ Composite gained 1% to 7140.25. The dollar strengthened: the live dollar index data show the ICE US Dollar index, a measure of the dollar’s strength against a basket of six rival currencies, rose 0.3% to 89.745. Stock indices futures indicate mixed openings today.

Geopolitical tensions eased after President Trump tweeted a US military strike in Syria “Could be very soon or not so soon at all!” The focus is now on earnings season which started yesterday by better than expected results from BlackRock, world’s largest asset management firm. Today JPMorgan (NYSE:JPM) and Citigroup (NYSE:C) are scheduled to release their quarterly reports. Economic data were positive: initial jobless claims fell in the first week of April and returned near the lowest levels since the early 1970s.

DAX leads European indices recovery

European stocks ended higher on Thursday as fears of escalation in Syria conflict eased after President Trump’s tweet. The euro turned lower against the dollar while the British Pound extended gains. The Stoxx Europe 600 index added 0.7%. Germany’s DAX 30 outperformed rallying 1% to 12415.01. France’s CAC 40 rose 0.6% and UK’s FTSE 100edged up less than 0.1% to 7258.34. Indices opened 0.1% - 0.4% higher today.

Euro weakened after minutes of the European Central Bank’s meeting indicated the central bank plans to move only gradually in phasing out its 30 billion-euro ($37 billion) a month bond-buying program and starting to raise interest rates. Economic data were weak: industrial production in the euro-zone fell for a third straight month in February.

China posts surprise trade deficit

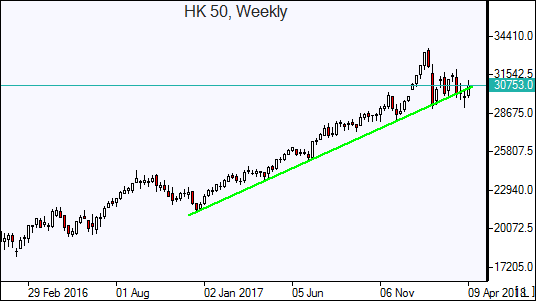

Asian stock indices are mostly higher today despite surprise China trade deficit for March. Nikkei rose 0.6% to 21778.74 helped by continued yen weakening against the dollar. Chinese stocks are mixed as China’s trade balance turned to a deficit of $4.98 billion in March from a $33.7 billion surplus the previous month: the Shanghai Composite Index is 0.7% lower while Hong Kong’s Hang Seng Index is up 0.1%. Australia’s All Ordinaries Index is up 0.2% despite continued rise in Australian dollar against the greenback.

Brent slides

Brent futures prices are edging lower today as geopolitical tensions subsided. They ended lower yesterday: Brent for June settlement lost less than 0.1% to close at $72.02 a barrel on Thursday.