The FX market was in consolidation yesterday as not much news happened. Greece is now the focus with its new Prime Minister Alexis Tsipras reaffirming his rejection of the international bailout program. A couple years ago, when the Euro crisis had just started, some economists suggested Greece be removed from the union. European political leaders certainly thought the costs would be too high and they may have been right at the time.

However, it now seems that the political and economic costs of quitting the currency union would be considerably higher for both the Greek administration and Euro area. Greece cannot and would not have avoided the crisis even if it had started using its former Drachma currency. The domestic situation could lose even more control without support from Germany and other international institutions. On the other side, the quitting of Greece may cause a chain effect on other high-debt-burden Southern European nations like Italy and Spain. The market turmoils could tear the union apart in very little time.

Even as political games continue, it is highly likely that Greek and European leaders will reach a new agreement. The alternative would be too costly for both.

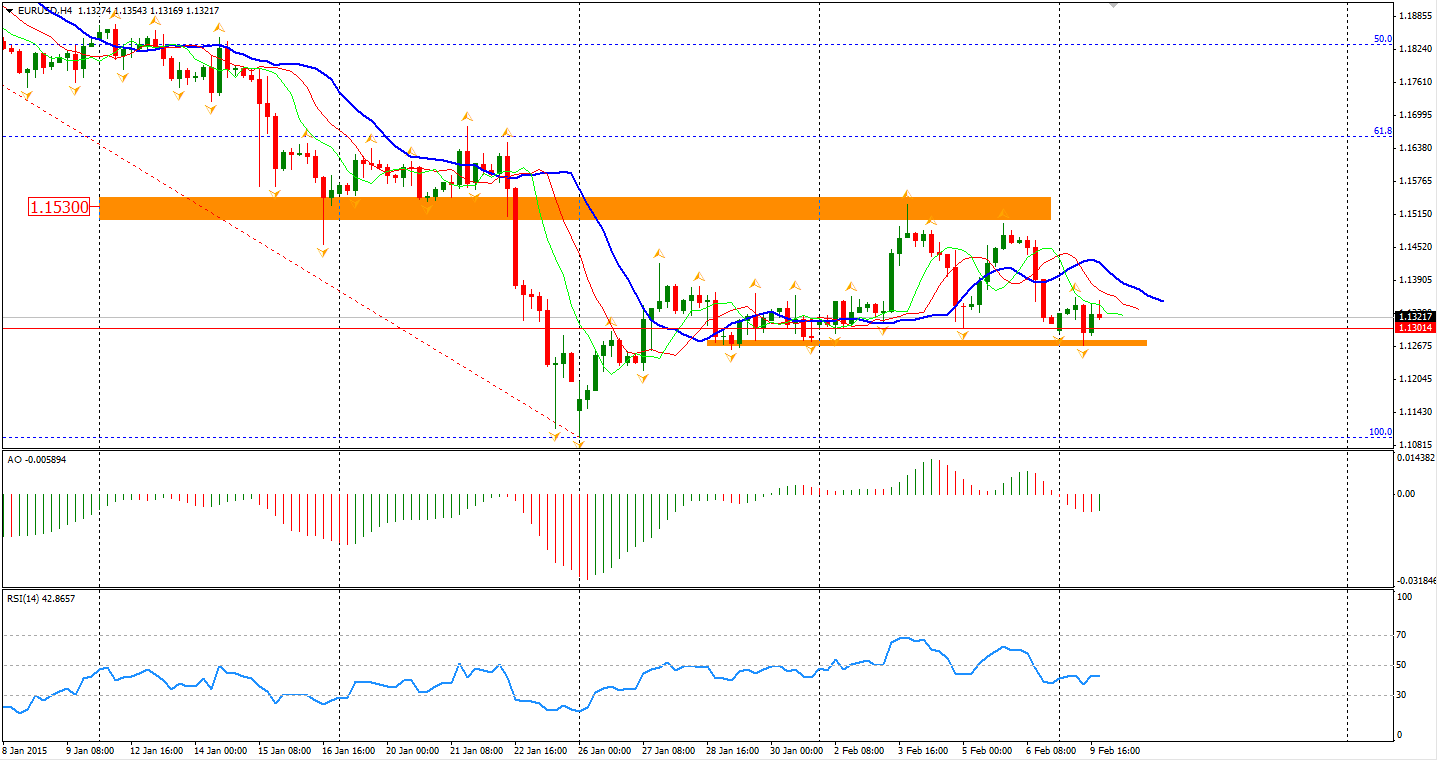

The Euro once fell to 1.1270 yesterday but rebounded later. A double-top pattern has been formed with a neck line at 1.13. 1.1270 is the strong support level below, a breakout of which may lead the pair to fall to 1.11.

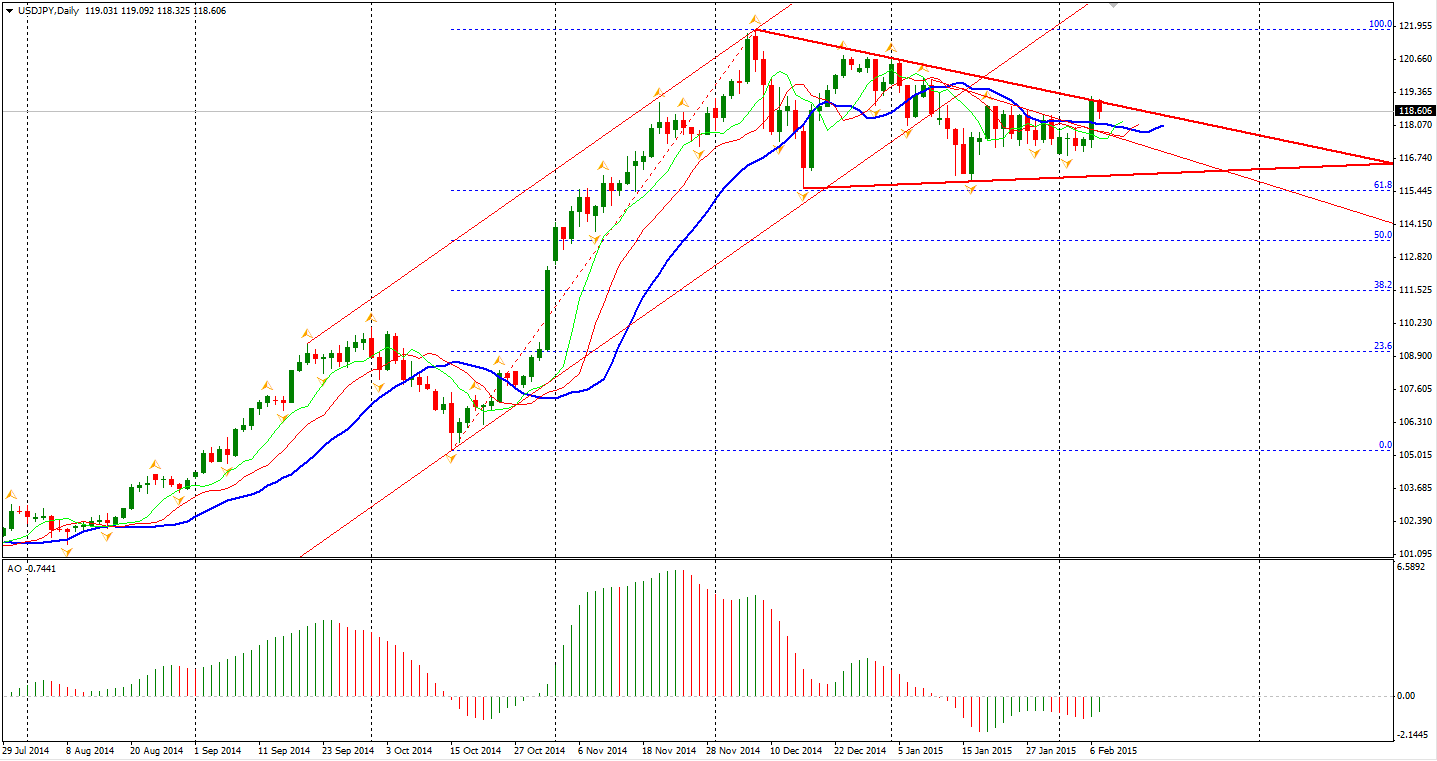

USD/JPY did not upwardly break the downward trendline of the triangle pattern since it reached 121.80 at December 8th last year with safe-haven demands pushing up the Yen. If we don’t see a strong breakout, the triangle consolidation may continue.

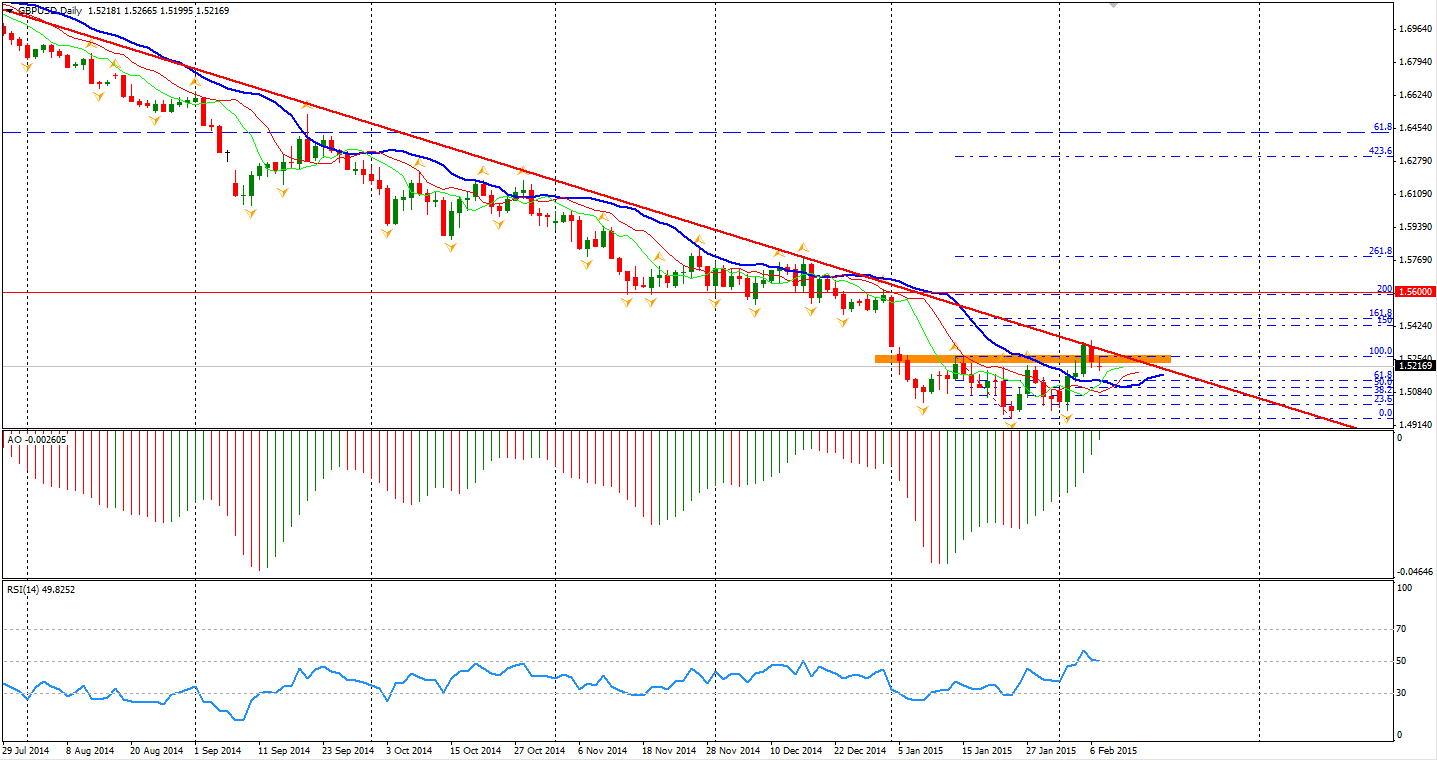

In the daily chart, we can still see the head-and-shoulders pattern of the GBP/USD. However, the pair is still suppressed by the long-term downtrend line. The Pound has the potential to outperform the USD, as the UK economic outlook is promising. Nevertheless, the BOE may delay the rate hike holding concerns on the Euro area’s impact.

Back to stock markets, the Shanghai Composite rebounded by 0.62% to 3095. The Nikkei Stock Average gained 0.36%. S&P/ASX All Australian 200 lost 0.1% to 5815. In European markets, the UK FTSE 100was down 0.24%, the German DAX slumped by 1.54% and the French CAC 40 Index slid down 0.85%. US stocks fell on the Greek situation. The S&P 500 closed 0.43% lower to 2047. The Dow lost 0.53% to 17729, and the Nasdaq Composite Index fell by 0.39% to 4726.

On the data front, Australian NAB Business Confidence will be out at 11:30 AEDST. China CPI will be an hour later. UK Manufacturing Production will be at 20:30 AEDST.

Have a great trading day!

Anthony