Market Brief

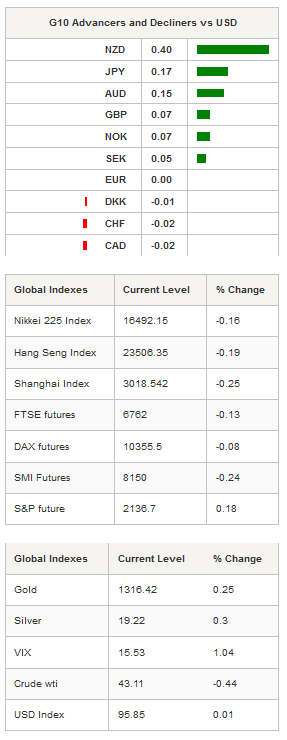

USD/JPY has been trading in a very tight since the beginning of the month as traders has been reluctant to load on more risk ahead of Wednesday’s Fed and BoJ meetings. Traders do not really know what to expect from the Governor Kuroda as the last increase in stimulus have failed to curb inflation expectations and to weaken the Japanese yen. However, looking at the 1-week 25 delta risk reversal measure (i.e. the difference of implied volatility between calls and puts) on USD/JPY, we notice that the market is wagering that the BoJ will disappoint again as the measure rose to 0.60% from -0.20% last week. After hitting 102.06 in Tokyo, USD/JPY eased to 101.75. The closest support lies at 101.21, while on the upside a resistance can be found at 104.32.

EUR/USD was also little changed as it traded range bound between 1.1169 and 1.1180. The risk is biased to the upside, especially now that the European Central Bank decided to leave its main interest rates unchanged and restrained from extending its quantitative easing programme beyond March 2017. The single currency is currently trading slightly above its 50dma (1.1166) and 200dma (1.1148). A break of those levels would definitely open the road toward 1.05, however a triggering event would be required.

Precious metals edged slightly higher in Asia with the yellow metal up 0.25% to $1,316.40 an ounce, while silver held ground above $19.20, up 0.30% on the session. Palladium was 0.25% to 687.25 and platinum rose 0.57% to 1,026.80. The overall risk-off environment will most likely prevent a sell-off in those assets. However, the situation may change as soon as tomorrow as several central banks (Fed, BoJ and RBNZ) will release their monetary policy decision.

In the equity market, the uncertainty stemming from tomorrow’s central banks meetings dampened investors’ mood and sent equity returns in the red. In Asia, the Nikkei was down 0.16% but the broader Topix index soared 0.42%. In mainland China, both the Shenzhen and Shanghai Composites were blinking red, down 0.25% and 0.24% respectively. Offshore, Hong Kong’s Hang Seng fell 0.14%, while the Taiex edged up 0.10%. In Europe, equity futures are trading in negative territory as the negative lead from Asia spreads, signalling a lower open.

Currency Tech

EUR/USD

R 2: 1.1616

R 1: 1.1428

CURRENT: 1.1205

S 1: 1.1046

S 2: 1.0913

GBP/USD

R 2: 1.5018

R 1: 1.3534

CURRENT: 1.3060

S 1: 1.2851

S 2: 1.2798

USD/JPY

R 2: 107.90

R 1: 104.32

CURRENT: 101.63

S 1: 99.02

S 2: 96.57

USD/CHF

R 2: 0.9956

R 1: 0.9885

CURRENT: 0.9776

S 1: 0.9522

S 2: 0.9444