Investing.com’s stocks of the week

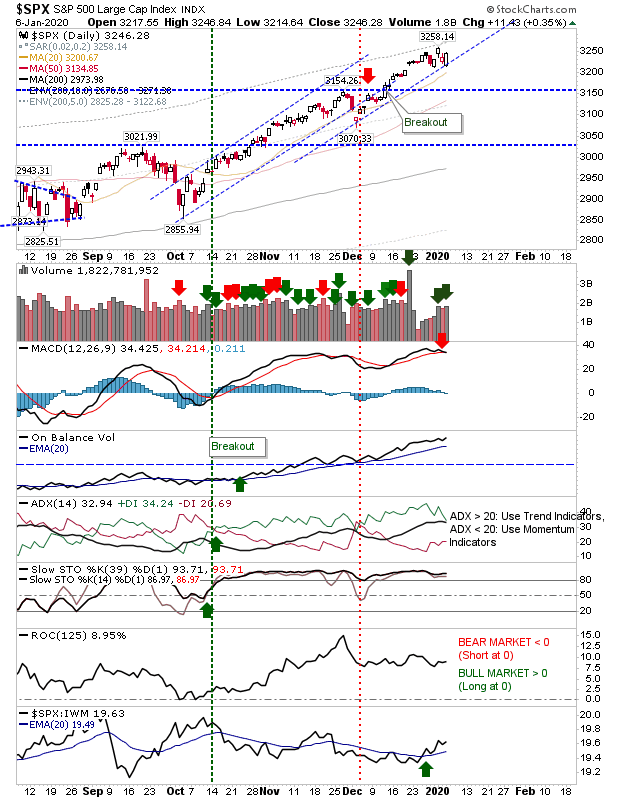

Markets yesterday were able to make up some of the lost ground from New Year's early losses. There was no great damage done up until yesterday, but Monday's action did register as accumulation.

For the S&P, the latest rally is from an adjusted rising trendline which yesterday was used as support. However, the rally wasn't enough to prevent a MACD trigger 'sell.'

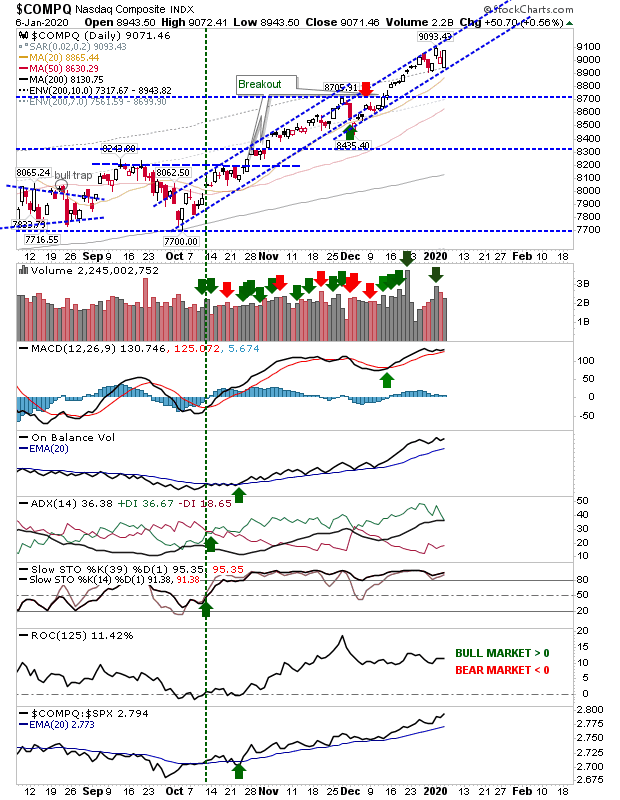

The NASDAQ also worked off the rising channel, but there wasn't the volume boost which came with the S&P.

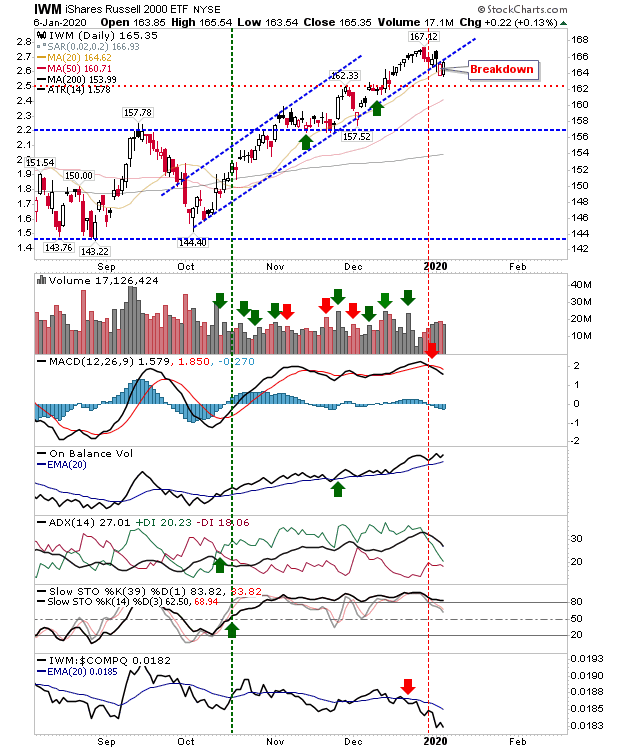

The Russell 2000 (iShares Russell 2000 ETF (NYSE:IWM)) rallied, but it wasn't quite enough to recover channel support. Because of this, the index continued to deteriorate sharply against the NASDAQ and the MACD remained negative—although other technicals are still positive. I'm still liking growth stocks for 2020, so we may be looking at a buying opportunity rather than anything truly bearish.

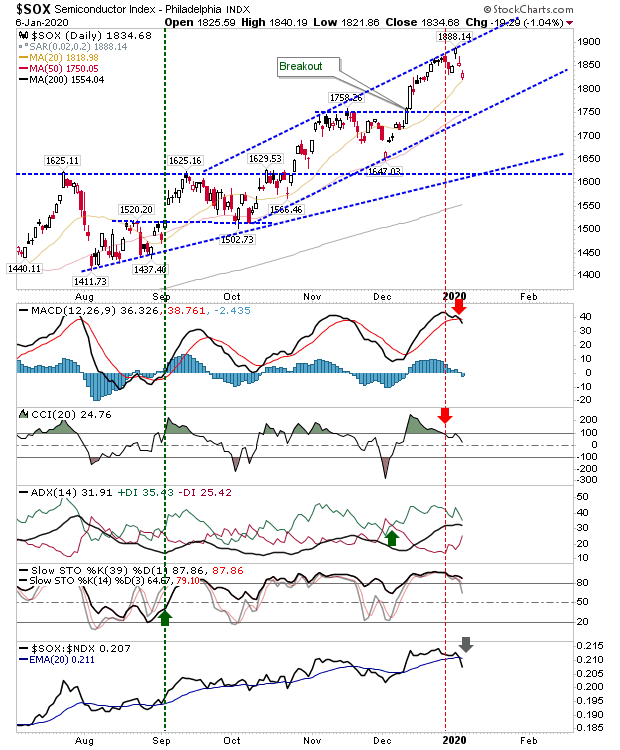

The Semiconductor Index bucked yesterday's trend by losing more ground. This resulted in a relative performance shift in the NASDAQ 100.

For today, look for indices to continue to rally off their security blanket rising trendlines and perhaps broaden out what are currently very narrow rising channels.