Who is Kevin Hassett? Wolfe looks at the Trump ally tipped to become Fed Chair.

Friday January 6: Five things the markets are talking about

U.S jobs growth remains strong, but is slowing, which is certainly not a surprise when the world’s largest economy approaches full employment.

Today, all eyes are on December’s nonfarm payroll (NFP) report, the “granddaddy” of U.S economic indicators. The market anticipates a headline print of +175k and an unemployment rate of +4.7%, while the average hourly earnings are expected to rebound with a +0.3% rise.

Unless we deviate too far from expectations, the markets reaction should be rather moot to the headline expectations. A weaker number could prompt the Fed to pull back on its rate-raise trajectory.

Note: Some markets are closed in Europe as they observe the day of the Epiphany.

With a headline number there or there about, investors will return to Trump Twitter watching and try to map out the potential fall out of U.S President-elect’s “protectionist” stance following his remarks yesterday on Toyota Motor's (NYSE:TM) plant construction in Mexico.

Will Chinese authorities retaliate to Trump’s trade war by increasing their scrutiny (antitrust and tax probes) of U.S companies with major China operations? Don’t expect them to step down, even Mexico is on full alert as they try and protect their own currency in overnight trading.

1. Stocks at the mercy of dollar moves

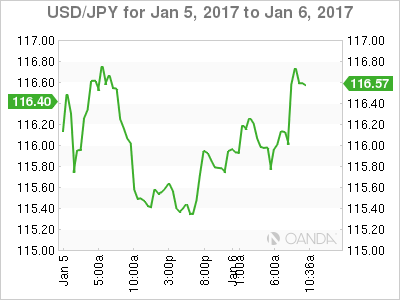

“Big” dollar moves are having an impact on equities overnight. In Japan, shares fell amid yen strengthening (¥115.95) as traders’ wait for this morning’s U.S. jobs data for clues on Fed actions.

The Nikkei Stock Average declined -0.4%. In Australia, the ASX 200 was flat despite stellar trade data overnight suggesting that their economy could bypass a recession. Singapore’s FTSE Straits index added +0.3%, while Hong Kong’s Hang Seng Index gained +0.4%.

In Europe, equity indices are mostly trading lower as market participants await payrolls. Financial stocks are weighing on most of the indices across Europe, particularly the Euro Stoxx. On the FTSE 100, commodity and mining stocks are trading notably lower.

U.S markets are set to open small down (-0.1%).

Indices: Stoxx50 -0.4% at 3,301, FTSE -0.1% at 7,192, DAX -0.3% at 11,556, CAC 40 -0.5% at 4,877, IBEX 35 -0.3% at 9,457, FTSE MIB -0.7% at 19,515, SMI -0.2% at 8,374, S&P 500 Futures -0.1%

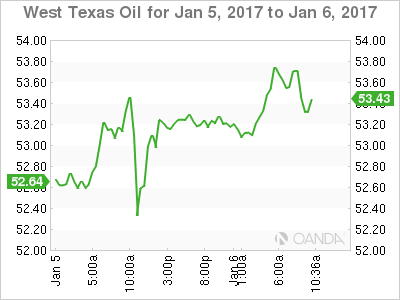

2. Oil prices dip on doubts of cut commitments

Oil prices have dipped overnight over lingering doubts that some OPEC and non-OPEC producers might not implement announced production cuts in an attempt to curb global oversupply. Expect this to remain the crude price theme for the next six-months as policing cuts is near an impossible task.

Brent crude futures are trading at +$56.76 per barrel, down -13c from yesterday’s close, while West Texas Intermediate (WTI) crude futures are at +$53.65 a barrel, -11c below Thursday’s settlement.

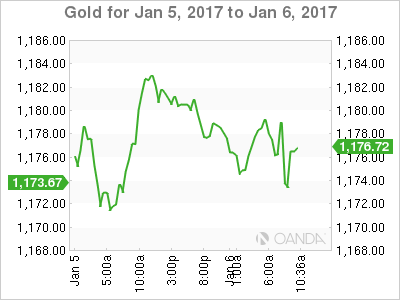

Gold prices overnight have slipped from their one-month high touched yesterday, with some traders taking profit ahead of NFP as they wait for clues on the pace of possible U.S interest rate hikes this year.

Spot gold has eased -0.2% to +$1,178.41 per ounce. The “yellow” metal on Thursday hit its highest since 5 December at +$1,184.90.

3. Sovereign yield curves flatten

U.S Treasuries are modestly stronger after yesterday’s ADP private payrolls report came in below expectations, casting some doubt on the strength of the U.S economy.

U.S 10s have fallen -9bps to +2.34%. Prior to yesterday’s move, yields had been under pressure from Wednesday’s December FOMC minutes that suggested U.S officials were unsure of the impact of President-elect Trump’s policies on the economy and concerned about soft overseas growth. A strong NFP print today should go some ways to reverse this course.

Elsewhere, Aussie bonds have climbed overnight. This has sent their benchmark 10-year yields down –5bps to +2.68%, a level last seen in November. New Zealand's debt product saw similar moves with 10s dropping -5bps to +3.19%.

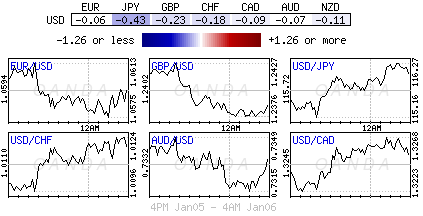

4. Forex moves limited ahead of U.S data

It no surprise to see the market keep forex moves limited ahead of this mornings jobs report. If anything, the USD is slightly firmer in relatively quiet trading with the greenback remaining within its recent ranges. The EUR/USD is holding around the psychological €1.06 handle, while USD/JPY is a tad higher from its overnight low just south of the ¥116 handle.

There have been a few exceptions to the “quiet” rule. Both CNH and MXN saw a volatile session.

China’s PBoC set the yuan mid-point at ¥6.8668 vs. ¥6.9307 prior (biggest margin of strength since 2005 revaluation of yuan), but the CNY later weakened as the market believed the yuan was still poised to break beyond the psychological ¥7.0000 handle despite efforts by Chinese authorities this week to slow the currency’s decline.

Note: The PBoC said to consider increasing CNY currency (yuan) rate expectation management in 2017 and would not tolerate sustained depreciation of yuan.

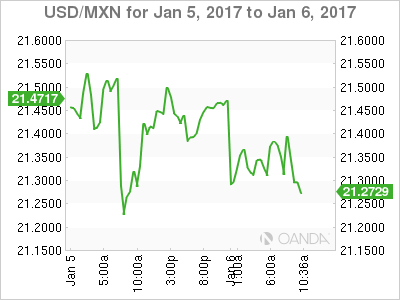

The Central Bank of Mexico was at it again, intervening on behalf of its own currency (MXN) during Asian hours. The peso has been battered this week on Trump protectionism rhetoric that pushed the MXN to new outright lows to the USD (MXN$21.62). It’s unusual for a North American central bank to be intervening during Asian hours, but their actions suggest two things, one they Mexican authorities mean business, and two, the lack of liquidity during the Asian session would suggest they seek they biggest bang for their “buck”.

5. Eurozone confidence stronger than expected, but sales disappoint

Data this morning revealed that Eurozone business and consumer sentiment was stronger than expected last month, with the Commission’s Economic Sentiment Indicator rising to 107.8 from 106.6 in November – the highest print in nearly six-years.

Added to other recent data points would suggest that eurozone economic growth had picked up in Q4 last year. This along with a rise in consumer inflation expectations should please the ECB.

Yet, Eurostat’s retail sales figures for Nov. was much weaker than expected, falling -0.4% on the month as against an expected rise of +0.6%, a reminder that the eurozone’s recovery is based on fragile foundations!