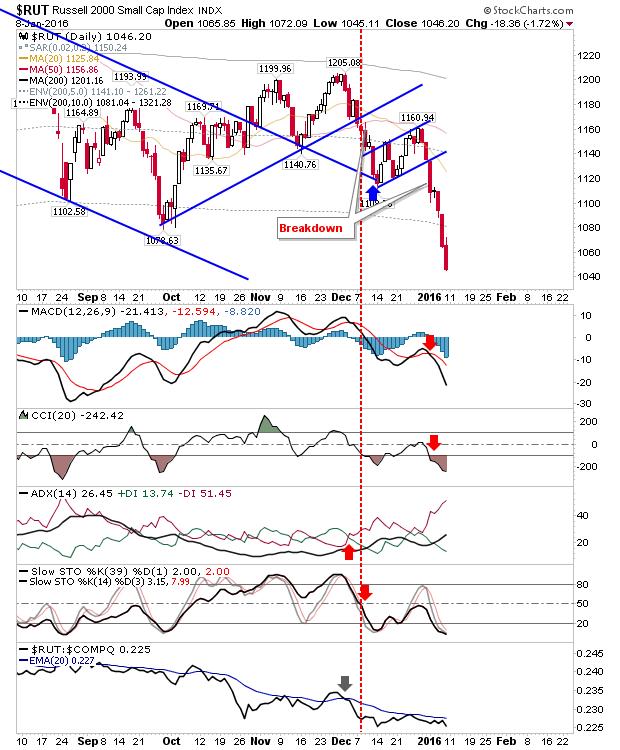

Friday was an ugly day for bulls. It pushed what was already an oversold market into deeper state of weakness. Short-term traders will be looking for a bounce as markets speed their way to August/September lows. One index has already surpassed these levels. The Russell 2000 is in the 90% zone of historic weak prices going back to 1987 and is well beyond September lows.

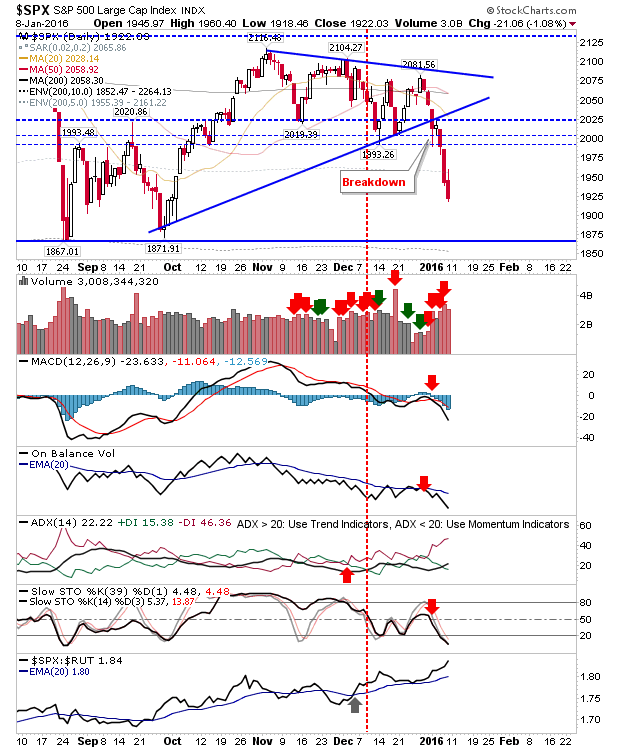

The S&P has only seen one day of gain for the last seven days of trading. Friday's selling leaves the index in a 'no-mans' land. What was particularly disappointing was to see such selling coming off the back of very strong NFP data. If there is a positive, it's that the selling was not on heavier volume distribution, which is unusual given the significance of the data released.

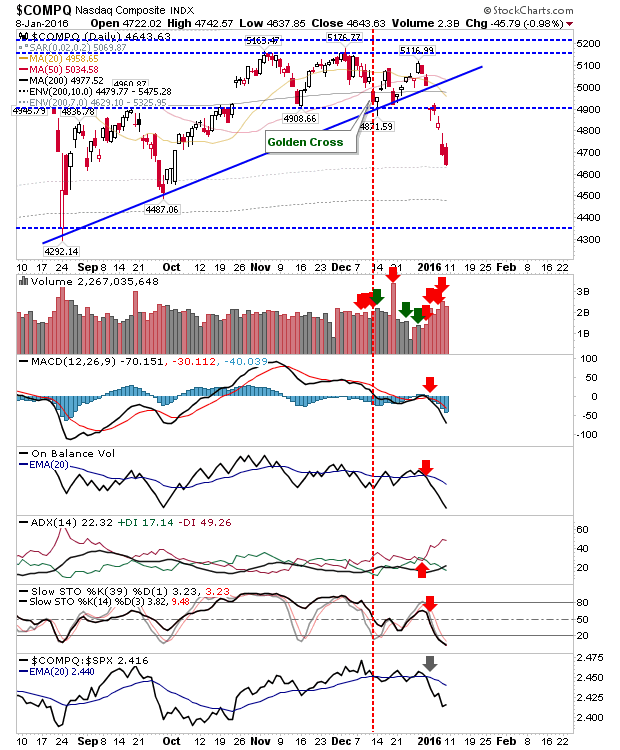

The NASDAQ is getting close to the 15% zone of oversold historic conditions dating back to 1971. As with the S&P, selling volume did not rank as distribution. Friday's action wasn't pretty, but there may be grounds for optimism.

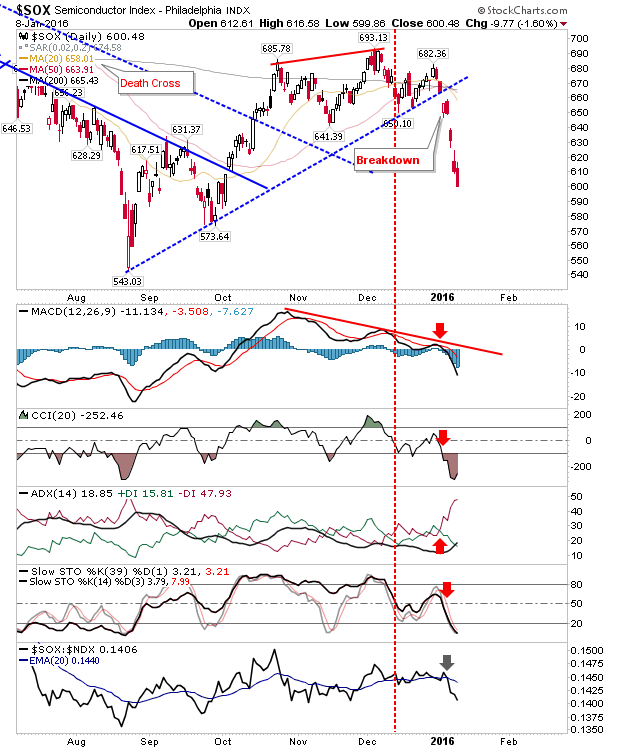

The Semiconductor Index continued its run lower with 7 consecutive down days. The chances for an 8th can't be ruled out, but a bounce of some form will occur sooner rather than later. How much such a bounce can help the NASDAQ and NASDAQ 100 remains to be seen.

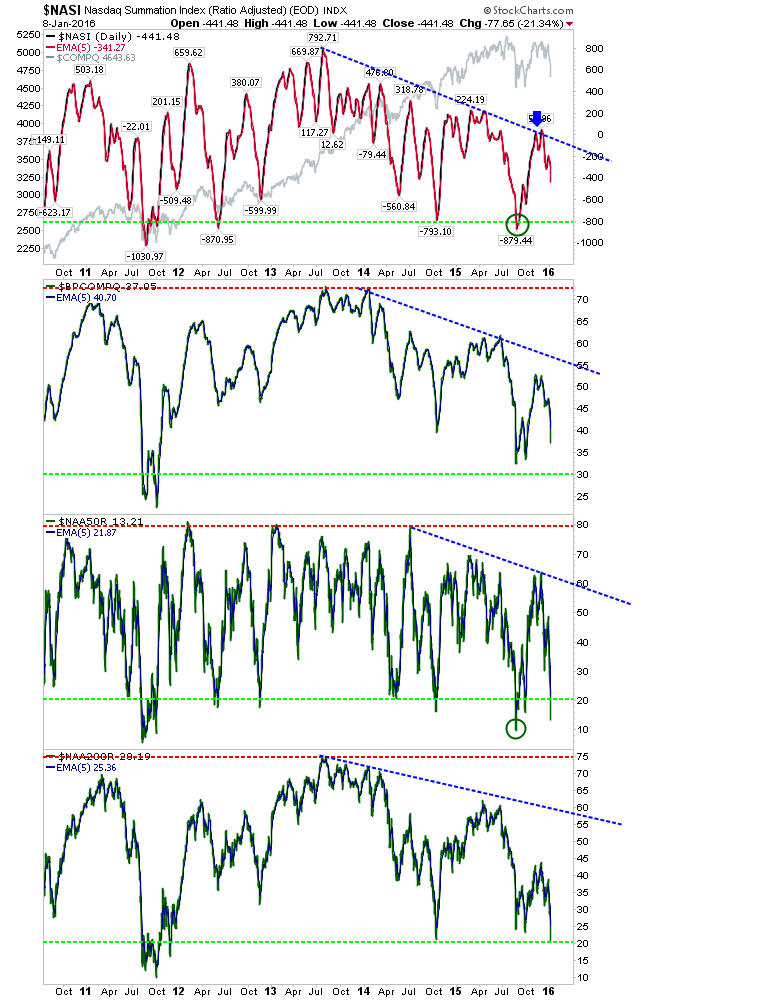

Just as a watch point for NASDAQ breadth, the Percentage of NASDAQ stocks above 50-day MA has dropped into oversold conditions. The Percentage of NASDAQ stocks above the 200-day MA has tagged the 2014 swing low. Any additional losses will push this breadth metric down to 2011 swing lows. However, other metrics haven't reached oversold levels: the NASDAQ Summation Index is well off oversold conditions, and Bullish Percents has yet to tag the 2015 low.

For Monday, watch the pre-market for leads. A weak Asian session might offer an aggressive long at the US open. What will be more telling is how far the next rally goes. I suspect there are plenty of 'weak-hand' longs who bought shares on the premise of the 'Santa Rally' and are now regretting it.