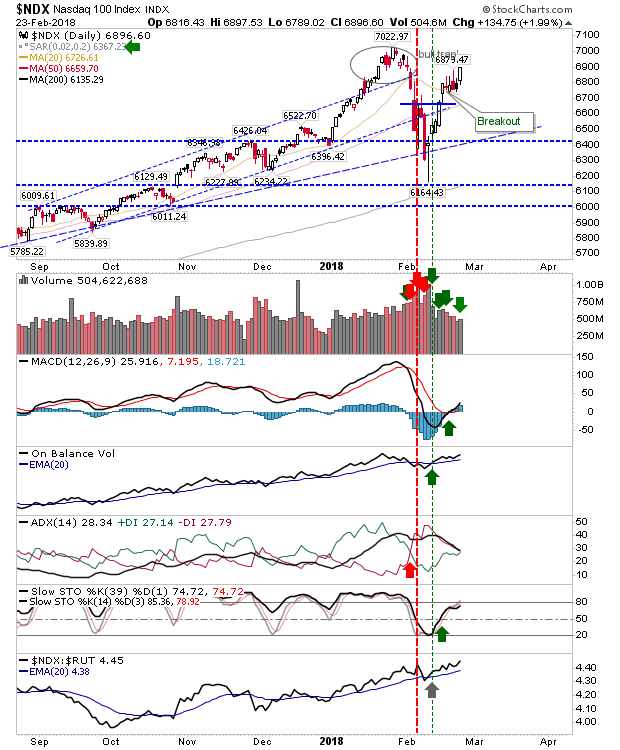

Markets delivered a strong end-of-week close which for many meant a close near spike highs. The strongest finish of the week was delivered by the NASDAQ 100 - it posted a new high as it builds a challenge on the January 'bull trap'. Volume climbed to register an accumulation day. If bulls are in control then the NASDAQ 100 should see some follow through higher; note the strong relative performance against the Russell 2000.

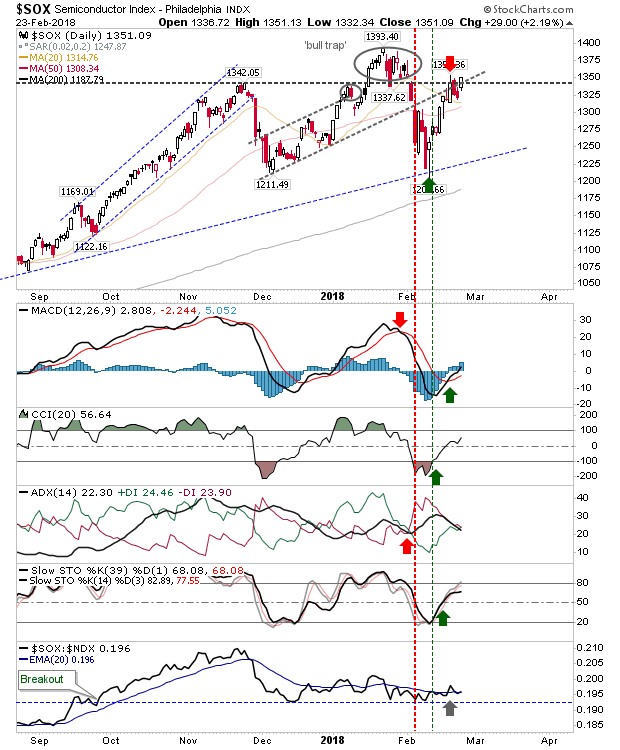

The Semiconductor Index had looked to offer a short at 1,340 but this is under threat from Friday's close. This may look, in hindsight, like a picture-perfect short but whipsaw is the real risk here.

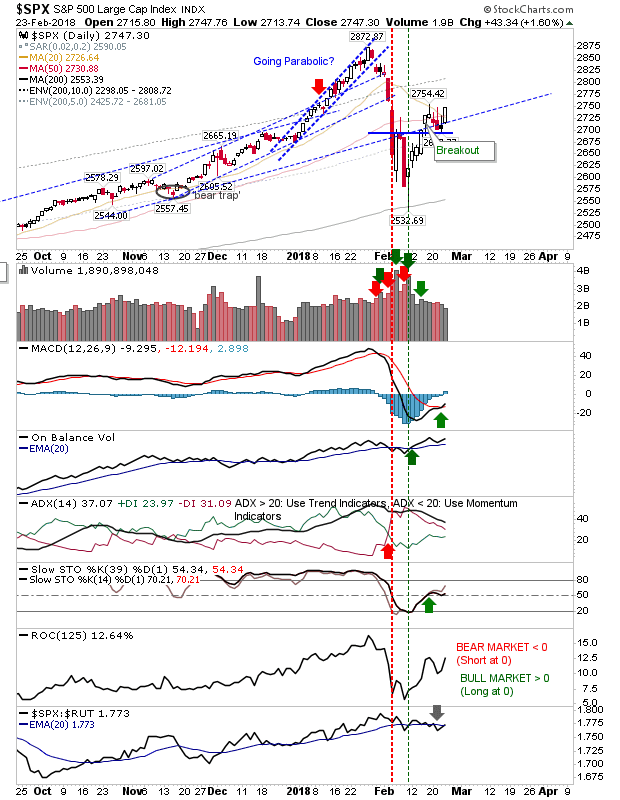

The S&P did well to prevent a 'bull trap' as the series of 'inverse hammers' and 'gravestone doji' were undone by Friday's gain. Technicals are a mix although more bullish than bearish—only relative performance looks weak.

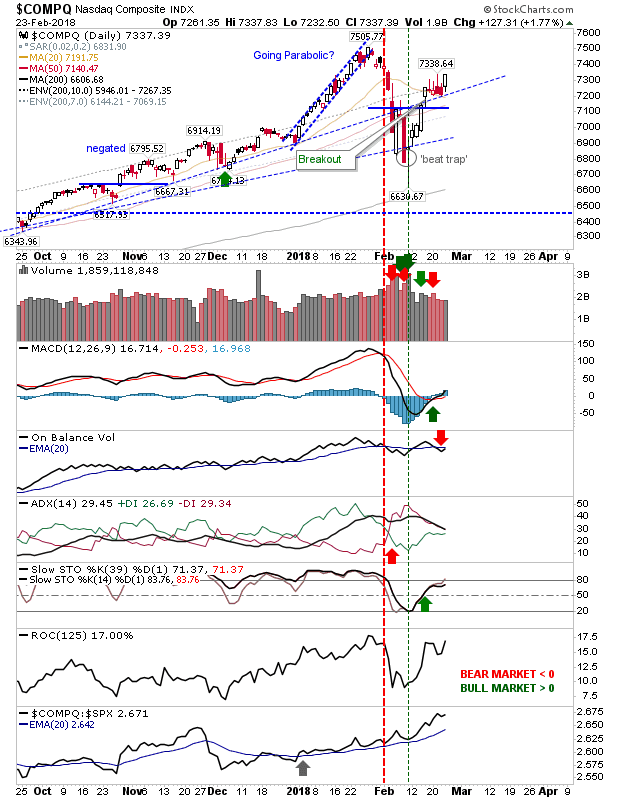

The NASDAQ performed similarly to the S&P and is working back towards December's highs. Relative performance against Semiconductors is on the verge of new highs as the MACD edges back above the bullish zero line.

For Monday, it will be important to hold near Friday's highs or higher. Worst case is a close at or lower than Friday—particularly if there is a spike high. This applies to any of the lead indices.