Although most major EU indices traded in positive territory yesterday, market sentiment softened during the US session, with the subdued appetite rolling into the Asia trading today. As for today’s main event, it may be the BoE monetary policy decision, with officials expected to expand their QE purchases.

Given that such a decision is largely priced in, we believe that most of the attention will fall on whether there is any discussion over the adoption of negative interest rates.

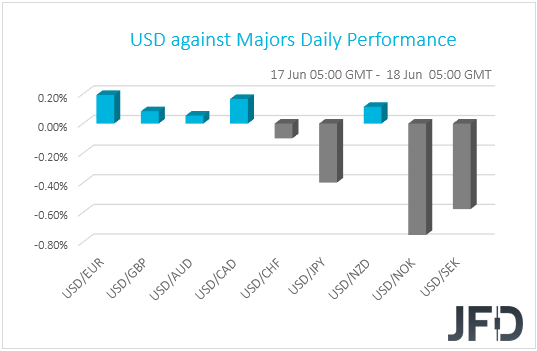

The dollar traded mixed against the other G10 currencies on Wednesday and during the Asian morning Thursday. It underperformed versus NOK, SEK, JPY, and CHF in that order, while it recorded some gains against EUR, CAD, NZD, GBP, and AUD.

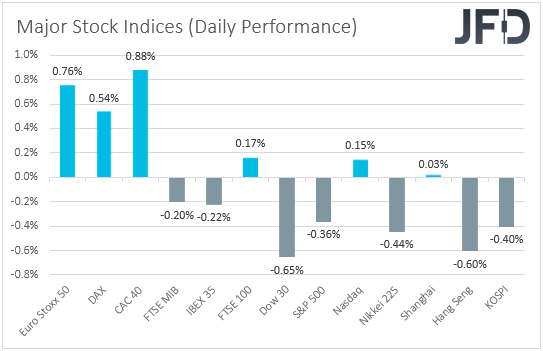

The strengthening of the yen and the franc, combined with the weakness in the risk-linked Aussie and Kiwi, suggests that investors continued trading in a risk-off fashion. Although most major EU indices closed in positive territory, in the US, both the Dow Jones and the S&P 500 ended their session lower. Only the NASDAQ closed slightly up, gaining only 0.15% The subdued appetite rolled over into the Asian trading today as well. Despite China’s Shanghai Composite trading virtually unchanged, Japan’s Nikkei 225 and Hong Kong’s Hang Seng slid 0.44% and 0.60% respectively.

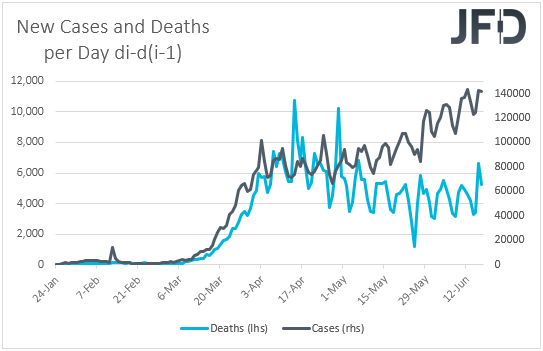

It seems that there is a battle between those who are optimistic over an economic recovery as lockdown measures continue to be lifted around most of the world, and those who are concerned over a second wave of coronavirus infections, after the new flare-up in China, as well as the surging cases in several US states, including Oklahoma, where President Trump is planning a campaign rally on Saturday. As for the overall picture, although infections slowed somewhat yesterday, the daily number of new cases remains near Friday's record peak.

As for our view, as long as most governments around the globe continue to ease their restrictive measures, we still see decent chances for the broader appetite to improve. That said, investors appear a bit more cautious than we have initially anticipated and thus, until we get clear indications of a further recovery, we prefer to stay somewhat sidelined. Among currency pairs, one of the best gauges of the broader market sentiment is AUD/JPY, in our view. If indeed, optimism returns, this pair may drift north. In order to start examining the bearish case, we would like to see more governments re-introducing restrictions, something that could result in a second hit to the global economy.

Overnight, apart from the subdued market sentiment, the Aussie and the Kiwi felt the heat of disappointing domestic data. Australia’s employment numbers came in worse than expected, with the unemployment rate rising to 7.1% from 6.2%, and the net change in employment revealing that the economy has lost 227.7k jobs instead of 125.0k as the forecast suggested.

In New Zealand, GDP contracted 1.6% qoq, at a time when the forecast was for a 1.0% slide, dragging the yoy rate into negative waters, to -0.2% from +1.8%.

Is The BoE Thinking About Negative Rates?

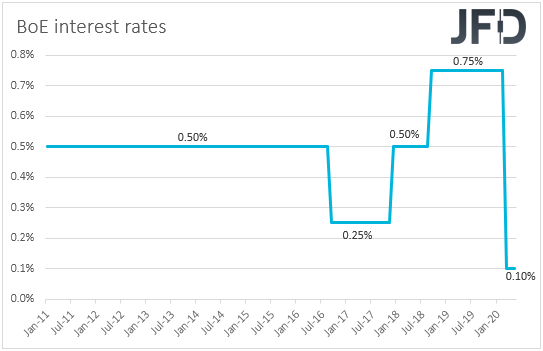

As for today, the main event may be the BoE monetary policy decision. At their last meeting, BoE policymakers kept policy unchanged. Via a unanimous vote, they kept interest rates on hold, while with regards to their QE program, the vote was 7-2 in favor of keeping the amount of purchases unchanged.

The two dissenters, Saunders and Haskel, preferred to increase the target for the stock of asset purchases by an additional GBP 100bn. With officials noting that the current QE is set to reach its target at the beginning of July, we see it nearly certain that they will expand their purchases at this gathering, perhaps by another GBP 100bn as the dissenters suggested at the prior gathering.

However, bearing in mind that such a decision may be largely expected, we don’t believe it will shake the pound. We think that GBP-traders will focus more on the language around interest rates. Remember that in the aftermath of the prior gathering, BoE Governor Andrew Bailey and Chief Economist Andy Haldane said that the Bank is looking more urgently at negative interest rates. Thus, although they may not cut rates at this gathering, it would be interesting to see how ready they are to do so in the months to come.

If there is intense talk with regards to the examination of negative interest rates, the pound is likely to come under selling interest, but the currency’s traders may also keep an eye on developments and headlines surrounding Brexit. Today and tomorrow, an EU leaders’ summit is scheduled to take place and we will look for clues as to how far away the EU and the UK are in finding common ground.

EU leaders are also expected to discuss the proposed coronavirus recovery fund. Most members support the plan, but Netherlands, Austria, Denmark, and Sweden are still skeptical. For the plan to take flesh, it must be accepted by all members and any conflict may result in a decent retreat in the euro.

Other Events Today

Apart from the BoE, we have two more central banks deciding on monetary policy today: The SNB and the Norges Bank.

Kicking off with the SNB, no policy changes are expected. The SNB's last meeting was on March 19th, with officials refraining from touching the already low interest rate of -0.75%. However, they strengthened their intervention language in light of the fast spreading of the coronavirus, noting that they will intervene more strongly in the FX market. They also added that the franc was even more highly valued.

With governments around the globe easing their lockdown measures and economic data suggesting that the deep economic wounds from the coronavirus may be behind us, we don’t expect the SNB to make any policy changes. After all, they didn't do so in March, when every other central bank was expanding its stimulus efforts to fight the economic fallout from the coronavirus. That said, bearing in mind that now the franc is stronger than it was when officials last met, we believe that they will stay ready to intervene in the FX market if things fall out of orbit.

Passing the ball to the Norges Bank, we don’t expect any changes either. At its latest meeting, the Norges Bank cut its benchmark policy rate to 0.0%, with officials saying that it will most likely stay at that level for some time ahead. “We do not envisage making further policy rate cuts”, Governor Olsen said in the accompanying statement. Last week, data showed that both headline and core inflation accelerated more than anticipated, something that allows policymakers to sit more comfortably on the sidelines, in our view.

With regards to the data, the US initial jobless claims for last week are coming out, as well as the Philadelphia Fed manufacturing index for June. Jobless claims are forecast to have slowed even further, to 1.3mn from 1.54mn the week before, while the Philly index is expected to have risen to -23.0 from -43.1.

Tomorrow, we get Japan’s National CPIs for May, while in Europe, we will get UK retail sales. With regards to the Japanese numbers, the core CPI rate is expected to have ticked up to -0.1% yoy from -0.2%, while no forecast is available for the headline rate. The UK retail sales are expected to have rebounded 5.7% mom after tumbling 18.1% in April, with the core rate expected to have risen to 4.5% mom from -15.2.%.

As for the speakers, apart from SNB President Thomas Jordan, who will hold a press conference after the rate decision, we will also get to hear from Cleveland Fed President Loretta Mester and BoC Governing Council member Lawrence Schembri.