Investing.com’s stocks of the week

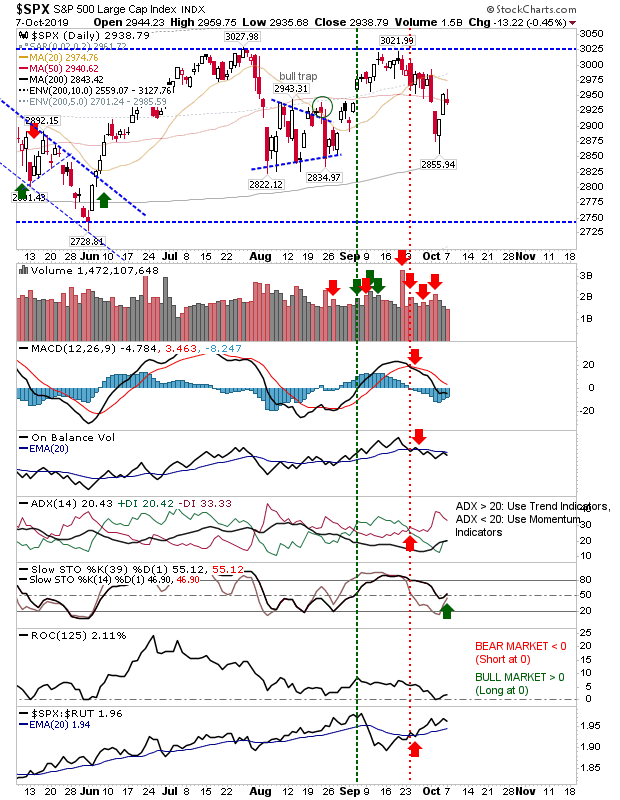

After Thursday and Friday's gains, today saw the brakes applied with a stall in the rally.

The S&P 500 came up to resistance at the 50-day MA and even managed a recovery of slow stochastics [39,1]. There are bearish 'sell' triggers for the MACD and On-Balance-Volume, counterbalanced by an uptick in relative performance against the Russell 2000.

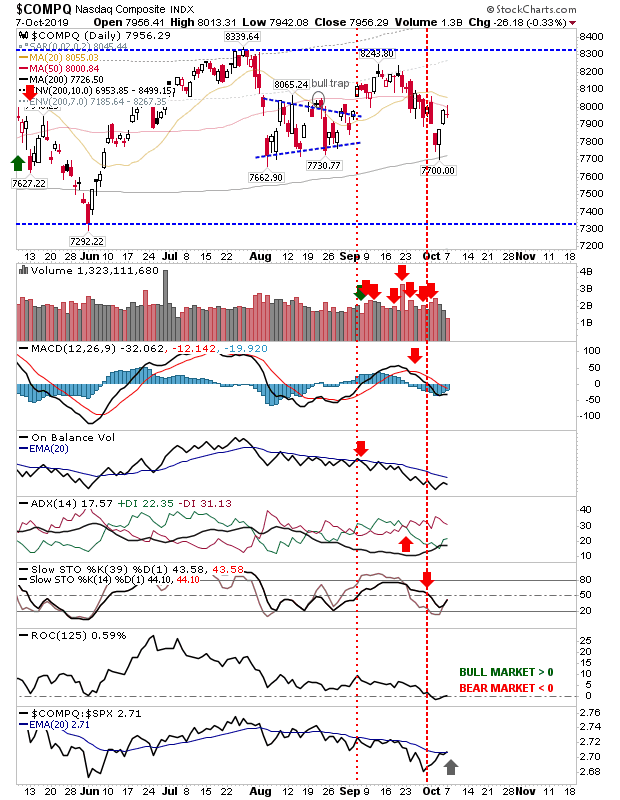

The Nasdaq wasn't able to make it to the 50-day MA and technicals are net bearish - although it does look like its about to make a relative performance gain against the S&P which will help it attract funds.

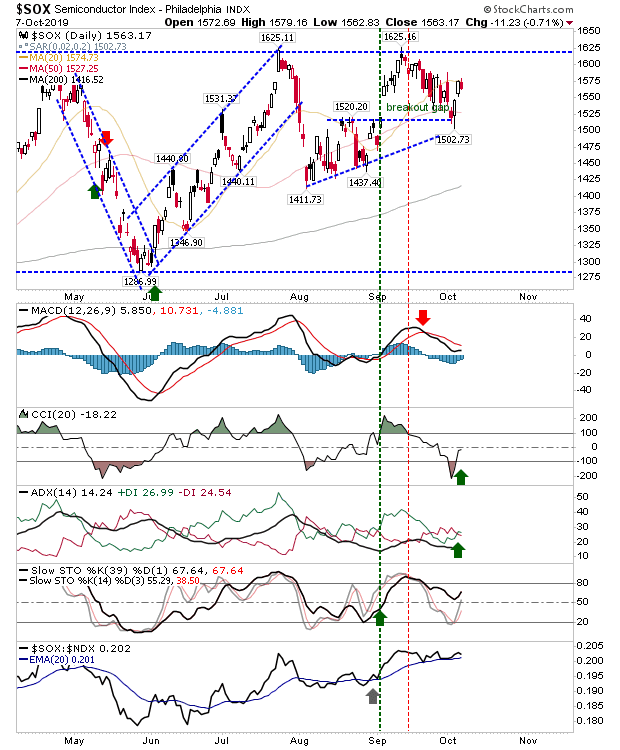

Supporting strength in the Philadelphia Semiconductor Index was weakened by the closure in the breakout gap which was setting up for a break of 1,625. Technicals are mostly bullish bar the MACD. There is still a chance bulls can drive a break of 1,625 and help the Nasdaq and Nasdaq 100 in the process, but the loss of the breakout gap was disappointing.

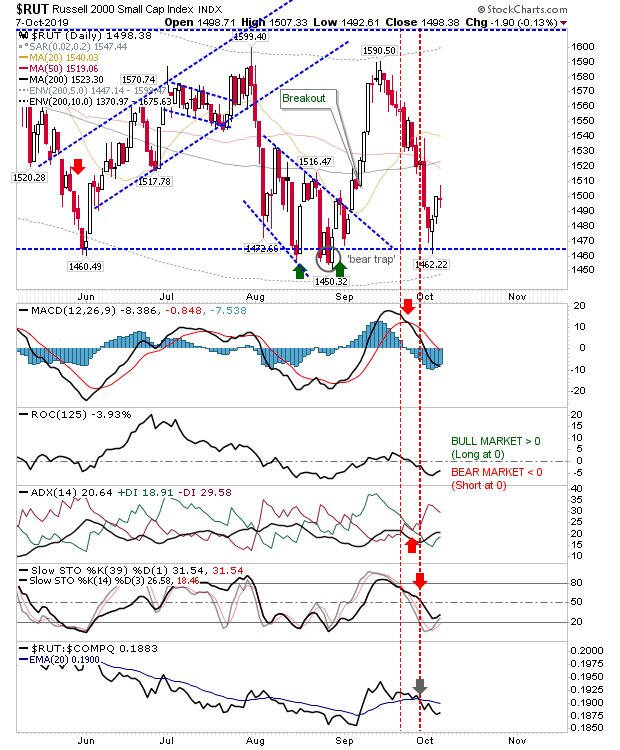

The Russell 2000 has given up most of its gains over the course of September and the bounce off 1,465 is not looking likely to succeed given Monday's doji.

It should be noted, all indices are still range bound dating back to early 2018, although the Russell 2000 is looking like it will be breaking out - and down - from this range first. However, until it does, this is a neutral market.